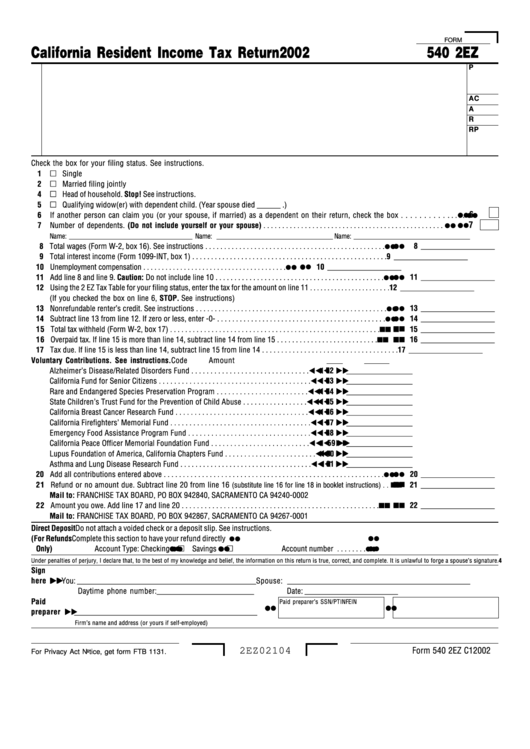

Form 540 2ez - California Resident Income Tax Return - 2002

ADVERTISEMENT

FORM

540 2EZ

California Resident Income Tax Return 2002

P

AC

A

R

RP

Check the box for your filing status. See instructions.

1

Single

2

Married filing jointly

4

Head of household. Stop! See instructions.

5

Qualifying widow(er) with dependent child. (Year spouse died ______ .)

¼ ¼ ¼ ¼ ¼

6

6

If another person can claim you (or your spouse, if married) as a dependent on their return, check the box . . . . . . . . . . . . . . .

¼ ¼ ¼ ¼ ¼

7

7

Number of dependents. (Do not include yourself or your spouse) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Name: ___________________________________ Name: _________________________________ Name: _________________________________

¼ ¼ ¼ ¼ ¼

8 Total wages (Form W-2, box 16). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8 ___________________

9 Total interest income (Form 1099-INT, box 1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 ___________________

¼ ¼ ¼ ¼ ¼

10 Unemployment compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10 ___________________

¼ ¼ ¼ ¼ ¼

11 Add line 8 and line 9. Caution: Do not include line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11 ___________________

12 Using the 2 EZ Tax Table for your filing status, enter the tax for the amount on line 11 . . . . . . . . . . . . . . . . . . . . . . .

12 ___________________

(If you checked the box on line 6, STOP. See instructions)

¼ ¼ ¼ ¼ ¼

13 Nonrefundable renter’s credit. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 ___________________

¼ ¼ ¼ ¼ ¼

14 Subtract line 13 from line 12. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14 ___________________

15 Total tax withheld (Form W-2, box 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15 ___________________

16 Overpaid tax. If line 15 is more than line 14, subtract line 14 from line 15 . . . . . . . . . . . . . . . . . . . . . . . . . . .

16 ___________________

17 Tax due. If line 15 is less than line 14, subtract line 15 from line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17 ___________________

Voluntary Contributions. See instructions.

Code

Amount

Alzheimer’s Disease/Related Disorders Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

52

_________________

California Fund for Senior Citizens . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

53

_________________

Rare and Endangered Species Preservation Program . . . . . . . . . . . . . . . . . . . . . . . .

54

_________________

State Children’s Trust Fund for the Prevention of Child Abuse . . . . . . . . . . . . . . . . .

55

_________________

California Breast Cancer Research Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

56

_________________

California Firefighters’ Memorial Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

57

_________________

Emergency Food Assistance Program Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

58

_________________

California Peace Officer Memorial Foundation Fund . . . . . . . . . . . . . . . . . . . . . . . . . .

59

_________________

Lupus Foundation of America, California Chapters Fund . . . . . . . . . . . . . . . . . . . . . . . .

60

_________________

Asthma and Lung Disease Research Fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

61

_________________

¼ ¼ ¼ ¼ ¼

20 Add all contributions entered above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20 ___________________

21 Refund or no amount due. Subtract line 20 from line 16

(substitute line 16 for line 18 in booklet instructions) . .

21 ___________________

Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA 94240-0002

22 Amount you owe. Add line 17 and line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22 ___________________

Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA 94267-0001

Direct Deposit

Do not attach a voided check or a deposit slip. See instructions.

¼ ¼ ¼ ¼ ¼

(For Refunds

Complete this section to have your refund directly deposited. Routing number . . . . . . . .

¼ ¼ ¼ ¼ ¼

¼ ¼ ¼ ¼ ¼

¼ ¼ ¼ ¼ ¼

Only)

Account Type: Checking

Savings

Account number . . . . . . . .

Under penalties of perjury, I declare that, to the best of my knowledge and belief, the information on this return is true, correct, and complete. It is unlawful to forge a spouse’s signature. 4

Sign

here

You: ______________________________________________

Spouse: _______________________________________________

Daytime phone number: _________________________

Date: ________________________

Paid

Paid preparer’s SSN/PTIN

FEIN

¼ ¼ ¼ ¼ ¼

¼ ¼ ¼ ¼ ¼

preparer

_______________________________________________

Firm’s name and address (or yours if self-employed)

2EZ02104

Form 540 2EZ C1 2002

For Privacy Act Notice, get form FTB 1131.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1