Electronic Filing - Ohio Department Of Taxation - 2011

ADVERTISEMENT

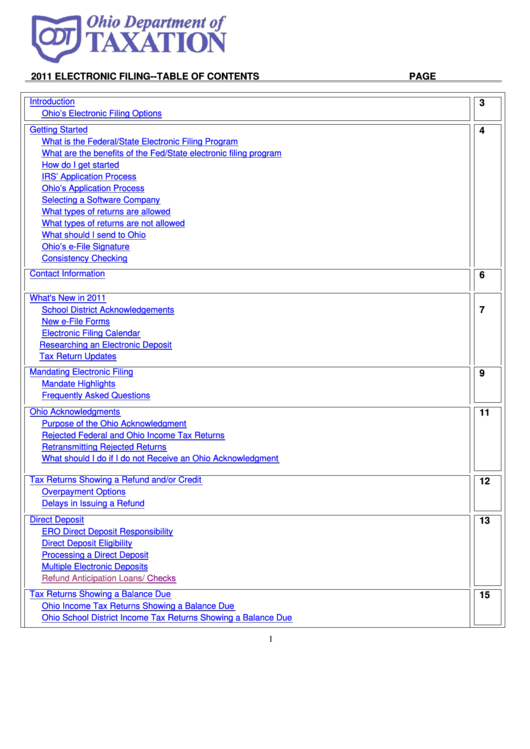

2011 ELECTRONIC FILING--TABLE OF CONTENTS

PAGE

Introduction

3

Ohio‟s Electronic Filing Options

Getting Started

4

What is the Federal/State Electronic Filing Program

What are the benefits of the Fed/State electronic filing program

How do I get started

IRS‟ Application Process

Ohio‟s Application Process

Selecting a Software Company

What types of returns are allowed

What types of returns are not allowed

What should I send to Ohio

Ohio‟s e-File Signature

Consistency Checking

Contact Information

6

What's New in 2011

7

School District Acknowledgements

New e-File Forms

Electronic Filing Calendar

Researching an Electronic Deposit

Tax Return Updates

Mandating Electronic Filing

9

Mandate Highlights

Frequently Asked Questions

Ohio Acknowledgments

11

Purpose of the Ohio Acknowledgment

Rejected Federal and Ohio Income Tax Returns

Retransmitting Rejected Returns

What should I do if I do not Receive an Ohio Acknowledgment

Tax Returns Showing a Refund and/or Credit

12

Overpayment Options

Delays in Issuing a Refund

Direct Deposit

13

ERO Direct Deposit Responsibility

Direct Deposit Eligibility

Processing a Direct Deposit

Multiple Electronic Deposits

Refund Anticipation Loans/

Checks

Tax Returns Showing a Balance Due

15

Ohio Income Tax Returns Showing a Balance Due

Ohio School District Income Tax Returns Showing a Balance Due

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24