Form 41a720-S54 Schedule Kbi-Sp Draft - Tax Computation Schedule - 2015

ADVERTISEMENT

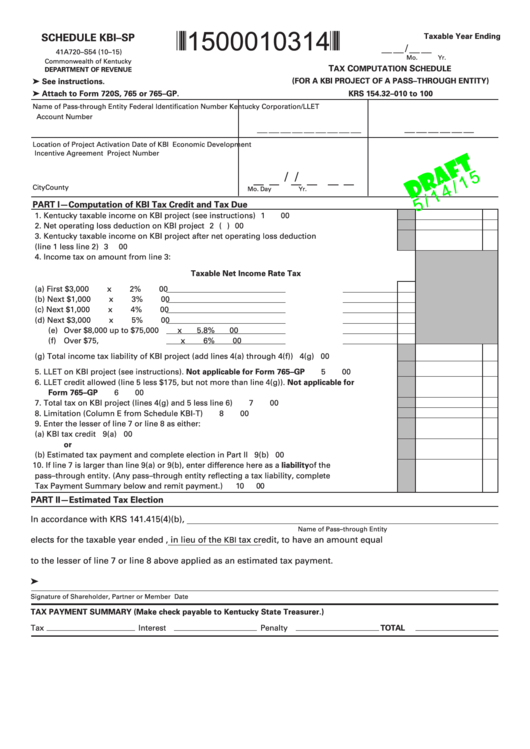

SCHEDULE KBI–SP

*1500010314*

Taxable Year Ending

__ __ / __ __

41A720–S54 (10–15)

Mo.

Yr.

Commonwealth of Kentucky

T

C

S

AX

OMPUTATION

CHEDULE

DEPARTMENT OF REVENUE

(FOR A KBI PROJECT OF A PASS–THROUGH ENTITY)

➤ See instructions.

➤ Attach to Form 720S, 765 or 765–GP .

KRS 154.32–010 to 100

Name of Pass-through Entity

Federal Identification Number

Kentucky Corporation/LLET

Account Number

__ __ __ __ __ __ __ __ __

__ __ __ __ __ __

Location of Project

Activation Date of KBI

Economic Development

Incentive Agreement

Project Number

/

/

City

County

Mo.

Day

Yr.

PART I—Computation of KBI Tax Credit and Tax Due

1. Kentucky taxable income on KBI project (see instructions) .............................................................

1

00

2. Net operating loss deduction on KBI project ....................................................................................

2 (

)

00

3. Kentucky taxable income on KBI project after net operating loss deduction

(line 1 less line 2) .................................................................................................................................

3

00

4. Income tax on amount from line 3:

Taxable Net Income

Rate

Tax

(a) First $3,000 ........................

x

2%

00

(b) Next $1,000 ........................

x

3%

00

(c) Next $1,000 ........................

x

4%

00

(d) Next $3,000 ........................

x

5%

00

(e) Over $8,000 up to $75,000

x

5.8%

00

(f) Over $75,000.......................

x

6%

00

(g) Total income tax liability of KBI project (add lines 4(a) through 4(f)) ...................................... 4(g)

00

5. LLET on KBI project (see instructions). Not applicable for Form 765–GP .......................................

5

00

6. LLET credit allowed (line 5 less $175, but not more than line 4(g)). Not applicable for

Form 765–GP ........................................................................................................................................

6

00

7. Total tax on KBI project (lines 4(g) and 5 less line 6) ........................................................................

7

00

8. Limitation (Column E from Schedule KBI-T) .....................................................................................

8

00

9. Enter the lesser of line 7 or line 8 as either:

(a) KBI tax credit .................................................................................................................................

9(a)

00

or

(b) Estimated tax payment and complete election in Part II ........................................................... 9(b)

00

10. If line 7 is larger than line 9(a) or 9(b), enter difference here as a liability of the

pass–through entity. (Any pass–through entity reflecting a tax liability, complete

Tax Payment Summary below and remit payment.) ........................................................................

10

00

PART II—Estimated Tax Election

In accordance with KRS 141.415(4)(b),

Name of Pass–through Entity

elects for the taxable year ended

, in lieu of the

tax credit, to have an amount equal

KBI

to the lesser of line 7 or line 8 above applied as an estimated tax payment.

➤

Signature of Shareholder, Partner or Member

Date

TAX PAYMENT SUMMARY (Make check payable to Kentucky State Treasurer.)

Tax

Interest

Penalty

TOTAL

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2