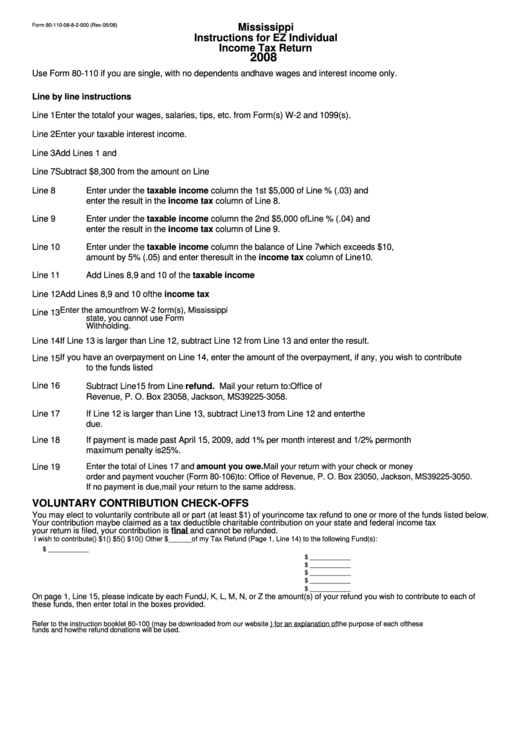

Form 80-110-08-8-2-000 - Mississippi Instructions For Ez Individual Income Tax Return - 2008

ADVERTISEMENT

Form 80-110-08-8-2-000 (Rev.05/08)

Mississippi

Instructions for EZ Individual

Income Tax Return

2008

Use Form 80-110 if you are single, with no dependents and have wages and interest income only.

Line by line instructions

Line 1

Enter the total of your wages, salaries, tips, etc. from Form(s) W-2 and 1099(s).

Line 2

Enter your taxable interest income.

Line 3

Add Lines 1 and 2. Enter the total.

Line 7

Subtract $8,300 from the amount on Line 3. Enter the result.

Line 8

Enter under the taxable income column the 1st $5,000 of Line 7. Multiply this amount by 3% (.03) and

enter the result in the income tax column of Line 8.

Line 9

Enter under the taxable income column the 2nd $5,000 of Line 7. Multiply this amount by 4% (.04) and

enter the result in the income tax column of Line 9.

Line 10

Enter under the taxable income column the balance of Line 7 which exceeds $10,000. Multiply this

amount by 5% (.05) and enter the result in the income tax column of Line 10.

Line 11

Add Lines 8, 9 and 10 of the taxable income column. Enter the result on Line 11.

Line 12

Add Lines 8, 9 and 10 of the income tax column. Enter the result on Line 12.

Enter the amount from W-2 form(s), Mississippi withholding. If you have withholding from another

Line 13

state, you cannot use Form 80-110. Use Form 80-105. You must ATTACH W-2 to receive credit for

Withholding.

Line 14

If Line 13 is larger than Line 12, subtract Line 12 from Line 13 and enter the result.

If you have an overpayment on Line 14, enter the amount of the overpayment, if any, you wish to contribute

Line 15

to the funds listed below. See Voluntary Contribution Check-Offs.

Line 16

Subtract Line 15 from Line 14. Enter the result. This is your refund. Mail your return to: Office of

Revenue, P. O. Box 23058, Jackson, MS 39225-3058.

Line 17

If Line 12 is larger than Line 13, subtract Line 13 from Line 12 and enter the result. This is your balance

due.

Line 18

If payment is made past April 15, 2009, add 1% per month interest and 1/2% per month penalty. The

maximum penalty is 25%.

Enter the total of Lines 17 and 18. This is the amount you owe. Mail your return with your check or money

Line 19

order and payment voucher (Form 80-106) to: Office of Revenue, P. O. Box 23050, Jackson, MS 39225-3050.

If no payment is due, mail your return to the same address.

VOLUNTARY CONTRIBUTION CHECK-OFFS

You may elect to voluntarily contribute all or part (at least $1) of your income tax refund to one or more of the funds listed below.

Your contribution may be claimed as a tax deductible charitable contribution on your state and federal income tax returns. Once

your return is filed, your contribution is final and cannot be refunded.

I wish to contribute ( ) $1 ( ) $5 ( ) $10 ( ) Other $______ of my Tax Refund (Page 1, Line 14) to the following Fund(s):

J.

Mississippi Military Family Relief Fund

$ ____________

K.

Mississippi Commission for Volunteer Service Fund

$ ____________

L.

Mississippi Wildlife Heritage Fund

$ ____________

M.

Mississippi Educational Trust Fund

$ ____________

N.

Mississippi Wildlife Fisheries and Parks Foundation

$ ____________

Z.

Mississippi Burn Care Fund

$ ____________

On page 1, Line 15, please indicate by each Fund J, K, L, M, N, or Z the amount(s) of your refund you wish to contribute to each of

these funds, then enter total in the boxes provided.

Refer to the instruction booklet 80-100 (may be downloaded from our website ) for an explanation of the purpose of each of these

funds and how the refund donations will be used.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1