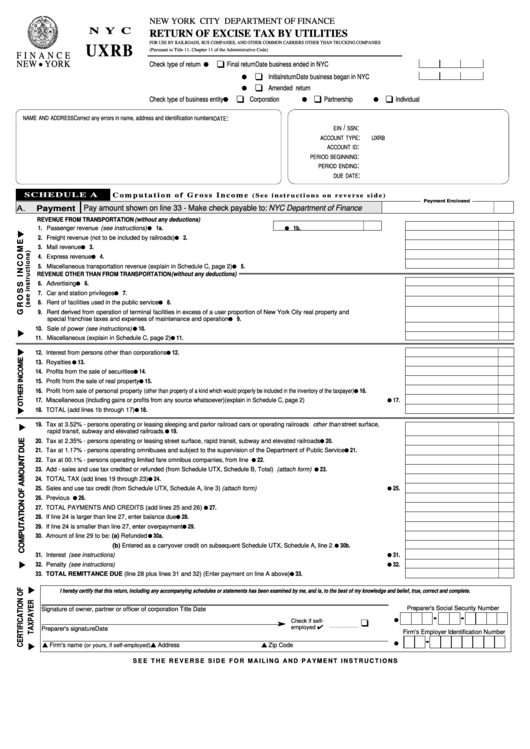

NEW YORK CITY DEPARTMENT OF FINANCE

N Y C

RETURN OF EXCISE TAX BY UTILITIES

FOR USE BY RAILROADS, BUS COMPANIES, AND OTHER COMMON CARRIERS OTHER THAN TRUCKING COMPANIES

UXRB

(Pursuant to Title 11, Chapter 11 of the Administrative Code)

F I N A N C E

q

NEW

YORK

l

l

Check type of return ....................

Final return

Date business ended in NYC

q

l

Initial return

Date business began in NYC

q

l

Amended return

q

q

q

l

l

l

Check type of business entity ......

Corporation

Partnership

Individual

:

Correct any errors in name, address and identification numbers

NAME AND ADDRESS

DATE

/

:

EIN

SSN

:

ACCOUNT TYPE

UXRB

:

ACCOUNT ID

:

PERIOD BEGINNING

:

PERIOD ENDING

:

DUE DATE

SCHEDULE A

C o m p u t a t i o n o f G r o s s I n c o m e

( S e e i n s t r u c t i o n s o n r e v e r s e s i d e )

Payment Enclosed

Pay amount shown on line 33 - Make check payable to: NYC Department of Finance

A.

Payment

REVENUE FROM TRANSPORTATION (without any deductions)

l

l

1. Passenger revenue (see instructions)

1a.

1b.

.....................................................................................

l

2. Freight revenue (not to be included by railroads)

2.

................................................................................................................................................................................

l

3. Mail revenue

3.

..............................................................................................................................................................................................................................................................

l

4. Express revenue

4.

......................................................................................................................................................................................................................................................

l

5. Miscellaneous transportation revenue (explain in Schedule C, page 2)

5.

................................................................................................................................

REVENUE OTHER THAN FROM TRANSPORTATION (without any deductions)

l

6. Advertising

6.

..................................................................................................................................................................................................................................................................

l

7. Car and station privileges

7.

..................................................................................................................................................................................................................................

l

8. Rent of facilities used in the public service

8.

.............................................................................................................................................................................................

9. Rent derived from operation of terminal facilities in excess of a user proportion of New York City real property and

l

special franchise taxes and expenses of maintenance and operation

9.

...................................................................................................................................

l

10. Sale of power (see instructions)

10.

....................................................................................................................................................................................................................

l

11. Miscellaneous (explain in Schedule C, page 2)

11.

...................................................................................................................................................................................

l

12. Interest from persons other than corporations

12.

......................................................................................................................................................................................

l

13. Royalties

13.

......................................................................................................................................................................................................................................................................

l

14. Profits from the sale of securities

14.

..................................................................................................................................................................................................................

l

15. Profit from the sale of real property

15.

..............................................................................................................................................................................................................

l

16. Profit from sale of personal property (other than property of a kind which would properly be included in the inventory of the taxpayer)

16.

...........

l

17. Miscellaneous (including gains or profits from any source whatsoever)(explain in Schedule C, page 2)

17.

......................................................................

l

18. TOTAL (add lines 1b through 17)

18.

..................................................................................................................................................................................................................

19. Tax at 3.52% - persons operating or leasing sleeping and parlor railroad cars or operating railroads other than street surface,

l

rapid transit, subway and elevated railroads

19.

.

.........................................................................................................................................................................................

l

20. Tax at 2.35% - persons operating or leasing street surface, rapid transit, subway and elevated railroads

20.

......................................................

l

21. Tax at 1.17% - persons operating omnibuses and subject to the supervision of the Department of Public Service

21.

..................................

l

22. Tax at 00.1% - persons operating limited fare omnibus companies, from line 1a.............................................................................

22.

l

23. Add - sales and use tax credited or refunded (from Schedule UTX, Schedule B, Total) (attach form)

23.

............................................................

l

24. TOTAL TAX (add lines 19 through 23)

24.

.....................................................................................................................................................................................................

l

25. Sales and use tax credit (from Schedule UTX, Schedule A, line 3) (attach form)

25.

............................................................................................................

l

26. Previous payment .............................................................................................................................................................................

26.

l

27. TOTAL PAYMENTS AND CREDITS (add lines 25 and 26)..............................................................................................................

27.

l

28. If line 24 is larger than line 27, enter balance due

28.

.............................................................................................................................................................................

l

29. If line 24 is smaller than line 27, enter overpayment

29.

........................................................................................................................................................................

l

30. Amount of line 29 to be: (a) Refunded

30a.

.....................................................................................................................................................................................................

l

(b) Entered as a carryover credit on subsequent Schedule UTX, Schedule A, line 2

30b.

.

..........................................

l

31. Interest (see instructions)

31.

..................................................................................................................................................................................................................................

l

32. Penalty (see instructions)

32.

..................................................................................................................................................................................................................................

l

33. TOTAL REMITTANCE DUE (line 28 plus lines 31 and 32) (Enter payment on line A above)

33.

................................................................................

I hereby certify that this return, including any accompanying schedules or statements has been examined by me, and is, to the b

est of my knowledge and belief, true, correct and complete.

Preparer's Social Security Number

Signature of owner, partner or officer of corporation

Title

Date

q

l

Check if self-

employed 4

Preparer's signature

Date

Firm's Employer Identification Number

l

s Firm's name

s Address

s Zip Code

(or yours, if self-employed)

S E E T H E R E V E R S E S I D E F O R M A I L I N G A N D P A Y M E N T I N S T R U C T I O N S

1

1 2

2 3

3