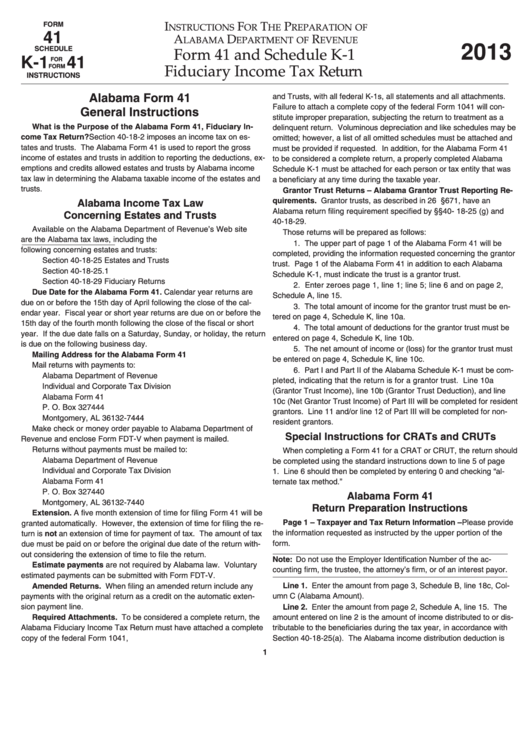

Form 41 - Schedule K-1 Fiduciary Income Tax Return Instructions - 2013

ADVERTISEMENT

FORM

I

F

T

P

NSTRUCTIONS

OR

HE

REPARATION OF

41

A

D

R

LABAMA

EPARTMENT OF

EVENUE

2013

SCHEDULE

Form 41 and Schedule K-1

K-1

41

FOR

FORM

Fiduciary Income Tax Return

INSTRUCTIONS

Alabama Form 41

and Trusts, with all federal K-1s, all statements and all attachments.

Failure to attach a complete copy of the federal Form 1041 will con-

General Instructions

stitute improper preparation, subjecting the return to treatment as a

What is the Purpose of the Alabama Form 41, Fiduciary In-

delinquent return. Voluminous depreciation and like schedules may be

come Tax Return? Section 40-18-2 imposes an income tax on es-

omitted; however, a list of all omitted schedules must be attached and

tates and trusts. The Alabama Form 41 is used to report the gross

must be provided if requested. In addition, for the Alabama Form 41

income of estates and trusts in addition to reporting the deductions, ex-

to be considered a complete return, a properly completed Alabama

emptions and credits allowed estates and trusts by Alabama income

Schedule K-1 must be attached for each person or tax entity that was

tax law in determining the Alabama taxable income of the estates and

a beneficiary at any time during the taxable year.

trusts.

Grantor Trust Returns – Alabama Grantor Trust Reporting Re-

quirements. Grantor trusts, as described in 26 U.S.C. §671, have an

Alabama Income Tax Law

Alabama return filing requirement specified by §§40- 18-25 (g) and

Concerning Estates and Trusts

40-18-29.

Available on the Alabama Department of Revenue’s Web site

Those returns will be prepared as follows:

are the Alabama tax laws, including the

1. The upper part of page 1 of the Alabama Form 41 will be

following concerning estates and trusts:

completed, providing the information requested concerning the grantor

Section 40-18-25 Estates and Trusts

trust. Page 1 of the Alabama Form 41 in addition to each Alabama

Section 40-18-25.1

Schedule K-1, must indicate the trust is a grantor trust.

Section 40-18-29 Fiduciary Returns

2. Enter zeroes page 1, line 1; line 5; line 6 and on page 2,

Due Date for the Alabama Form 41. Calendar year returns are

Schedule A, line 15.

due on or before the 15th day of April following the close of the cal-

3. The total amount of income for the grantor trust must be en-

endar year. Fiscal year or short year returns are due on or before the

tered on page 4, Schedule K, line 10a.

15th day of the fourth month following the close of the fiscal or short

4. The total amount of deductions for the grantor trust must be

year. If the due date falls on a Saturday, Sunday, or holiday, the return

entered on page 4, Schedule K, line 10b.

is due on the following business day.

5. The net amount of income or (loss) for the grantor trust must

Mailing Address for the Alabama Form 41

be entered on page 4, Schedule K, line 10c.

Mail returns with payments to:

6. Part I and Part II of the Alabama Schedule K-1 must be com-

Alabama Department of Revenue

pleted, indicating that the return is for a grantor trust. Line 10a

Individual and Corporate Tax Division

(Grantor Trust Income), line 10b (Grantor Trust Deduction), and line

Alabama Form 41

10c (Net Grantor Trust Income) of Part III will be completed for resident

P. O. Box 327444

grantors. Line 11 and/or line 12 of Part III will be completed for non-

Montgomery, AL 36132-7444

resident grantors.

Make check or money order payable to Alabama Department of

Special Instructions for CRATs and CRUTs

Revenue and enclose Form FDT-V when payment is mailed.

Returns without payments must be mailed to:

When completing a Form 41 for a CRAT or CRUT, the return should

Alabama Department of Revenue

be completed using the standard instructions down to line 5 of page

Individual and Corporate Tax Division

1. Line 6 should then be completed by entering 0 and checking “al-

Alabama Form 41

ternate tax method.”

P. O. Box 327440

Alabama Form 41

Montgomery, AL 36132-7440

Return Preparation Instructions

Extension. A five month extension of time for filing Form 41 will be

Page 1 – Taxpayer and Tax Return Information – Please provide

granted automatically. However, the extension of time for filing the re-

the information requested as instructed by the upper portion of the

turn is not an extension of time for payment of tax. The amount of tax

form.

due must be paid on or before the original due date of the return with-

out considering the extension of time to file the return.

Note Do not use the Employer Identification Number of the ac-

Estimate payments are not required by Alabama law. Voluntary

counting firm, the trustee, the attorney’s firm, or of an interest payor.

estimated payments can be submitted with Form FDT-V.

Amended Returns. When filing an amended return include any

Line 1. Enter the amount from page 3, Schedule B, line 18c, Col-

payments with the original return as a credit on the automatic exten-

umn C (Alabama Amount).

sion payment line.

Line 2. Enter the amount from page 2, Schedule A, line 15. The

Required Attachments. To be considered a complete return, the

amount entered on line 2 is the amount of income distributed to or dis-

Alabama Fiduciary Income Tax Return must have attached a complete

tributable to the beneficiaries during the tax year, in accordance with

copy of the federal Form 1041, U.S. Income Tax Return for Estates

Section 40-18-25(a). The Alabama income distribution deduction is

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4