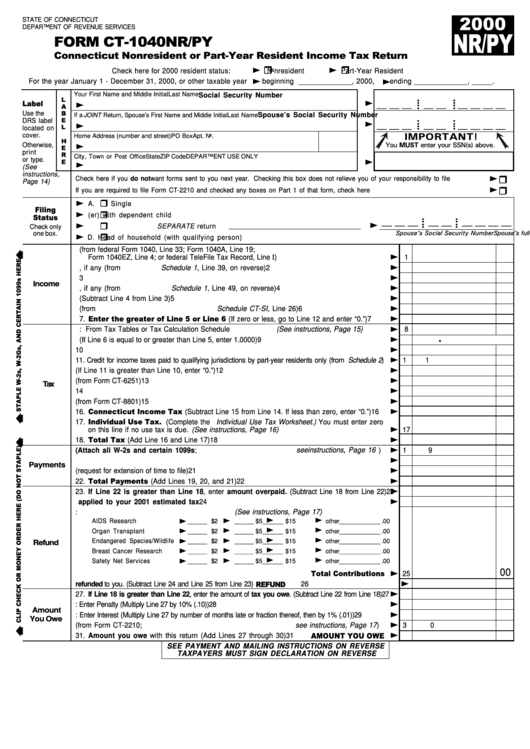

Form Ct-1040nr/py - Nonresident And Part-Year Resident Income Tax Return - 2000

ADVERTISEMENT

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

<

<

H

H

Check here for 2000 resident status:

Nonresident

Part-Year Resident

<

<

For the year January 1 - December 31, 2000, or other taxable year

beginning _____________, 2000,

ending _____________, _____.

Your First Name and Middle Initial

Last Name

Social Security Number

<

<

__ __ __

__ __

__ __ __ __

• •

• •

• •

• •

Use the

Spouse’s Social Security Number

If a JOINT Return, Spouse’s First Name and Middle Initial

Last Name

<

<

__ __ __

__ __

__ __ __ __

DRS label

• •

• •

• •

• •

located on

IMPORTANT!

cover.

Home Address (number and street)

PO Box

Apt. No.

<

You MUST enter your SSN(s) above.

Otherwise,

print

<

City, Town or Post Office

State

ZIP Code

DEPARTMENT USE ONLY

<

or type.

(See

<

instructions,

H

Check here if you do not want forms sent to you next year. Checking this box does not relieve you of your responsibility to file ...............

Page 14)

<

H

If you are required to file Form CT-2210 and checked any boxes on Part 1 of that form, check here .............................................................

<

H

A .

Single

<

H

B.

Married filing joint return or Qualifying widow(er) with dependent child

<

<

• •

• •

__ __ __ __ __ __ __ __ __

H

• •

• •

Married filing SEPARATE return

C.

Check only

<

Spouse’s full name

Spouse’s Social Security Number

one box.

H

D.

Head of household (with qualifying person)

1. Federal Adjusted Gross Income (from federal Form 1040, Line 33; Form 1040A, Line 19;

<

Form 1040EZ, Line 4; or federal TeleFile Tax Record, Line I)

1

<

2. Additions, if any (from Schedule 1 , Line 39, on reverse)

2

<

3. Add Line 1 and Line 2

3

<

Income

4. Subtractions, if any (from Schedule 1 , Line 49, on reverse)

4

<

5. Connecticut Adjusted Gross Income (Subtract Line 4 from Line 3)

5

<

6. Income from Connecticut sources (from Schedule CT-SI , Line 26)

6

<

7.

(If zero or less, go to Line 12 and enter “0.”)

7

<

8. Income Tax: From Tax Tables or Tax Calculation Schedule (See instructions, Page 15)

8

<

.

9. Divide Line 6 by Line 5 (If Line 6 is equal to or greater than Line 5, enter 1.0000)

9

<

10. Multiply Line 9 by Line 8

10

<

11. Credit for income taxes paid to qualifying jurisdictions by part-year residents only (from Schedule 2 )

11

<

12. Subtract Line 11 from Line 10 (If Line 11 is greater than Line 10, enter “0.”)

12

<

13. Connecticut Alternative Minimum Tax (from Form CT-6251)

13

Tax

<

14. Add Line 12 and Line 13

14

<

15. Adjusted Net Connecticut Minimum Tax Credit (from Form CT-8801)

15

<

16.

(Subtract Line 15 from Line 14. If less than zero, enter “0.”)

16

17.

(Complete the Individual Use Tax Worksheet.) You must enter zero

<

on this line if no use tax is due. (See instructions, Page 16)

17

<

18.

(Add Line 16 and Line 17)

18

<

19. Connecticut tax withheld (Attach all W-2s and certain 1099s; see instructions, Page 16 )

19

<

20. All 2000 estimated tax payments and any overpayments applied from a prior year

20

<

Payments

21. Payments made with Form CT-1040 EXT (request for extension of time to file)

21

<

22.

(Add Lines 19, 20, and 21)

22

<

23. If Line 22 is greater than Line 18, enter amount overpaid. (Subtract Line 18 from Line 22)

23

<

24. Amount of Line 23 you want applied to your 2001 estimated tax

24

25. Amount of Line 23 you want to contribute to: (See instructions, Page 17)

<

<

<

<

AIDS Research

____ $2

____ $5

______ $15

other ____________ .00

<

<

<

<

Organ Transplant

____ $2

____ $5

______ $15

other ____________ .00

<

<

<

<

Endangered Species/Wildlife

____ $2

____ $5

______ $15

other ____________ .00

Refund

<

<

<

<

Breast Cancer Research

____ $2

____ $5

______ $15

other ____________ .00

<

<

<

<

Safety Net Services

____ $2

____ $5

______ $15

other ____________ .00

<

00

25

<

26. Amount of Line 23 you want refunded to you. (Subtract Line 24 and Line 25 from Line 23) REFUND

26

<

27. If Line 18 is greater than Line 22, enter the amount of tax you owe. (Subtract Line 22 from Line 18)

27

<

28. If late: Enter Penalty (Multiply Line 27 by 10% (.10))

28

<

Amount

29. If late: Enter Interest (Multiply Line 27 by number of months late or fraction thereof, then by 1% (.01))

29

<

You Owe

30. Interest on underpayment of estimated tax (from Form CT-2210; see instructions, Page 17 )

30

<

31. Amount you owe with this return (Add Lines 27 through 30)

31

SEE PAYMENT AND MAILING INSTRUCTIONS ON REVERSE

TAXPAYERS MUST SIGN DECLARATION ON REVERSE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2