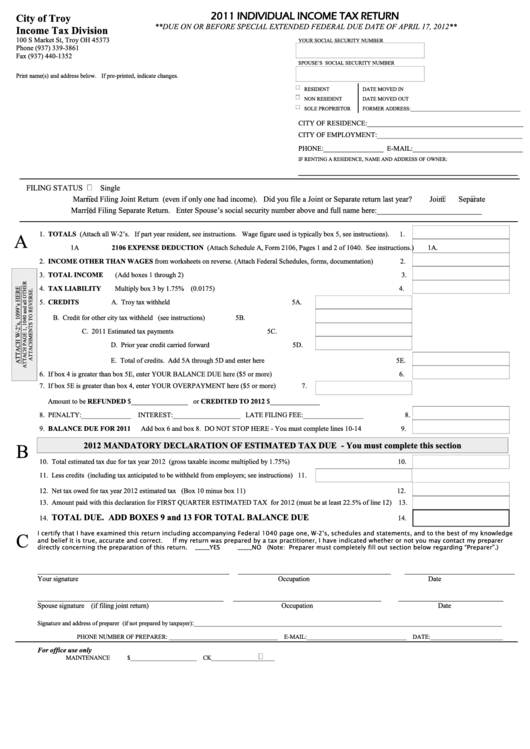

2011 INDIVIDUAL INCOME TAX RETURN

City of Troy

**DUE ON OR BEFORE SPECIAL EXTENDED FEDERAL DUE DATE OF APRIL 17, 2012**

Income Tax Division

100 S Market St, Troy OH 45373

YOUR SOCIAL SECURITY NUMBER

Phone (937) 339-3861

Fax (937) 440-1352

SPOUSE’S SOCIAL SECURITY NUMBER

Print name(s) and address below. If pre-printed, indicate changes.

DATE MOVED IN

RESIDENT

DATE MOVED OUT

NON RESIDENT

SOLE PROPRIETOR

FORMER ADDRESS:_________________________________________

CITY OF RESIDENCE:____________________________________________

CITY OF EMPLOYMENT:_________________________________________

PHONE:_________________ E-MAIL:_______________________________

IF RENTING A RESIDENCE, NAME AND ADDRESS OF OWNER:

____________________________________

FILING STATUS

Single

Married Filing Joint Return (even if only one had income). Did you file a Joint or Separate return last year?

Joint

Separate

Married Filing Separate Return. Enter Spouse’s social security number above and full name here:___________________________

1. TOTALS (Attach all W-2’s. If part year resident, see instructions. Wage figure used is typically box 5, see instructions).

1.

A

1A 2106 EXPENSE DEDUCTION (Attach Schedule A, Form 2106, Pages 1 and 2 of 1040. See instructions.)

1A.

2. INCOME OTHER THAN WAGES from worksheets on reverse. (Attach Federal Schedules, forms, documentation)

2.

3. TOTAL INCOME

(Add boxes 1 through 2)

3.

4. TAX LIABILITY

Multiply box 3 by 1.75% (0.0175)

4.

5. CREDITS

A. Troy tax withheld

5A.

B. Credit for other city tax withheld (see instructions)

5B.

C. 2011 Estimated tax payments

5C.

D. Prior year credit carried forward

5D.

E. Total of credits. Add 5A through 5D and enter here

5E.

6. If box 4 is greater than box 5E, enter YOUR BALANCE DUE here ($5 or more)

6.

7. If box 5E is greater than box 4, enter YOUR OVERPAYMENT here ($5 or more)

7.

Amount to be REFUNDED $________________ or CREDITED TO 2012 $______________

8. PENALTY:______________ INTEREST:___________________ LATE FILING FEE:_________________

8.

9. BALANCE DUE FOR 2011

Add box 6 and box 8. DO NOT STOP HERE - You must complete lines 10-14

9.

B

2012 MANDATORY DECLARATION OF ESTIMATED TAX DUE - You must complete this section

10. Total estimated tax due for tax year 2012 (gross taxable income multiplied by 1.75%)

10.

11. Less credits (including tax anticipated to be withheld from employers; see instructions) 11.

12. Net tax owed for tax year 2012 estimated tax (Box 10 minus box 11)

12.

13. Amount paid with this declaration for FIRST QUARTER ESTIMATED TAX for 2012 (must be at least 22.5% of line 12) 13.

TOTAL DUE. ADD BOXES 9 and 13 FOR TOTAL BALANCE DUE

14.

14.

I certify that I have examined this return including accompanying Federal 1040 page one, W-2’s, schedules and statements, and to the best of my knowledge

C

and belief it is true, accurate and correct.

If my return was prepared by a tax practitioner, I have indicated whether or not you may contact my preparer

directly concerning the preparation of this return.

_____YES

_____NO (Note: Preparer must completely fill out section below regarding “Preparer”.)

______________________________________________________

___________________________________________

_______________________________

Your signature

Occupation

Date

_______________________________________ _______________________________

______________________

Spouse signature (if filing joint return)

Occupation

Date

Signature and address of preparer (if not prepared by taxpayer):______________________________________________________________________________________________________

PHONE NUMBER OF PREPARER: ____________________________________ E-MAIL:_________________________________ DATE:________________________

For office use only

MAINTENANCE

$______________________ CK_____________________

1

1 2

2