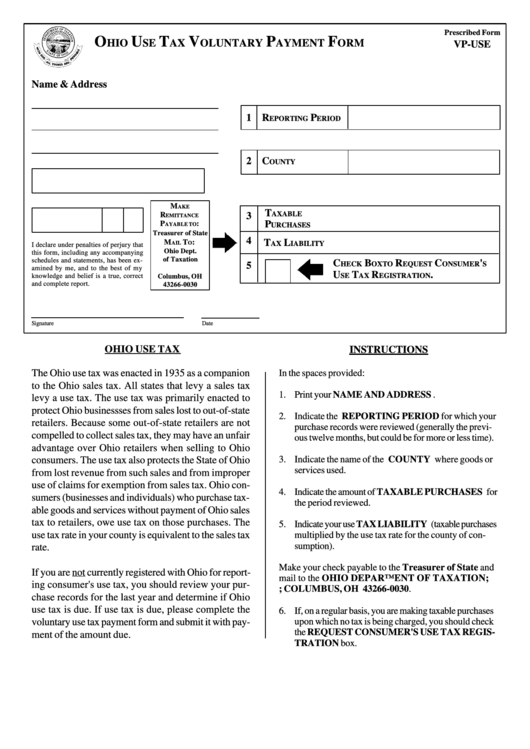

Prescribed Form

O

U

T

V

P

F

HIO

SE

AX

OLUNTARY

AYMENT

ORM

VP-USE

Name & Address

1 R

P

EPORTING

ERIOD

2 C

OUNTY

M

AKE

T

AXABLE

R

3

EMITTANCE

P

P

:

AYABLE TO

URCHASES

Treasurer of State

4

T

L

M

T

:

AIL

O

AX

IABILITY

I declare under penalties of perjury that

Ohio Dept.

this form, including any accompanying

of Taxation

schedules and statements, has been ex-

C

B

R

C

'

HECK

OX TO

EQUEST

ONSUMER

S

5

amined by me, and to the best of my

P.O. Box 530

U

T

R

.

SE

AX

EGISTRATION

knowledge and belief is a true, correct

Columbus, OH

and complete report.

43266-0030

Signature

Date

OHIO USE TAX

INSTRUCTIONS

The Ohio use tax was enacted in 1935 as a companion

In the spaces provided:

to the Ohio sales tax. All states that levy a sales tax

1. Print your NAME AND ADDRESS .

levy a use tax. The use tax was primarily enacted to

protect Ohio businessses from sales lost to out-of-state

2. Indicate the REPORTING PERIOD for which your

retailers. Because some out-of-state retailers are not

purchase records were reviewed (generally the previ-

compelled to collect sales tax, they may have an unfair

ous twelve months, but could be for more or less time).

advantage over Ohio retailers when selling to Ohio

3. Indicate the name of the COUNTY where goods or

consumers. The use tax also protects the State of Ohio

services used.

from lost revenue from such sales and from improper

use of claims for exemption from sales tax. Ohio con-

4. Indicate the amount of TAXABLE PURCHASES for

sumers (businesses and individuals) who purchase tax-

the period reviewed.

able goods and services without payment of Ohio sales

tax to retailers, owe use tax on those purchases. The

5. Indicate your use TAX LIABILITY (taxable purchases

use tax rate in your county is equivalent to the sales tax

multiplied by the use tax rate for the county of con-

sumption).

rate.

Make your check payable to the Treasurer of State and

If you are not currently registered with Ohio for report-

mail to the OHIO DEPARTMENT OF TAXATION;

ing consumer's use tax, you should review your pur-

P.O. BOX 530; COLUMBUS, OH 43266-0030 .

chase records for the last year and determine if Ohio

use tax is due. If use tax is due, please complete the

6. If, on a regular basis, you are making taxable purchases

voluntary use tax payment form and submit it with pay-

upon which no tax is being charged, you should check

the REQUEST CONSUMER'S USE TAX REGIS-

ment of the amount due.

TRATION box.

1

1