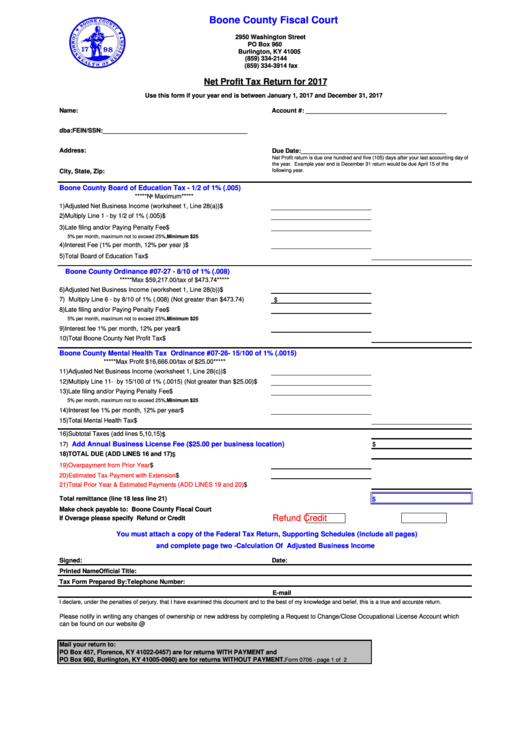

Boone County Fiscal Court

2950 Washington Street

PO Box 960

Burlington, KY 41005

(859) 334-2144

(859) 334-3914 fax

Net Profit Tax Return for 2017

Use this form if your year end is between January 1, 2017 and December 31, 2017

Name:

Account #: ________________________________________

dba:

FEIN/SSN:_________________________________________

Address:

Due Date:_________________________________________

Net Profit return is due one hundred and five (105) days after your last accounting day of

the year. Example year end is December 31 return would be due April 15 of the

City, State, Zip:

following year.

Boone County Board of Education Tax - 1/2 of 1% (.005)

*****No Maximum*****

1) Adjusted Net Business Income (worksheet 1, Line 28(a))

$

2) Multiply Line 1 - by 1/2 of 1% (.005)

$

3) Late filing and/or Paying Penalty Fee

$

5% per month, maximum not to exceed 25%,Minimum $25

4) Interest Fee (1% per month, 12% per year )

$

5) Total Board of Education Tax

$

Boone County Ordinance #07-27 - 8/10 of 1% (.008)

*****Max $59,217.00/tax of $473.74*****

6) Adjusted Net Business Income (worksheet 1, Line 28(b))

$

7) Multiply Line 6 - by 8/10 of 1% (.008) (Not greater than $473.74)

$

8) Late filing and/or Paying Penalty Fee

$

5% per month, maximum not to exceed 25%,Minimum $25

9) Interest fee 1% per month, 12% per year

$

10) Total Boone County Net Profit Tax

$

Boone County Mental Health Tax Ordinance #07-26- 15/100 of 1% (.0015)

*****Max Profit $16,666.00/tax of $25.00*****

11) Adjusted Net Business Income (worksheet 1, Line 28(c))

$

12) Multiply Line 11- by 15/100 of 1% (.0015) (Not greater than $25.00)

$

13) Late filing and/or Paying Penalty Fee

$

5% per month, maximum not to exceed 25%,Minimum $25

14) Interest fee 1% per month, 12% per year

$

15) Total Mental Health Tax

$

16) Subtotal Taxes (add lines 5,10,15)

$

17)

Add Annual Business License Fee ($25.00 per business location)

$

18) TOTAL DUE (ADD LINES 16 and 17)

$

19) Overpayment from Prior Year

$

20) Estimated Tax Payment with Extension

$

21) Total Prior Year & Estimated Payments (ADD LINES 19 and 20)

$

Total remittance (line 18 less line 21)

$

Make check payable to: Boone County Fiscal Court

Refund

Credit

If Overage please specify Refund or Credit

You must attach a copy of the Federal Tax Return, Supporting Schedules (include all pages)

and complete page two -Calculation Of Adjusted Business Income

Signed:

Date:

Printed Name

Official Title:

Tax Form Prepared By:

Telephone Number:

E-mail

I declare, under the penalties of perjury, that I have examined this document and to the best of my knowledge and belief, this is a true and accurate return.

Please notify in writing any changes of ownership or new address by completing a Request to Change/Close Occupational License Account which

can be found on our website @ If you have any questions please call 859-334-2144 or email

Mail your return to:

PO Box 457, Florence, KY 41022-0457) are for returns WITH PAYMENT and

PO Box 960, Burlington, KY 41005-0960) are for returns WITHOUT PAYMENT.

Form 0706 - page 1 of 2

1

1 2

2