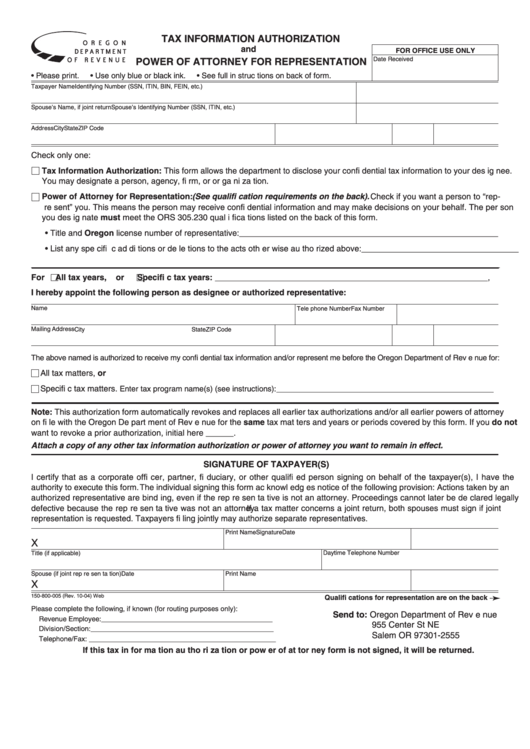

Clear Form

TAX INFORMATION AUTHORIZATION

O R E G O N

and

FOR OFFICE USE ONLY

D E PA R T M E N T

Date Received

O F R E V E N U E

POWER OF ATTORNEY FOR REPRESENTATION

• Please print.

• Use only blue or black ink.

• See full in struc tions on back of form.

Taxpayer Name

Identifying Number (SSN, ITIN, BIN, FEIN, etc.)

Spouse’s Name, if joint return

Spouse’s Identifying Number (SSN, ITIN, etc.)

Address

City

State

ZIP Code

Check only one:

Tax Information Authorization: This form allows the department to disclose your confi dential tax information to your des ig nee.

You may designate a person, agency, fi rm, or or ga ni za tion.

Power of Attorney for Representation: (See qualifi cation requirements on the back). Check if you want a person to “rep-

re sent” you. This means the person may receive confi dential information and may make decisions on your behalf. The per son

you des ig nate must meet the ORS 305.230 qual i fi ca tions listed on the back of this form.

• Title and Oregon license number of representative:________________________________________________________

• List any spe cifi c ad di tions or de le tions to the acts oth er wise au tho rized above: __________________________________

___________________________________________________________________________________________________________

For

All tax years,

or

Specifi c tax years: ___________________________________________________________,

I hereby appoint the following person as designee or authorized representative:

Name

Tele phone Number

Fax Number

Mailing Address

City

State

ZIP Code

The above named is authorized to receive my confi dential tax information and/or represent me before the Oregon Department of Rev e nue for:

All tax matters, or

Specifi c tax matters.

_______________________________________________

Enter tax program name(s) (see instructions):

Note: This authorization form automatically revokes and replaces all earlier tax authorizations and/or all earlier powers of attorney

on fi le with the Oregon De part ment of Rev e nue for the same tax mat ters and years or periods covered by this form. If you do not

want to revoke a prior authorization, initial here ______.

Attach a copy of any other tax information authorization or power of attorney you want to remain in effect.

SIGNATURE OF TAXPAYER(S)

I certify that as a corporate offi cer, partner, fi duciary, or other qualifi ed person signing on behalf of the taxpayer(s), I have the

authority to execute this form. The individual signing this form ac knowl edg es notice of the following provision: Actions taken by an

authorized representative are bind ing, even if the rep re sen ta tive is not an attorney. Proceedings cannot later be de clared legally

defective because the rep re sen ta tive was not an attorney. If a tax matter concerns a joint return, both spouses must sign if joint

representation is requested. Taxpayers fi ling jointly may authorize separate representatives.

Signature

Print Name

Date

X

Daytime Telephone Number

Title (if applicable)

Spouse (if joint rep re sen ta tion)

Print Name

Date

X

150-800-005 (Rev. 10-04) Web

➛

Qualifi cations for representation are on the back

Please complete the following, if known (for routing purposes only):

Send to: Oregon Department of Rev e nue

Revenue Employee: ____________________________________________

955 Center St NE

Division/Section: _______________________________________________

Salem OR 97301-2555

Telephone/Fax: ________________________________________________

If this tax in for ma tion au tho ri za tion or pow er of at tor ney form is not signed, it will be returned.

1

1