Income And Expense Schedule For Cooperative And Condominium Property Form Tc203 Instructions For 2004

ADVERTISEMENT

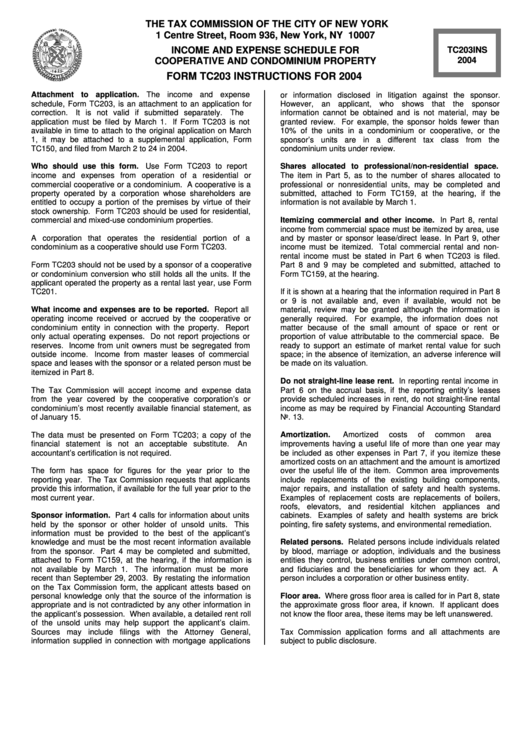

THE TAX COMMISSION OF THE CITY OF NEW YORK

1 Centre Street, Room 936, New York, NY 10007

INCOME AND EXPENSE SCHEDULE FOR

TC203INS

COOPERATIVE AND CONDOMINIUM PROPERTY

2004

FORM TC203 INSTRUCTIONS FOR 2004

Attachment to application. The income and expense

or information disclosed in litigation against the sponsor.

schedule, Form TC203, is an attachment to an application for

However, an applicant, who shows that the sponsor

correction.

It is not valid if submitted separately.

The

information cannot be obtained and is not material, may be

application must be filed by March 1. If Form TC203 is not

granted review. For example, the sponsor holds fewer than

available in time to attach to the original application on March

10% of the units in a condominium or cooperative, or the

1, it may be attached to a supplemental application, Form

sponsor’s units are in a different tax class from the

TC150, and filed from March 2 to 24 in 2004.

condominium units under review.

Who should use this form.

Use Form TC203 to report

Shares allocated to professional/non-residential space.

income and expenses from operation of a residential or

The item in Part 5, as to the number of shares allocated to

commercial cooperative or a condominium. A cooperative is a

professional or nonresidential units, may be completed and

property operated by a corporation whose shareholders are

submitted, attached to Form TC159, at the hearing, if the

entitled to occupy a portion of the premises by virtue of their

information is not available by March 1.

stock ownership. Form TC203 should be used for residential,

Itemizing commercial and other income. In Part 8, rental

commercial and mixed-use condominium properties.

income from commercial space must be itemized by area, use

A corporation that operates the residential portion of a

and by master or sponsor lease/direct lease. In Part 9, other

condominium as a cooperative should use Form TC203.

income must be itemized. Total commercial rental and non-

rental income must be stated in Part 6 when TC203 is filed.

Form TC203 should not be used by a sponsor of a cooperative

Part 8 and 9 may be completed and submitted, attached to

or condominium conversion who still holds all the units. If the

Form TC159, at the hearing.

applicant operated the property as a rental last year, use Form

TC201.

If it is shown at a hearing that the information required in Part 8

or 9 is not available and, even if available, would not be

What income and expenses are to be reported. Report all

material, review may be granted although the information is

operating income received or accrued by the cooperative or

generally required.

For example, the information does not

condominium entity in connection with the property. Report

matter because of the small amount of space or rent or

only actual operating expenses. Do not report projections or

proportion of value attributable to the commercial space. Be

reserves. Income from unit owners must be segregated from

ready to support an estimate of market rental value for such

outside income. Income from master leases of commercial

space; in the absence of itemization, an adverse inference will

space and leases with the sponsor or a related person must be

be made on its valuation.

itemized in Part 8.

Do not straight-line lease rent. In reporting rental income in

The Tax Commission will accept income and expense data

Part 6 on the accrual basis, if the reporting entity’s leases

from the year covered by the cooperative corporation’s or

provide scheduled increases in rent, do not straight-line rental

condominium’s most recently available financial statement, as

income as may be required by Financial Accounting Standard

of January 15.

No. 13.

The data must be presented on Form TC203; a copy of the

Amortization.

Amortized

costs

of

common

area

financial statement is not an acceptable substitute.

An

improvements having a useful life of more than one year may

accountant’s certification is not required.

be included as other expenses in Part 7, if you itemize these

amortized costs on an attachment and the amount is amortized

The form has space for figures for the year prior to the

over the useful life of the item. Common area improvements

reporting year. The Tax Commission requests that applicants

include replacements of the existing building components,

provide this information, if available for the full year prior to the

major repairs, and installation of safety and health systems.

most current year.

Examples of replacement costs are replacements of boilers,

roofs, elevators, and residential kitchen appliances and

Sponsor information. Part 4 calls for information about units

cabinets. Examples of safety and health systems are brick

held by the sponsor or other holder of unsold units.

This

pointing, fire safety systems, and environmental remediation.

information must be provided to the best of the applicant’s

knowledge and must be the most recent information available

Related persons. Related persons include individuals related

from the sponsor. Part 4 may be completed and submitted,

by blood, marriage or adoption, individuals and the business

attached to Form TC159, at the hearing, if the information is

entities they control, business entities under common control,

not available by March 1.

The information must be more

and fiduciaries and the beneficiaries for whom they act. A

recent than September 29, 2003. By restating the information

person includes a corporation or other business entity.

on the Tax Commission form, the applicant attests based on

Floor area. Where gross floor area is called for in Part 8, state

personal knowledge only that the source of the information is

appropriate and is not contradicted by any other information in

the approximate gross floor area, if known. If applicant does

the applicant’s possession. When available, a detailed rent roll

not know the floor area, these items may be left unanswered.

of the unsold units may help support the applicant’s claim.

Sources may include filings with the Attorney General,

Tax Commission application forms and all attachments are

information supplied in connection with mortgage applications

subject to public disclosure.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1