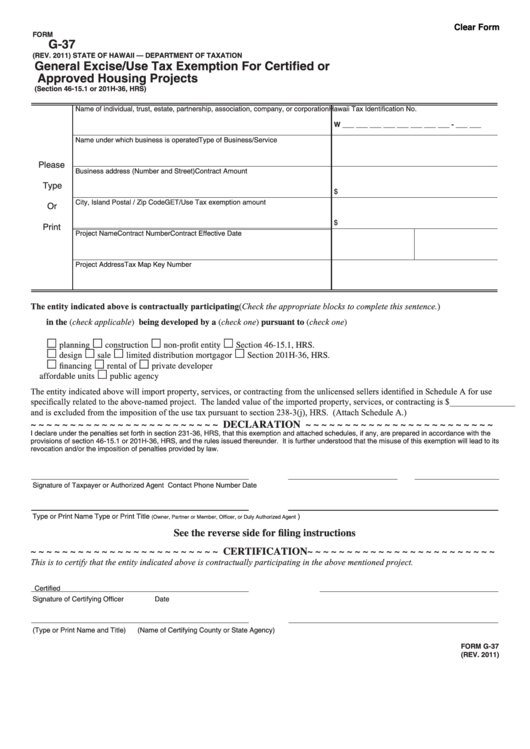

Clear Form

FORM

G-37

(REV. 2011)

STATE OF HAWAII — DEPARTMENT OF TAXATION

General Excise/Use Tax Exemption For Certified or

Approved Housing Projects

(Section 46-15.1 or 201H-36, HRS)

Name of individual, trust, estate, partnership, association, company, or corporation Hawaii Tax Identification No.

W ___ ___ ___ ___ ___ ___ ___ ___ - ___ ___

Name under which business is operated

Type of Business/Service

Please

Business address (Number and Street)

Contract Amount

Type

$

City, Island

Postal / Zip Code

GET/Use Tax exemption amount

Or

$

Print

Project Name

Contract Number

Contract Effective Date

Project Address

Tax Map Key Number

The entity indicated above is contractually participating (Check the appropriate blocks to complete this sentence.)

in the (check applicable)

being developed by a (check one)

pursuant to (check one)

planning

construction

non-profit entity

Section 46-15.1, HRS.

design

sale

limited distribution mortgagor

Section 201H-36, HRS.

financing

rental of

private developer

affordable units

public agency

The entity indicated above will import property, services, or contracting from the unlicensed sellers identified in Schedule A for use

specifically related to the above-named project. The landed value of the imported property, services, or contracting is $_______________

and is excluded from the imposition of the use tax pursuant to section 238-3(j), HRS. (Attach Schedule A.)

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ DECLARATION ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

I declare under the penalties set forth in section 231-36, HRS, that this exemption and attached schedules, if any, are prepared in accordance with the

provisions of section 46-15.1 or 201H-36, HRS, and the rules issued thereunder. It is further understood that the misuse of this exemption will lead to its

revocation and/or the imposition of penalties provided by law.

Signature of Taxpayer or Authorized Agent

Contact Phone Number

Date

Type or Print Name

Type or Print Title

)

(Owner, Partner or Member, Officer, or Duly Authorized Agent

See the reverse side for filing instructions

~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ CERTIFICATION~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~ ~

This is to certify that the entity indicated above is contractually participating in the above mentioned project.

Certified

Signature of Certifying Officer

Date

(Type or Print Name and Title)

(Name of Certifying County or State Agency)

FORM G-37

(REV. 2011)

1

1 2

2 3

3