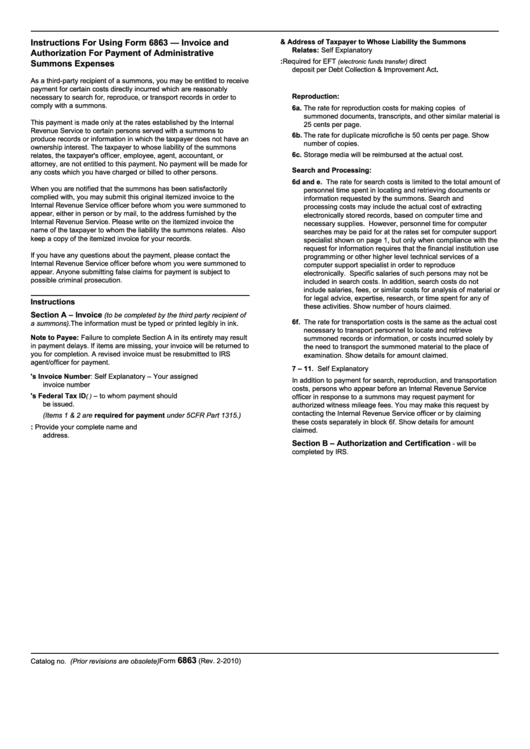

Instructions For Using Form 6863 - Invoice And Authorization For Payment Of Administrative Summons Expenses

ADVERTISEMENT

Instructions For Using Form 6863 — Invoice and

4. Name & Address of Taxpayer to Whose Liability the Summons

Relates: Self Explanatory

Authorization For Payment of Administrative

5. Payment Method: Required for EFT

direct

(electronic funds transfer)

Summons Expenses

deposit per Debt Collection & Improvement Act.

As a third-party recipient of a summons, you may be entitled to receive

6. Service/Financial Records Provided

payment for certain costs directly incurred which are reasonably

Reproduction:

necessary to search for, reproduce, or transport records in order to

comply with a summons.

6a. The rate for reproduction costs for making copies of

summoned documents, transcripts, and other similar material is

This payment is made only at the rates established by the Internal

25 cents per page.

Revenue Service to certain persons served with a summons to

6b. The rate for duplicate microfiche is 50 cents per page. Show

produce records or information in which the taxpayer does not have an

number of copies.

ownership interest. The taxpayer to whose liability of the summons

6c. Storage media will be reimbursed at the actual cost.

relates, the taxpayer's officer, employee, agent, accountant, or

attorney, are not entitled to this payment. No payment will be made for

Search and Processing:

any costs which you have charged or billed to other persons.

6d and e. The rate for search costs is limited to the total amount of

When you are notified that the summons has been satisfactorily

personnel time spent in locating and retrieving documents or

complied with, you may submit this original itemized invoice to the

information requested by the summons. Search and

Internal Revenue Service officer before whom you were summoned to

processing costs may include the actual cost of extracting

appear, either in person or by mail, to the address furnished by the

electronically stored records, based on computer time and

Internal Revenue Service. Please write on the itemized invoice the

necessary supplies. However, personnel time for computer

name of the taxpayer to whom the liability the summons relates. Also

searches may be paid for at the rates set for computer support

keep a copy of the itemized invoice for your records.

specialist shown on page 1, but only when compliance with the

request for information requires that the financial institution use

If you have any questions about the payment, please contact the

programming or other higher level technical services of a

Internal Revenue Service officer before whom you were summoned to

computer support specialist in order to reproduce

appear. Anyone submitting false claims for payment is subject to

electronically. Specific salaries of such persons may not be

possible criminal prosecution.

included in search costs. In addition, search costs do not

include salaries, fees, or similar costs for analysis of material or

for legal advice, expertise, research, or time spent for any of

Instructions

these activities. Show number of hours claimed.

Section A – Invoice

(to be completed by the third party recipient of

6f. The rate for transportation costs is the same as the actual cost

a summons).The information must be typed or printed legibly in ink.

necessary to transport personnel to locate and retrieve

Note to Payee: Failure to complete Section A in its entirety may result

summoned records or information, or costs incurred solely by

in payment delays. If items are missing, your invoice will be returned to

the need to transport the summoned material to the place of

you for completion. A revised invoice must be resubmitted to IRS

examination. Show details for amount claimed.

agent/officer for payment.

7 – 11. Self Explanatory

1. Payee's Invoice Number: Self Explanatory – Your assigned

In addition to payment for search, reproduction, and transportation

invoice number

costs, persons who appear before an Internal Revenue Service

2. Payee's Federal Tax ID

– to whom payment should

(e.g. TIN or EIN)

officer in response to a summons may request payment for

be issued.

authorized witness mileage fees. You may make this request by

contacting the Internal Revenue Service officer or by claiming

(Items 1 & 2 are required for payment under 5CFR Part 1315.)

these costs separately in block 6f. Show details for amount

3. Name and Address of Payee: Provide your complete name and

claimed.

address.

Section B – Authorization and Certification

- will be

completed by IRS.

6863

Form

(Rev. 2-2010)

Catalog no. 25140B

(Prior revisions are obsolete)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1