Form Ptax-342 - Application For Disabled Veterans' Standard Homestead Exemption (Dvshe)

ADVERTISEMENT

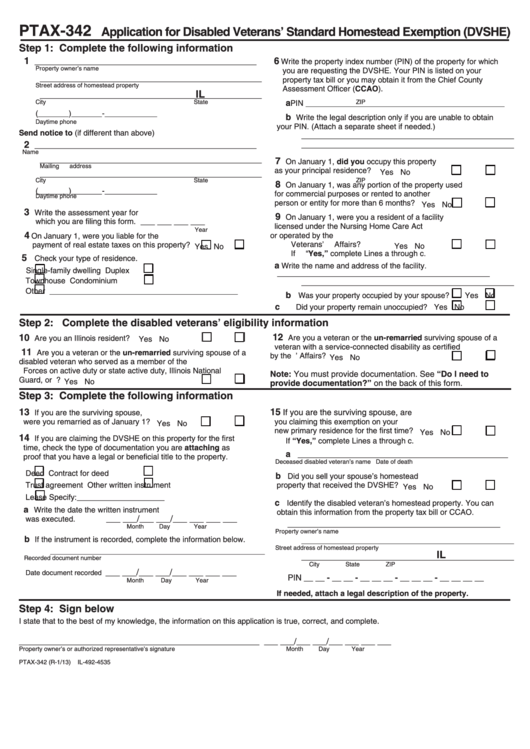

PTAX-342

Application for Disabled Veterans’ Standard Homestead Exemption (DVSHE)

Step 1: Complete the following information

1

6

________________________________________________

Write the property index number (PIN) of the property for which

Property owner’s name

you are requesting the DVSHE. Your PIN is listed on your

________________________________________________

property tax bill or you may obtain it from the Chief County

Street address of homestead property

Assessment Officer (CCAO).

IL

________________________________________________

City

State

ZIP

a

___________________________________________

PIN

(_______)_______-____________

b

Write the legal description only if you are unable to obtain

Daytime phone

your PIN. (Attach a separate sheet if needed.)

Send notice to (if different than above)

______________________________________________

2

______________________________________________

________________________________________________

Name

________________________________________________

7

On January 1, did you occupy this property

Mailing address

as your principal residence?

Yes

No

________________________________________________

City

State

ZIP

8

On January 1, was any portion of the property used

(_______)_______-____________

for commercial purposes or rented to another

Daytime phone

person or entity for more than 6 months?

Yes

No

3

Write the assessment year for

9

On January 1, were you a resident of a facility

___ ___ ___ ___

which you are filing this form.

licensed under the Nursing Home Care Act

Year

4

On January 1, were you liable for the

or operated by the U.S. Department of

Veterans’ Affairs?

payment of real estate taxes on this property?

Yes

No

Yes

No

If “Yes,” complete Lines a through c.

5

Check your type of residence.

a

Write the name and address of the facility.

Single-family dwelling

Duplex

______________________________________________

Townhouse

Condominium

______________________________________________

Other ___________________________________________

b

Was your property occupied by your spouse?

Yes

No

c

Did your property remain unoccupied?

Yes

No

Step 2: Complete the disabled veterans’ eligibility information

12

10

Are you a veteran or the un-remarried surviving spouse of a

Are you an Illinois resident?

Yes

No

veteran with a service-connected disability as certified

11

Are you a veteran or the un-remarried surviving spouse of a

by the U.S. Department of Veterans’ Affairs?

Yes

No

disabled veteran who served as a member of the U.S. Armed

Forces on active duty or state active duty, Illinois National

Note: You must provide documentation. See “Do I need to

Guard, or U.S. Reserve Forces?

Yes

No

provide documentation?” on the back of this form.

Step 3: Complete the following information

13

15

If you are the surviving spouse,

If you are the surviving spouse, a

re

you claiming this exemption on your

were you remarried as of January 1?

Yes

No

new primary residence for the first time?

Yes

No

14

If you are claiming the DVSHE on this property for the first

If “Yes,” complete Lines a through c.

time, check the type of documentation you are attaching as

a

________________________________________________

proof that you have a legal or beneficial title to the property.

Deceased disabled veteran’s name

Date of death

Deed

Contract for deed

b

Did you sell your spouse’s homestead

Trust agreement

Other written instrument

property that received the DVSHE?

Yes

No

Lease

Specify:____________________

c

Identify the disabled veteran’s homestead property. You can

a

Write the date the written instrument

obtain this information from the property tax bill or CCAO.

___ ___/___ ___/___ ___ ___ ___

was executed.

______________________________________________

Month

Day

Year

Property owner’s name

b

If the instrument is recorded, complete the information below.

______________________________________________

Street address of homestead property

_______________________________________________________________

IL

______________________________________________

Recorded document number

City

State

ZIP

___ ___/___ ___/___ ___ ___ ___

Date document recorded

PIN __ __ - __ __ - __ __ __ - __ __ __ - __ __ __ __

Month

Day

Year

If needed, attach a legal description of the property.

Step 4: Sign below

I state that to the best of my knowledge, the information on this application is true, correct, and complete.

____________________________________________________

___ ___/___ ___/___ ___ ___ ___

Property owner’s or authorized representative’s signature

Month

Day

Year

PTAX-342 (R-1/13)

IL-492-4535

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2