Form Rv11strtn - Sales And Use Tax Return

ADVERTISEMENT

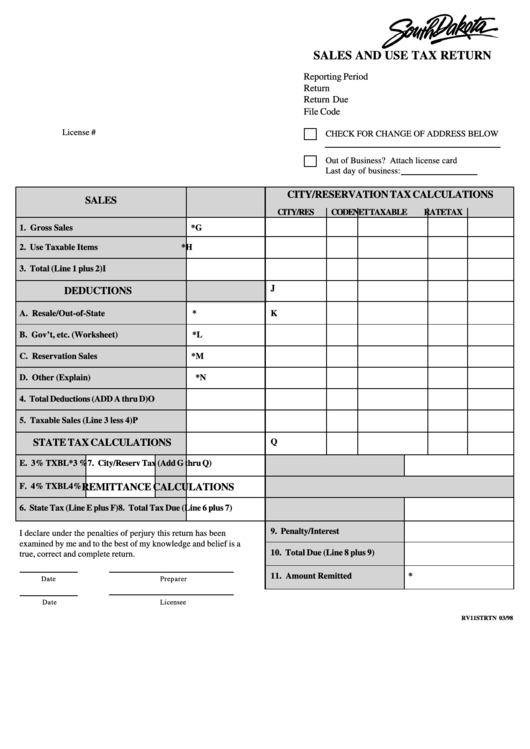

SALES AND USE TAX RETURN

Reporting Period

Return

Return Due

File Code

License #

CHECK FOR CHANGE OF ADDRESS BELOW

Out of Business? Attach license card

Last day of business:

CITY/RESERVATION TAX CALCULATIONS

SALES

CITY/RES

CODE

NET TAXABLE

RATE

TAX

1. Gross Sales

*

G

2. Use Taxable Items

*

H

3. Total (Line 1 plus 2)

I

J

DEDUCTIONS

A. Resale/Out-of-State

*

K

B. Gov’t, etc. (Worksheet)

*

L

C. Reservation Sales

*

M

D. Other (Explain)

*

N

4. Total Deductions (ADD A thru D)

O

5. Taxable Sales (Line 3 less 4)

P

STATE TAX CALCULATIONS

Q

E. 3% TXBL*

3 %

7. City/Reserv Tax (Add G thru Q)

F. 4% TXBL

4 %

REMITTANCE CALCULATIONS

6. State Tax (Line E plus F)

8. Total Tax Due (Line 6 plus 7)

9. Penalty/Interest

I declare under the penalties of perjury this return has been

examined by me and to the best of my knowledge and belief is a

10. Total Due (Line 8 plus 9)

true, correct and complete return.

11. Amount Remitted

*

Date

Preparer

Date

Licensee

RV11STRTN 03/98

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7