(

)

(

)

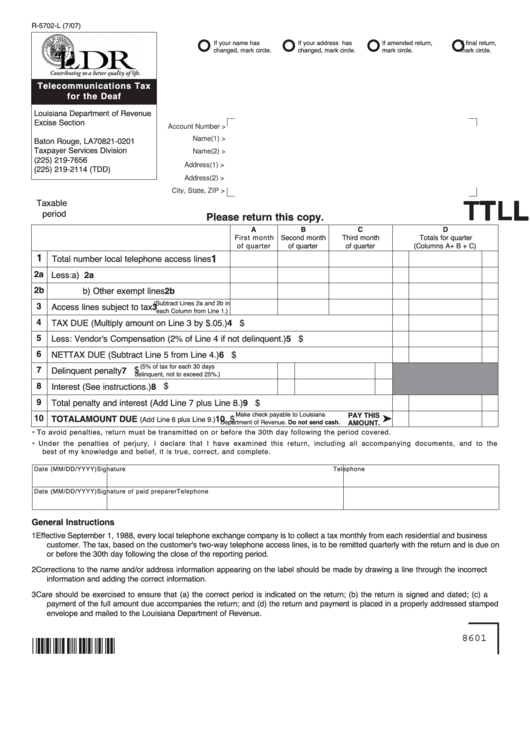

R-5702-L (7/07)

°

°

°

°

If your name has

If your address has

If amended return,

If final return,

changed, mark circle.

changed, mark circle.

mark circle.

mark circle.

Telecommunications Tax

for the Deaf

Louisiana Department of Revenue

Excise Section

Account Number >

P.O. Box 201

Name(1) >

Baton Rouge, LA 70821-0201

Taxpayer Services Division

Name(2) >

(225) 219-7656

Address(1) >

(225) 219-2114 (TDD)

Address(2) >

City, State, ZIP >

Taxable

T T L L

period

Please return this copy.

A

B

C

D

First month

Second month

Third month

Totals for quarter

of quarter

of quarter

of quarter

(Columns A + B + C)

1

1

Total number local telephone access lines

2a Less:

a) U.S. Government lines

2a

2b

b) Other exempt lines

2b

(Subtract Lines 2a and 2b in

3

Access lines subject to tax

3

each Column from Line 1.)

4

TAX DUE (Multiply amount on Line 3 by $.05.)

4 $

5

Less: Vendor's Compensation (2% of Line 4 if not delinquent.)

5 $

6

NET TAX DUE (Subtract Line 5 from Line 4.)

6 $

(5% of tax for each 30 days

7

7 $

Delinquent penalty

delinquent, not to exceed 25%.)

8

8 $

Interest (See instructions.)

9

Total penalty and interest (Add Line 7 plus Line 8.)

9 $

Make check payable to Louisiana

PAY THIS

➤

10 TOTAL AMOUNT DUE

10 $

(Add Line 6 plus Line 9.)

Department of Revenue. Do not send cash.

AMOUNT.

•

To avoid penalties, return must be transmitted on or before the 30th day following the period covered.

•

Under the penalties of perjury, I declare that I have examined this return, including all accompanying documents, and to the

best of my knowledge and belief, it is true, correct, and complete.

Date (MM/DD/YYYY)

Signature

Telephone

Date (MM/DD/YYYY)

Signature of paid preparer

Telephone

General Instructions

1

Effective September 1, 1988, every local telephone exchange company is to collect a tax monthly from each residential and business

customer. The tax, based on the customer's two-way telephone access lines, is to be remitted quarterly with the return and is due on

or before the 30th day following the close of the reporting period.

2

Corrections to the name and/or address information appearing on the label should be made by drawing a line through the incorrect

information and adding the correct information.

3

Care should be exercised to ensure that (a) the correct period is indicated on the return; (b) the return is signed and dated; (c) a

payment of the full amount due accompanies the return; and (d) the return and payment is placed in a properly addressed stamped

envelope and mailed to the Louisiana Department of Revenue.

8601

1

1 2

2