Village Of Walbridge Income Tax Return - 2011

ADVERTISEMENT

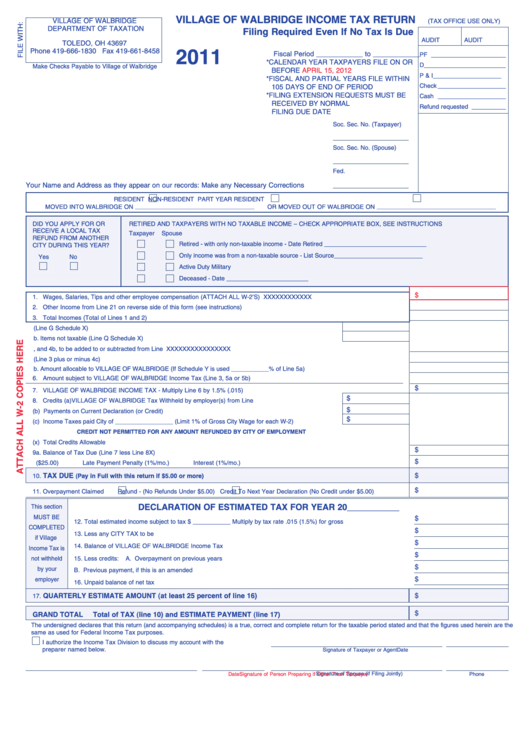

VILLAGE OF WALBRIDGE INCOME TAX RETURN

VILLAGE OF WALBRIDGE

(TAX OFFICE USE ONLY)

DEPARTMENT OF TAXATION

Filing Required Even If No Tax Is Due

P.O. BOX 530

AUDIT

AUDIT

TOLEDO, OH 43697

Phone 419-666-1830 Fax 419-661-8458

2011

Fiscal Period ____________ to ____________

PF ______________________

* CALENDAR YEAR TAXPAYERS FILE ON OR

D________________________

Make Checks Payable to Village of Walbridge

BEFORE

APRIL 15, 2012

P & I ____________________

* FISCAL AND PARTIAL YEARS FILE WITHIN

Check ____________________

105 DAYS OF END OF PERIOD

* FILING EXTENSION REQUESTS MUST BE

Cash ____________________

RECEIVED BY NORMAL

Refund requested __________

FILING DUE DATE

Soc. Sec. No. (Taxpayer)

Soc. Sec. No. (Spouse)

Fed. I.D. No.

Your Name and Address as they appear on our records: Make any Necessary Corrections

RESIDENT

NON-RESIDENT

PART YEAR RESIDENT

MOVED INTO WALBRIDGE ON ___________________________________

OR MOVED OUT OF WALBRIDGE ON ___________________________________

DID YOU APPLY FOR OR

RETIRED AND TAXPAYERS WITH NO TAXABLE INCOME – CHECK APPROPRIATE BOX, SEE INSTRUCTIONS

RECEIVE A LOCAL TAX

Taxpayer

Spouse

REFUND FROM ANOTHER

Retired - with only non-taxable income - Date Retired ______________________________

CITY DURING THIS YEAR?

Only income was from a non-taxable source - List Source __________________________

Yes

No

Active Duty Military

Deceased - Date ________________________

$

1. Wages, Salaries, Tips and other employee compensation (ATTACH ALL W-2’S) ..............................................XXXXXXXXXXXXXXXXX

2. Other Income from Line 21 on reverse side of this form (see instructions) ................................................................................................

3. Total Incomes (Total of Lines 1 and 2) ........................................................................................................................................................

4a. Items not deductible (Line G Schedule X) ..............................................................................Add

b. Items not taxable (Line Q Schedule X) ..............................................................................Deduct

c. Difference between Lines 4a, and 4b, to be added to or subtracted from Line 3 ........................XXXXXXXXXXXXXXXX

5a. Adjusted Net Income (Line 3 plus or minus 4c) ..................................................................................................................

b. Amount allocable to VILLAGE OF WALBRIDGE (If Schedule Y is used ___________% of Line 5a) ................................

6. Amount subject to VILLAGE OF WALBRIDGE Income Tax (Line 3, 5a or 5b) ............................................................................................

$

7. VILLAGE OF WALBRIDGE INCOME TAX - Multiply Line 6 by 1.5% (.015)..........................................................

$

8. Credits (a) VILLAGE OF WALBRIDGE Tax Withheld by employer(s) from Line 1 ..............................................

$

(b) Payments on Current Declaration (or Credit) ....................................................................................

$

(c) Income Taxes paid City of _________________ (Limit 1% of Gross City Wage for each W-2) ......

CREDIT NOT PERMITTED FOR ANY AMOUNT REFUNDED BY CITY OF EMPLOYMENT

(x) Total Credits Allowable ......................................................................................................................

$

9a. Balance of Tax Due (Line 7 less Line 8X)..............................................................................................................

$

b. Late File Penalty ($25.00)

Late Payment Penalty (1%/mo.)

Interest (1%/mo.)

TAX DUE

$

10.

(Pay in Full with this return if $5.00 or more) ......................................................................................................................

$

11. Overpayment Claimed

Refund - (No Refunds Under $5.00)

Credit To Next Year Declaration (No Credit under $5.00)

DECLARATION OF ESTIMATED TAX FOR YEAR 20___________

This section

MUST BE

$

12. Total estimated income subject to tax $ ___________ Multiply by tax rate .015 (1.5%) for gross tax................................

COMPLETED

$

13. Less any CITY TAX to be withheld ......................................................................................................................................

if Village

$

14. Balance of VILLAGE OF WALBRIDGE Income Tax declared..............................................................................................

Income Tax is

$

15. Less credits:

A. Overpayment on previous years return..................................................................................................

not withheld

$

by your

B. Previous payment, if this is an amended estimate ........................................................................................................

$

employer

16. Unpaid balance of net tax due ............................................................................................................................................

$

QUARTERLY ESTIMATE AMOUNT (at least 25 percent of line 16)

17.

......................................................................................

$

GRAND TOTAL

Total of TAX (line 10) and ESTIMATE PAYMENT (line 17) ..................................PAY THIS AMOUNT

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are the

same as used for Federal Income Tax purposes.

I authorize the Income Tax Division to discuss my account with the

preparer named below.

Signature of Taxpayer or Agent

Date

Signature of Spouse (if Filing Jointly)

Signature of Person Preparing if Other Than Taxpayer

Date

Phone

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2