Maine Minimum Tax Worksheet Instructions - Income Modification Worksheet

ADVERTISEMENT

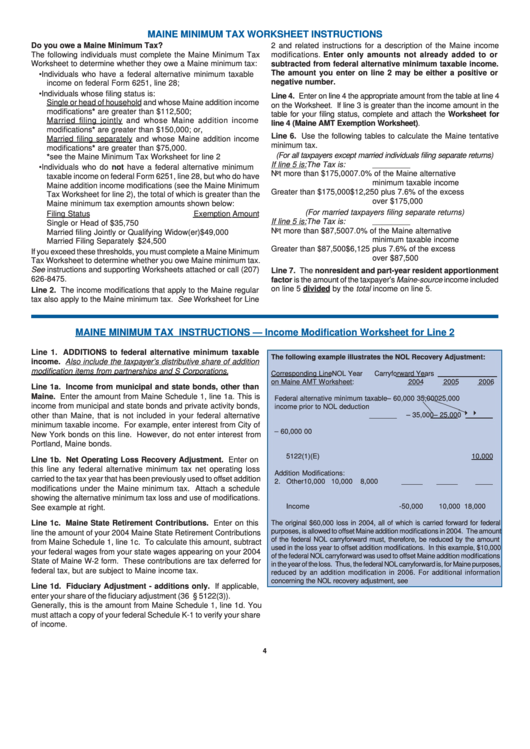

MAINE MINIMUM TAX WORKSHEET INSTRUCTIONS

Do you owe a Maine Minimum Tax?

2 and related instructions for a description of the Maine income

The following individuals must complete the Maine Minimum Tax

modifications. Enter only amounts not already added to or

Worksheet to determine whether they owe a Maine minimum tax:

subtracted from federal alternative minimum taxable income.

The amount you enter on line 2 may be either a positive or

• Individuals who have a federal alternative minimum taxable

negative number.

income on federal Form 6251, line 28;

• Individuals whose filing status is:

Line 4. Enter on line 4 the appropriate amount from the table at line 4

Single or head of household and whose Maine addition income

on the Worksheet. If line 3 is greater than the income amount in the

modifications* are greater than $112,500;

table for your filing status, complete and attach the Worksheet for

Married filing jointly and whose Maine addition income

line 4 (Maine AMT Exemption Worksheet).

modifications* are greater than $150,000; or,

Line 6. Use the following tables to calculate the Maine tentative

Married filing separately and whose Maine addition income

minimum tax.

modifications* are greater than $75,000.

(For all taxpayers except married individuals filing separate returns)

*see the Maine Minimum Tax Worksheet for line 2

If line 5 is:

The Tax is:

• Individuals who do not have a federal alternative minimum

Not more than $175,000

7.0% of the Maine alternative

taxable income on federal Form 6251, line 28, but who do have

minimum taxable income

Maine addition income modifications (see the Maine Minimum

Greater than $175,000

$12,250 plus 7.6% of the excess

Tax Worksheet for line 2), the total of which is greater than the

over $175,000

Maine minimum tax exemption amounts shown below:

(For married taxpayers filing separate returns)

Filing Status

Exemption Amount

If line 5 is:

The Tax is:

Single or Head of Household ................................... $35,750

Not more than $87,500

7.0% of the Maine alternative

Married filing Jointly or Qualifying Widow(er) .......... $49,000

minimum taxable income

Married Filing Separately ......................................... $24,500

Greater than $87,500

$6,125 plus 7.6% of the excess

If you exceed these thresholds, you must complete a Maine Minimum

over $87,500

Tax Worksheet to determine whether you owe Maine minimum tax.

See instructions and supporting Worksheets attached or call (207)

Line 7. The nonresident and part-year resident apportionment

626-8475.

factor is the amount of the taxpayer’s Maine-source income included

on line 5 divided by the total income on line 5.

Line 2. The income modifications that apply to the Maine regular

tax also apply to the Maine minimum tax. See Worksheet for Line

MAINE MINIMUM TAX INSTRUCTIONS — Income Modification Worksheet for Line 2

Line 1. ADDITIONS to federal alternative minimum taxable

The following example illustrates the NOL Recovery Adjustment:

income. Also include the taxpayer’s distributive share of addition

modification items from partnerships and S Corporations.

Corresponding Line

NOL Year

Carryforward Years

on Maine AMT Worksheet:

2004

2005

2006

Line 1a. Income from municipal and state bonds, other than

Maine. Enter the amount from Maine Schedule 1, line 1a. This is

Federal alternative minimum taxable

– 60,000

35,000

25,000

income from municipal and state bonds and private activity bonds,

income prior to NOL deduction

8

8

_______

– 35,000

– 25,000

other than Maine, that is not included in your federal alternative

minimum taxable income. For example, enter interest from City of

1. FAMTI after NOL deduction

– 60,000

0

0

New York bonds on this line. However, do not enter interest from

Portland, Maine bonds.

2. ADDITION Modification

5122(1)(E)

10,000

Line 1b. Net Operating Loss Recovery Adjustment. Enter on

this line any federal alternative minimum tax net operating loss

Addition Modifications:

carried to the tax year that has been previously used to offset addition

2. Other

10,000

10,000

8,000

modifications under the Maine minimum tax. Attach a schedule

showing the alternative minimum tax loss and use of modifications.

3. Maine Adjusted Gross

Income

-50,000

10,000

18,000

See example at right.

Line 1c. Maine State Retirement Contributions. Enter on this

The original $60,000 loss in 2004, all of which is carried forward for federal

purposes, is allowed to offset Maine addition modifications in 2004. The amount

line the amount of your 2004 Maine State Retirement Contributions

of the federal NOL carryforward must, therefore, be reduced by the amount

from Maine Schedule 1, line 1c. To calculate this amount, subtract

used in the loss year to offset addition modifications. In this example, $10,000

your federal wages from your state wages appearing on your 2004

of the federal NOL carryforward was used to offset Maine addition modifications

State of Maine W-2 form. These contributions are tax deferred for

in the year of the loss. Thus, the federal NOL carryforward is, for Maine purposes,

federal tax, but are subject to Maine income tax.

reduced by an addition modification in 2006. For additional information

concerning the NOL recovery adjustment, see

Line 1d. Fiduciary Adjustment - additions only. If applicable,

enter your share of the fiduciary adjustment (36 M.R.S.A. § 5122(3)).

Generally, this is the amount from Maine Schedule 1, line 1d. You

must attach a copy of your federal Schedule K-1 to verify your share

of income.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3