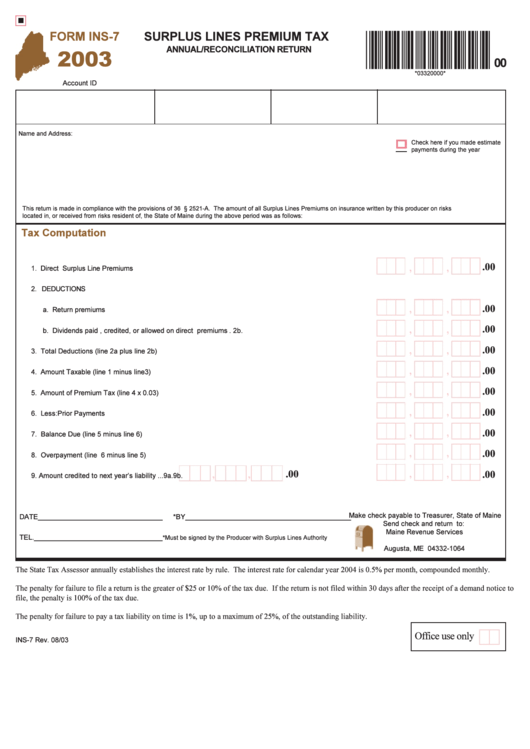

Form Ins-7 - Surplus Lines Premium Tax Annual / Reconciliation Return - 2003

ADVERTISEMENT

*0332000*

FORM INS-7

SURPLUS LINES PREMIUM TAX

ANNUAL/RECONCILIATION RETURN

2003

00

*03320000*

Account ID No.

Period Begin

Period End

Due Date

Name and Address:

Check here if you made estimate

payments during the year

This return is made in compliance with the provisions of 36 M.R.S.A. § 2521-A. The amount of all Surplus Lines Premiums on insurance written by this producer on risks

located in, or received from risks resident of, the State of Maine during the above period was as follows:

Tax Computation

.00

,

,

1. Direct Surplus Line Premiums ....................................................................................................................... 1.

2. DEDUCTIONS

.00

,

,

a. Return premiums .................................................................................................................................... 2a.

,

,

.00

b. Dividends paid , credited, or allowed on direct premiums ................................................................... 2b.

.00

,

,

3. Total Deductions (line 2a plus line 2b) ........................................................................................................... 3.

,

,

.00

4. Amount Taxable (line 1 minus line 3) ............................................................................................................. 4.

,

,

.00

5. Amount of Premium Tax (line 4 x 0.03) .......................................................................................................... 5.

,

,

.00

6. Less:Prior Payments ...................................................................................................................................... 6.

,

,

.00

7. Balance Due (line 5 minus line 6) ................................................................................................................... 7.

,

,

.00

8. Overpayment (line 6 minus line 5) ................................................................................................................ 8.

.00

,

,

.00

,

,

9. Amount credited to next year’s liability ... 9a.

9b. Refunded...9b.

Make check payable to Treasurer, State of Maine

DATE________________________________

*BY__________________________________________

Send check and return to:

Maine Revenue Services

TEL._________________________________

*Must be signed by the Producer with Surplus Lines Authority

P.O.Box 1064

Augusta, ME 04332-1064

The State Tax Assessor annually establishes the interest rate by rule. The interest rate for calendar year 2004 is 0.5% per month, compounded monthly.

The penalty for failure to file a return is the greater of $25 or 10% of the tax due. If the return is not filed within 30 days after the receipt of a demand notice to

file, the penalty is 100% of the tax due.

The penalty for failure to pay a tax liability on time is 1%, up to a maximum of 25%, of the outstanding liability.

Office use only

INS-7 Rev. 08/03

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1