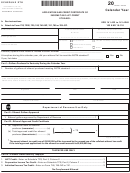

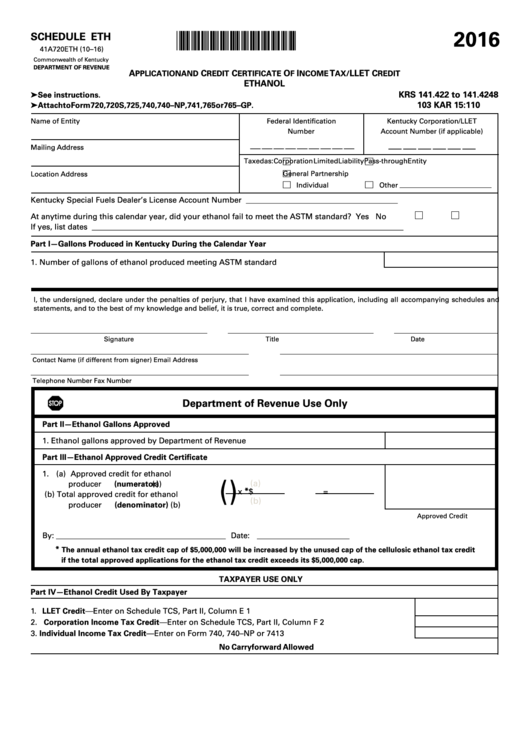

Schedule Eth (Form 41a720eth) - Application And Credit Certificate Of Income Tax/llet Credit Ethanol - 2016

ADVERTISEMENT

2016

SCHEDULE ETH

*1600010299*

41A720ETH (10–16)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

A

C

C

O

I

T

LLET C

PPLICATION AND

REDIT

ERTIFICATE

F

NCOME

AX/

REDIT

ETHANOL

KRS 141.422 to 141.4248

➤ See instructions.

103 KAR 15:110

➤ Attach to Form 720, 720S, 725, 740, 740–NP , 741, 765 or 765–GP .

Name of Entity

Federal Identification

Kentucky Corporation/LLET

Number

Account Number (if applicable)

__ __ __ __ __ __

__ __ __ __ __ __ __ __ __

Mailing Address

Taxed as:

Corporation

Limited Liability Pass-through Entity

Location Address

General Partnership

Individual

Other

Kentucky Special Fuels Dealer’s License Account Number _______________________________________

At anytime during this calendar year, did your ethanol fail to meet the ASTM standard?

Yes

No

If yes, list dates ________________________________________________________________________________

Part I—Gallons Produced in Kentucky During the Calendar Year

1. Number of gallons of ethanol produced meeting ASTM standard .......................................... 1

I, the undersigned, declare under the penalties of perjury, that I have examined this application, including all accompanying schedules and

statements, and to the best of my knowledge and belief, it is true, correct and complete.

Signature

Title

Date

Contact Name (if different from signer)

Email Address

Telephone Number

Fax Number

Department of Revenue Use Only

Part II—Ethanol Gallons Approved

1. Ethanol gallons approved by Department of Revenue ......................................................... 1

Part III—Ethanol Approved Credit Certificate

1. (a) Approved credit for ethanol

(

)

(a)

producer (numerator) ......................(a)

x * $

=

(b) Total approved credit for ethanol

(b)

producer (denominator) ................ (b)

Approved Credit

By: ____________________________________________ Date: ________________________

* The annual ethanol tax credit cap of $5,000,000 will be increased by the unused cap of the cellulosic ethanol tax credit

if the total approved applications for the ethanol tax credit exceeds its $5,000,000 cap.

TAXPAYER USE ONLY

Part IV—Ethanol Credit Used By Taxpayer

1. LLET Credit—Enter on Schedule TCS, Part II, Column E ..........................................................................1

2. Corporation Income Tax Credit—Enter on Schedule TCS, Part II, Column F ..........................................2

3. Individual Income Tax Credit—Enter on Form 740, 740–NP or 741 ..........................................................3

No Carryforward Allowed

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1