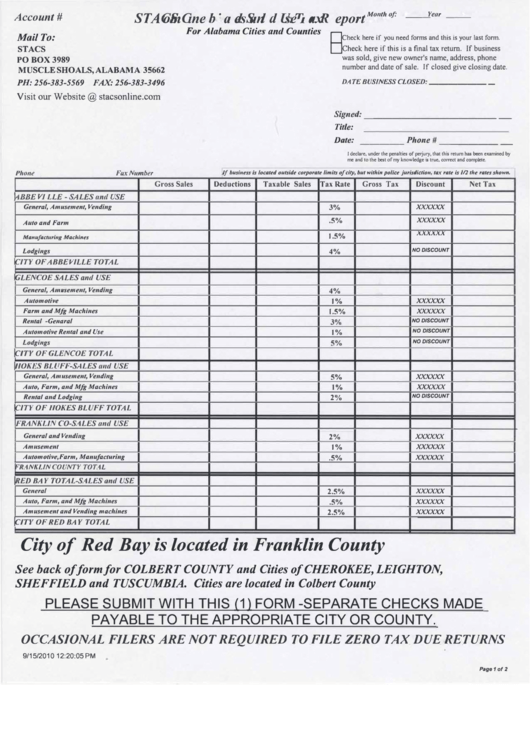

Stacs Combined Sales And Use Tax Report

ADVERTISEMENT

--

--

•

S

AC'S C

oni ine

b

d S l

a es an

d lJ.

se .,,_ ax eport

R

Account#

Mouth of:

Year

'T'

n

.1.

'T'

For Alabama Cities and Counties

Mail To:

Dcheck here if you need forms and this is your last form.

Ocheck here if this is a final tax return. If business

STAC S

was sold, give new owner's name, address, phone

POBOX3989

number and date of sale. If closed give closing date.

MUSCLE SHOALS, ALABAMA 35662

PH: 256-383-5569 FAX: 256-383-3496

DATE BUSINESS CLOSED: ______ _

Visit our

Signed: ______________ _

Title:

Date:

_____ Phone# ______ _

I declare, under the penalties of perjury, that this return has been examined by

me and to the best ofmy knowledge is true, correct and complete.

Phone

Fax Number

�f business is locatetl outsitle corporate limits of city, but within police jurisdiction, tax rate is //2 the rates shown.

Gross Sales

Deductions

Taxable Sales

Tax Rate

Gross Tax

Discount

Net Tax

�BBE VJ LLE - SALES 11ml USE

xxxxxx

3%

Ge11eral, Am11seme11t, Ve11di11g

xxxxxx

.5%

Auto a11d Farm

xxxxxx

1.5%

Ma11ufact11ri11g Machines

4%

Lodgi11gs

NO DISCOUNT

ICITY OF ABBEVILLE TOTAL

'GLENCOE !:, 'A LES and USE

4%

Ge11eral, A11111seme11t, Ve11di11g

xxxxxx

1%

Automotive

xxxxxx

l.5%

Farm a11d Mfg Machi11es

30_;;,

Re11tal -Ge11aral

NO DISCOUNT

1%

Automotive Rellfal a11d Use

NO DISCOUNT

5%

Lodgi11gs

NO DISCOUNT

IC/TY OF GLENCOE TOTAL

!HOKES BLUFF-SALES and USE

xxxxxx

5%

Ge11eral, Am11seme11t, Ve11dillg

xxxxxx

1%

Auto, Farm, a11d Mfg Machi11es

2'1/,,

Re11ta/ a11d Lodgi11g

NO DISCOUNT

ICITY OF HOKES BLUFF TOTAL

FRANKUM CO-SALES and USE

xxxxxx

2%

Ge11eral a11d Ve11di11g

xxxxxx

1%

Amuseme11t

xxxxxx

.5%

Automotive,Farm, Ma11ufact11ri11g

1 , F RANKLIN COUNTY TOTAL

I. R ED BAY TOTAL-SALES and USE

xxxxxx

2.5%

Ge11eral

xxxxxx

.5%

Auto, Farm, a11d Mfg Machi11es

xxxxxx

2.5%

Amuseme11t a11d Ve11di11g machi11es

CITY OF RED BAY TOTAL

City of Red Bay is located in Franklin County

See back of form for COLBERT COUNTY and Cities of CHEROKEE, LEIGHTON,

SHEFFIELD and TUSCUMBIA. Cities are located in Colbert County

PLEASE SUBMIT WITH THIS (1) FORM -SEPARATE CHECKS MADE

PAYABLE TO THE APPROPRIATE CITY OR COUNTY.

OCCASIONAL FILERS ARE NOT REQUIRED TO FILE ZERO TAX DUE RETURNS

9/15/2010 12:20:05 PM

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2