Solid Waste Reduction Investment Tax Credit (36 Mrsa, '5219-D) Worksheet - Maine Revenue Services

ADVERTISEMENT

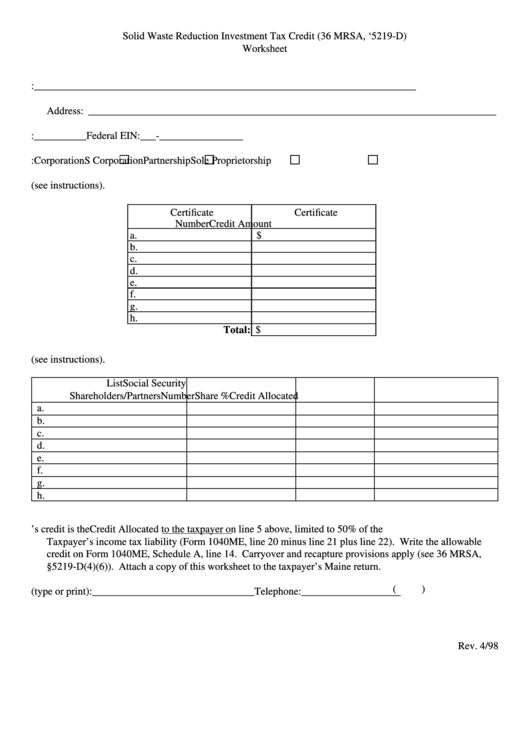

Solid Waste Reduction Investment Tax Credit (36 MRSA, ‘5219-D)

Worksheet

1. Business name: _________________________________________________________________________

Address: ______________________________________________________________________________

2. Business code: __________

Federal EIN: ___ - ________________

3. Business type:

Corporation

S Corporation

Partnership

Sole Proprietorship

4. Schedule of certificates for the Solid Waste Reduction Investment Tax Credit (see instructions).

Certificate

Certificate

Number

Credit Amount

a.

$

b.

c.

d.

e.

f.

g.

h.

Total: $

5. Schedule of shareholders or partners and allocation of the total credit (see instructions).

List

Social Security

Shareholders/Partners

Number

Share %

Credit Allocated

a.

b.

c.

d.

e.

f.

g.

h.

6. The taxpayer’s credit is the Credit Allocated to the taxpayer on line 5 above, limited to 50% of the

Taxpayer’s income tax liability (Form 1040ME, line 20 minus line 21 plus line 22). Write the allowable

credit on Form 1040ME, Schedule A, line 14. Carryover and recapture provisions apply (see 36 MRSA,

§5219-D(4)(6)). Attach a copy of this worksheet to the taxpayer’s Maine return.

(

)

7. Contact person (type or print): _______________________________ Telephone: ___________________

Rev. 4/98

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1