Worksheet For The Quarterly Report Of Wages Paid - Louisiana Workforce Commission

ADVERTISEMENT

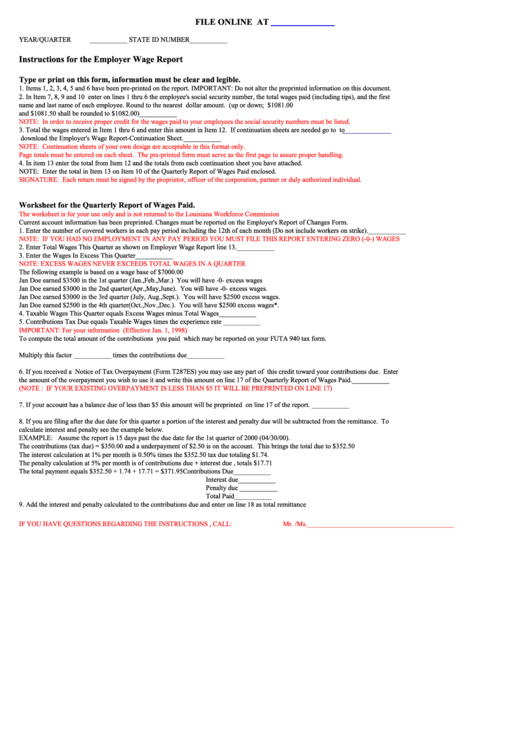

FILE ONLINE AT

YEAR/QUARTER

___________

STATE ID NUMBER

___________

Instructions for the Employer Wage Report

Type or print on this form, information must be clear and legible.

1. Items 1, 2, 3, 4, 5 and 6 have been pre-printed on the report. IMPORTANT: Do not alter the preprinted information on this document.

2. In Item 7, 8, 9 and 10 enter on lines 1 thru 6 the employee's social security number, the total wages paid (including tips), and the first

name and last name of each employee. Round to the nearest dollar amount. (up or down; I.e. 1081.49 shall be rounded to $1081.00

and $1081.50 shall be rounded to $1082.00)

___________

NOTE: In order to receive proper credit for the wages paid to your employees the social security numbers must be listed.

3. Total the wages entered in Item 1 thru 6 and enter this amount in Item 12. If continuation sheets are needed go to

to

download the Employer's Wage Report-Continuation Sheet.

___________

NOTE: Continuation sheets of your own design are acceptable in this format only.

Page totals must be entered on each sheet. The pre-printed form must serve as the first page to assure proper handling.

4. In item 13 enter the total from Item 12 and the totals from each continuation sheet you have attached.

NOTE: Enter the total in Item 13 on Item 10 of the Quarterly Report of Wages Paid enclosed.

SIGNATURE: Each return must be signed by the proprietor, officer of the corporation, partner or duly authorized individual.

Worksheet for the Quarterly Report of Wages Paid.

The worksheet is for your use only and is not returned to the Louisiana Workforce Commission

Current account information has been preprinted. Changes must be reported on the Employer's Report of Changes Form.

1. Enter the number of covered workers in each pay period including the 12th of each month (Do not include workers on strike).

___________

NOTE: IF YOU HAD NO EMPLOYMENT IN ANY PAY PERIOD YOU MUST FILE THIS REPORT ENTERING ZERO (-0-) WAGES

2. Enter Total Wages This Quarter as shown on Employer Wage Report line 13.

___________

3. Enter the Wages In Excess This Quarter

___________

NOTE: EXCESS WAGES NEVER EXCEEDS TOTAL WAGES IN A QUARTER

The following example is based on a wage base of $7000.00

Jan Doe earned $3500 in the 1st quarter (Jan.,Feb.,Mar.) You will have -0- excess wages

Jan Doe earned $3000 in the 2nd quarter(Apr.,May,June). You will have -0- excess wages.

Jan Doe earned $3000 in the 3rd quarter (July, Aug.,Sept.). You will have $2500 excess wages.

Jan Doe earned $2500 in the 4th quarter(Oct.,Nov.,Dec.). You will have $2500 excess wages*.

4. Taxable Wages This Quarter equals Excess Wages minus Total Wages

___________

5. Contributions Tax Due equals Taxable Wages times the experience rate

___________

IMPORTANT: For your information only...(Effective Jan. 1, 1998)

To compute the total amount of the contributions you paid which may be reported on your FUTA 940 tax form.

Multiply this factor

___________

times the contributions due

___________

6. If you received a Notice of Tax Overpayment (Form T287ES) you may use any part of this credit toward your contributions due. Enter

the amount of the overpayment you wish to use it and write this amount on line 17 of the Quarterly Report of Wages Paid.

___________

(NOTE : IF YOUR EXISTING OVERPAYMENT IS LESS THAN $5 IT WILL BE PREPRINTED ON LINE 17)

7. If your account has a balance due of less than $5 this amount will be preprinted on line 17 of the report.

___________

8. If you are filing after the due date for this quarter a portion of the interest and penalty due will be subtracted from the remittance. To

calculate interest and penalty see the example below.

EXAMPLE: Assume the report is 15 days past the due date for the 1st quarter of 2000 (04/30/00).

The contributions (tax due) = $350.00 and a underpayment of $2.50 is on the account. This brings the total due to $352.50

The interest calculation at 1% per month is 0.50% times the $352.50 tax due totaling $1.74.

The penalty calculation at 5% per month is of contributions due + interest due , totals $17.71

The total payment equals $352.50 + 1.74 + 17.71 = $371.95

Contributions Due

___________

Interest due

___________

Penalty due

___________

Total Paid

___________

9. Add the interest and penalty calculated to the contributions due and enter on line 18 as total remittance

IF YOU HAVE QUESTIONS REGARDING THE INSTRUCTIONS , CALL:

Mr. /Ms.___________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2