Authorization To Represent - Oregon Tax Court - Magistrate Division

ADVERTISEMENT

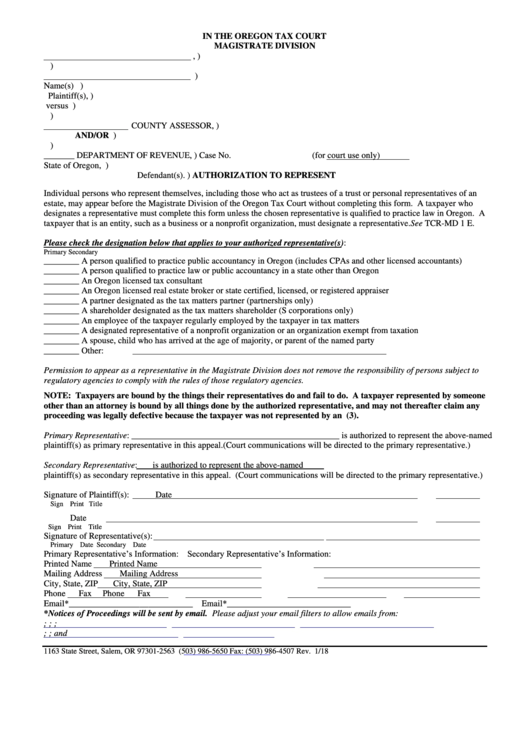

IN THE OREGON TAX COURT

MAGISTRATE DIVISION

,

)

)

)

Name(s)

)

Plaintiff(s),

)

versus

)

)

COUNTY ASSESSOR,

)

AND/OR

)

)

_______ DEPARTMENT OF REVENUE,

)

Case No.

(for court use only)

State of Oregon,

)

Defendant(s).

)

AUTHORIZATION TO REPRESENT

Individual persons who represent themselves, including those who act as trustees of a trust or personal representatives of an

estate, may appear before the Magistrate Division of the Oregon Tax Court without completing this form. A taxpayer who

designates a representative must complete this form unless the chosen representative is qualified to practice law in Oregon. A

taxpayer that is an entity, such as a business or a nonprofit organization, must designate a representative. See TCR-MD 1 E.

Please check the designation below that applies to your authorized representative(s):

Primary

Secondary

____

____

A person qualified to practice public accountancy in Oregon (includes CPAs and other licensed accountants)

____

____

A person qualified to practice law or public accountancy in a state other than Oregon

____

____

An Oregon licensed tax consultant

____

____

An Oregon licensed real estate broker or state certified, licensed, or registered appraiser

____

____

A partner designated as the tax matters partner (partnerships only)

____

____

A shareholder designated as the tax matters shareholder (S corporations only)

____

____

An employee of the taxpayer regularly employed by the taxpayer in tax matters

____

____

A designated representative of a nonprofit organization or an organization exempt from taxation

____

____

A spouse, child who has arrived at the age of majority, or parent of the named party

____

____

Other:

Permission to appear as a representative in the Magistrate Division does not remove the responsibility of persons subject to

regulatory agencies to comply with the rules of those regulatory agencies.

NOTE: Taxpayers are bound by the things their representatives do and fail to do. A taxpayer represented by someone

other than an attorney is bound by all things done by the authorized representative, and may not thereafter claim any

proceeding was legally defective because the taxpayer was not represented by an attorney. ORS 305.230(3).

Primary Representative: _______________________________________________ is authorized to represent the above-named

plaintiff(s) as primary representative in this appeal. (Court communications will be directed to the primary representative.)

Secondary Representative:

is authorized to represent the above-named

plaintiff(s) as secondary representative in this appeal. (Court communications will be directed to the primary representative.)

Signature of Plaintiff(s):

Date

Sign

Print

Title

Date

Sign

Print

Title

Signature of Representative(s):

Primary

Date

Secondary

Date

Primary Representative’s Information:

Secondary Representative’s Information:

Printed Name

Printed Name

Mailing Address

Mailing Address

City, State, ZIP

City, State, ZIP

Phone

Fax

Phone

Fax

Email*____________________________

Email*____________________________

*Notices of Proceedings will be sent by email. Please adjust your email filters to allow emails from:

hearing_scheduled@ojd.state.or.us; Court_Notification@ojd.state.or.us; Hearing_Rescheduled@ojd.state.or.us;

Hearing_CANCELED@ojd.state.or.us; Judgment@ojd.state.or.us; and efilingmail@tylerhost.net.

1163 State Street, Salem, OR 97301-2563

(503) 986-5650 Fax: (503) 986-4507

Rev. 1/18

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1