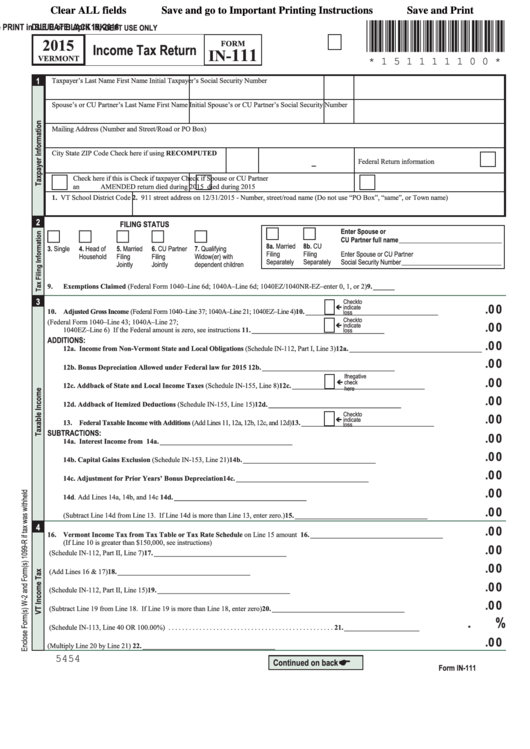

Clear ALL fields

Save and Print

Save and go to Important Printing Instructions

DUE DATE: April 18, 2016

Please PRINT in BLUE or BLACK INK

*151111100*

DEPT USE ONLY

2015

FORM

Income Tax Return

111

IN-

VERMONT

* 1 5 1 1 1 1 1 0 0 *

1

Taxpayer’s Last Name

First Name

Initial

Taxpayer’s Social Security Number

Spouse’s or CU Partner’s Last Name

First Name

Initial

Spouse’s or CU Partner’s Social Security Number

Mailing Address (Number and Street/Road or PO Box)

City

State

ZIP Code

Check here if using RECOMPUTED

Federal Return information

-

Check here if this is

Check if taxpayer

Check if Spouse or CU Partner

an AMENDED return

died during 2015

died during 2015

1. VT School District Code

2. 911 street address on 12/31/2015 - Number, street/road name (Do not use “PO Box”, “same”, or Town name)

2

FILING STATUS

Enter Spouse or

c

c

c

c

c

c

c

CU Partner full name ________________________________

8a. Married

8b. CU

3. Single

4. Head of

5. Married

6. CU Partner

7. Qualifying

Filing

Filing

Enter Spouse or CU Partner

Household

Filing

Filing

Widow(er) with

Separately

Separately

Social Security Number _______________________________

Jointly

Jointly

dependent children

9.

Exemptions Claimed (Federal Form 1040–Line 6d; 1040A–Line 6d; 1040EZ/1040NR-EZ–enter 0, 1, or 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9. ______

3

Check to

.0 0

ç indicate

10. Adjusted Gross Income (Federal Form 1040–Line 37; 1040A–Line 21; 1040EZ–Line 4) . . . . . . .

10. _____________________________________

loss

Check to

11. Federal Taxable Income (Federal Form 1040–Line 43; 1040A–Line 27;

.0 0

ç indicate

11. _____________________________________

1040EZ–Line 6) If the Federal amount is zero, see instructions . . . . . . . . . . . . . . . . . . . . . .

loss

ADDITIONS:

.0 0

12a. Income from Non-Vermont State and Local Obligations (Schedule IN-112, Part I, Line 3) . . . . . . 12a. _____________________________________

.0 0

12b. Bonus Depreciation Allowed under Federal law for 2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12b. _____________________________________

If negative

.0 0

ç check

12c. Addback of State and Local Income Taxes (Schedule IN-155, Line 8) . . . . . . . . . . .

12c. _____________________________________

here

.0 0

12d. Addback of Itemized Deductions (Schedule IN-155, Line 15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12d. _____________________________________

Check to

.0 0

ç indicate

13. Federal Taxable Income with Additions (Add Lines 11, 12a, 12b, 12c, and 12d) . . . . . . . .

13. _____________________________________

loss

SUBTRACTIONS:

.0 0

14a. Interest Income from U.S. Obligations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14a. _____________________________________

.0 0

14b. Capital Gains Exclusion (Schedule IN-153, Line 21) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14b. _____________________________________

.0 0

14c. Adjustment for Prior Years’ Bonus Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14c. _____________________________________

.0 0

14d . Add Lines 14a, 14b, and 14c . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14d. _____________________________________

15. Vermont Taxable Income

.0 0

(Subtract Line 14d from Line 13 . If Line 14d is more than Line 13, enter zero .) . . . . . . . . . . . . . . . . . . . . . 15. _____________________________________

4

.0 0

16.

Vermont Income Tax from Tax Table or Tax Rate Schedule on Line 15 amount

. . . . . . . . . . . . . . . . . . 16. _____________________________________

(If Line 10 is greater than $150,000, see instructions)

.0 0

17. Additions to Vermont Income Tax (Schedule IN-112, Part II, Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17. _____________________________________

.0 0

18. Vermont Income Tax with Additions (Add Lines 16 & 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18. _____________________________________

.0 0

19. Subtractions from Vermont Income Tax (Schedule IN-112, Part II, Line 15) . . . . . . . . . . . . . . . . . . . . . . 19. _____________________________________

.0 0

20. Vermont Income Tax (Subtract Line 19 from Line 18 . If Line 19 is more than Line 18, enter zero) . . . . . 20. _____________________________________

.

%

21. Income Adjustment (Schedule IN-113, Line 40 OR 100 .00%)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21. _____________________

.0 0

22. Adjusted Vermont Income Tax (Multiply Line 20 by Line 21)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22. _____________________________________

5454

Continued on back

E

Form IN-111

1

1 2

2