Form Nyc-204 - Unincorporated Business Tax Return - 2010

ADVERTISEMENT

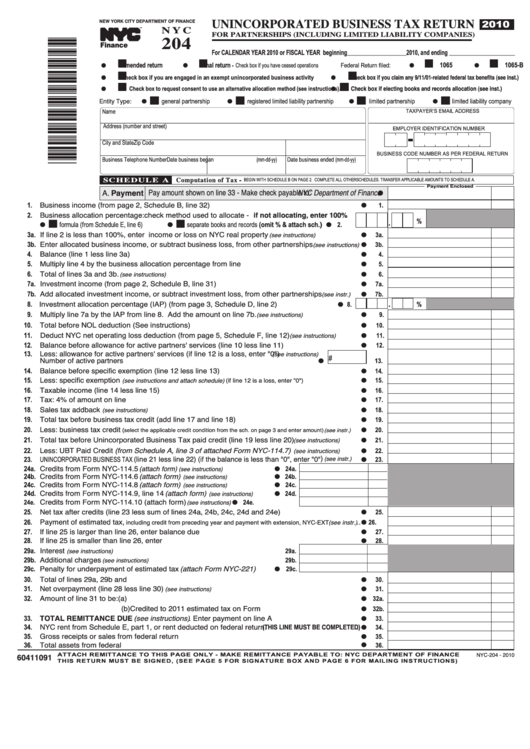

UNINCORPORATED BUSINESS TAX RETURN

204

N Y C

2010

NEW YORK CITY DEPARTMENT OF FINANCE

FOR PARTNERSHIPS (INCLUDING LIMITED LIABILITY COMPANIES)

TM

Finance

For CALENDAR YEAR 2010 or FISCAL YEAR beginning

2010, and ending

___________________________

______________________________

I I

I I

I I

I I

Amended return

Final return

1065

1065-B

- Check box if you have ceased operations.

Federal Return filed:

G

G

G

G

I I

I I

Check box if you claim any 9/11/01-related federal tax benefits (see inst.)

Check box if you are engaged in an exempt unincorporated business activity

G

G

I I

I I

Check box if electing books and records allocation (see inst.)

Check box to request consent to use an alternative allocation method (see instructions).

G

G

I I

I I

I I

I I

Entity Type:

general partnership

registered limited liability partnership

limited partnership

limited liability company

G

G

G

G

Name

TAXPAYER’S EMAIL ADDRESS

Address (number and street)

EMPLOYER IDENTIFICATION NUMBER

City and State

Zip Code

BUSINESS CODE NUMBER AS PER FEDERAL RETURN

Business Telephone Number

Date business began (mm-dd-yy)

Date business ended (mm-dd-yy)

-

S C H E D U L E A

Computation of Tax

BEGIN WITH SCHEDULE B ON PAGE 2. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

A. Payment

Pay amount shown on line 33 - Make check payable to: NYC Department of Finance

Payment Enclosed

G

Business income (from page 2, Schedule B, line 32)..........................................................................

1.

1.

G

Business allocation percentage: check method used to allocate - if not allocating, enter 100%

2.

I I

I I

.

%

formula (from Schedule E, line 6)

separate books and records (omit % & attach sch.)

G 2.

G

G

3a. If line 2 is less than 100%, enter income or loss on NYC real property

......................

(see instructions)

3a.

G

3b. Enter allocated business income, or subtract business loss, from other partnerships

(see instructions)

3b.

G

Balance (line 1 less line 3a).................................................................................................................

4.

4.

G

Multiply line 4 by the business allocation percentage from line 2........................................................

5.

5.

G

Total of lines 3a and 3b.

(see instructions) ...................................................................................................................

6.

6.

G

7a. Investment income (from page 2, Schedule B, line 31).......................................................................

7a.

G

7b. Add allocated investment income, or subtract investment loss, from other partnerships

.....

(see instr.)

7b.

G

8. Investment allocation percentage (IAP) (from page 3, Schedule D, line 2) ............................

.

