Clear This Page

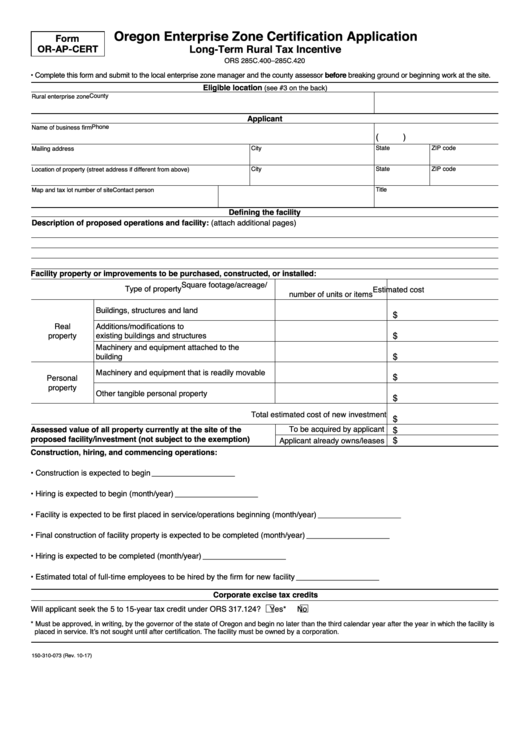

Oregon Enterprise Zone Certification Application

Form

Long-Term Rural Tax Incentive

OR-AP-CERT

ORS 285C.400–285C.420

• Complete this form and submit to the local enterprise zone manager and the county assessor before breaking ground or beginning work at the site.

Eligible location

(see #3 on the back)

County

Rural enterprise zone

Applicant

Phone

Name of business firm

(

)

City

State

ZIP code

Mailing address

City

State

ZIP code

Location of property (street address if different from above)

Title

Map and tax lot number of site

Contact person

Defining the facility

Description of proposed operations and facility: (attach additional pages)

Facility property or improvements to be purchased, constructed, or installed:

Square footage/acreage/

Type of property

Estimated cost

number of units or items

Buildings, structures and land

$

Real

Additions/modifications to

$

property

existing buildings and structures

Machinery and equipment attached to the

$

building

Machinery and equipment that is readily movable

$

Personal

property

Other tangible personal property

$

Total estimated cost of new investment

$

Assessed value of all property currently at the site of the

To be acquired by applicant

$

proposed facility/investment (not subject to the exemption)

$

Applicant already owns/leases

Construction, hiring, and commencing operations:

• Construction is expected to begin ..................................................................................................................

___________________

• Hiring is expected to begin (month/year) .......................................................................................................

___________________

• Facility is expected to be first placed in service/operations beginning (month/year) .....................................

___________________

• Final construction of facility property is expected to be completed (month/year) ..........................................

___________________

• Hiring is expected to be completed (month/year) ..........................................................................................

___________________

• Estimated total of full-time employees to be hired by the firm for new facility................................................

___________________

Corporate excise tax credits

Will applicant seek the 5 to 15-year tax credit under ORS 317.124?

Yes*

No

* Must be approved, in writing, by the governor of the state of Oregon and begin no later than the third calendar year after the year in which the facility is

placed in service. It’s not sought until after certification. The facility must be owned by a corporation.

150-310-073 (Rev. 10-17)

1

1 2

2