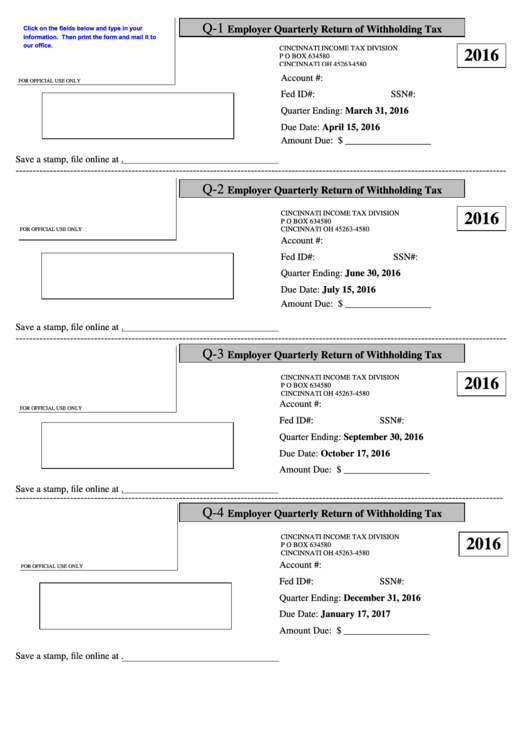

Employer Quarterly Return For Withholding Tax - 2016

ADVERTISEMENT

Q-1

Click on the fields below and type in your

Employer Quarterly Return of Withholding Tax

information. Then print the form and mail it to

our office.

CINCINNATI INCOME TAX DIVISION

2016

P O BOX 634580

CINCINNATI OH 45263-4580

Account #:

FOR OFFICIAL USE ONLY

Fed ID#:

SSN#:

Quarter Ending: March 31, 2016

Due Date: April 15, 2016

Amount Due: $ __________________

Save a stamp, file online at

.

------------------------------------------------------------------------------------------------------------------------------------------------

Q-2

Employer Quarterly Return of Withholding Tax

CINCINNATI INCOME TAX DIVISION

2016

P O BOX 634580

CINCINNATI OH 45263-4580

FOR OFFICIAL USE ONLY

Account #:

Fed ID#:

SSN#:

Quarter Ending: June 30, 2016

Due Date: July 15, 2016

Amount Due: $ __________________

Save a stamp, file online at

.

------------------------------------------------------------------------------------------------------------------------------------------------

Q-3

Employer Quarterly Return of Withholding Tax

CINCINNATI INCOME TAX DIVISION

2016

P O BOX 634580

CINCINNATI OH 45263-4580

Account #:

FOR OFFICIAL USE ONLY

Fed ID#:

SSN#:

Quarter Ending: September 30, 2016

Due Date: October 17, 2016

Amount Due: $ __________________

Save a stamp, file online at

.

-----------------------------------------------------------------------------------------------------------------------------------------------

Q-4

Employer Quarterly Return of Withholding Tax

CINCINNATI INCOME TAX DIVISION

2016

P O BOX 634580

CINCINNATI OH 45263-4580

Account #:

FOR OFFICIAL USE ONLY

Fed ID#:

SSN#:

Quarter Ending: December 31, 2016

Due Date: January 17, 2017

Amount Due: $ __________________

Save a stamp, file online at

.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1