%

G 8.

Multiply line 7a by the IAP from line 8. Add the amount on line 7b.

............................

(see instructions)

9.

9.

G

Total before NOL deduction (See instructions)....................................................................................

10.

10.

G

Deduct NYC net operating loss deduction (from page 5, Schedule F, line 12)

(see instructions) ..............

11.

11.

G

Balance before allowance for active partners' services (line 10 less line 11)......................................

12.

12.

G

Less: allowance for active partners' services (if line 12 is a loss, enter "0")

(see instructions)

13.

Number of active partners claimed ................................................................................... G

#

13.

Balance before specific exemption (line 12 less line 13).....................................................................

14.

.

14

G

Less: specific exemption

(see instructions and attach schedule) (if line 12 is a loss, enter "0") ..................................

15.

15.

G

Taxable income (line 14 less line 15)...................................................................................................

16.

16.

G

Tax: 4% of amount on line 16 ..............................................................................................................

17.

17.

G

Sales tax addback

........................................................................................................

(see instructions)

18.

18.

G

Total tax before business tax credit (add line 17 and line 18)..............................................................

19.

19.

G

Less: business tax credit

.....

(

select the applicable credit condition from the sch. on page 3 and enter amount) (see instr.)

20.

20.

G

Total tax before Unincorporated Business Tax paid credit (line 19 less line 20)

..........

(see instructions)

21.

21.

G

Less: UBT Paid Credit (from Schedule A, line 3 of attached Form NYC-114.7)

..........

(see instructions)

22.

22.

G

UNINCORPORATED BUSINESS TAX (line 21 less line 22) (if the balance is less than "0", enter "0" )

(see instr.)

23.

.....

23.

G

24a. Credits from Form NYC-114.5 (attach form)

.........................

(see instructions)

G 24a.

24b. Credits from Form NYC-114.6 (attach form)

.......................

(see instructions)

G 24b.

24c. Credits from Form NYC-114.8 (attach form)

.......................

(see instructions)

G 24c.

24d. Credits from Form NYC-114.9, line 14 (attach form)

..........

(see instructions)

G 24d.

Credits from Form NYC-114.10 (attach form)

......................G 24e.

(see instructions)

24e.

Net tax after credits (line 23 less sum of lines 24a, 24b, 24c, 24d and 24e) .......................................

25.

25.

G

Payment of estimated tax,

..

including credit from preceding year and payment with extension, NYC-EXT (see instr.)

26.

26.

G

If line 25 is larger than line 26, enter balance due

...........................................................................

27.

27.

G

If line 25 is smaller than line 26, enter overpayment ..........................................................................

28.

28.

G

29a. Interest

(see instructions) ...................................................................................................

29a.

29b. Additional charges

(see instructions) .............................................................................

29b.

29c. Penalty for underpayment of estimated tax (attach Form NYC-221) ........

G 29c.

Total of lines 29a, 29b and 29c............................................................................................................

30.

30.

G

Net overpayment (line 28 less line 30)

.........................................................................

(see instructions)

31.

31.

G

Amount of line 31 to be: (a) Refunded................................................................................................

32.

G 32a.

(b) Credited to 2011 estimated tax on Form NYC-5UB ...............................

G 32b.

TOTAL REMITTANCE DUE (see instructions) . Enter payment on line A above.................................

33.

33.

G

NYC rent from Schedule E, part 1, or rent deducted on federal return.

(THIS LINE MUST BE COMPLETED)..G

34.

34.

Gross receipts or sales from federal return

...........................................................................................................G

35.

35.

Total assets from federal return ................................................................................................................

36.

36.

G

60411091

NYC-204 - 2010

ATTACH REMITTANCE TO THIS PAGE ONLY - MAKE REMITTANCE PAYABLE TO: NYC DEPARTMENT OF FINANCE

THIS RETURN MUST BE SIGNED, (SEE PAGE 5 FOR SIGNATURE BOX AND PAGE 6 FOR MAILING INSTRUCTIONS)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5