Purpose And Instructions For Pa Schedule H-Corp (9-04)

ADVERTISEMENT

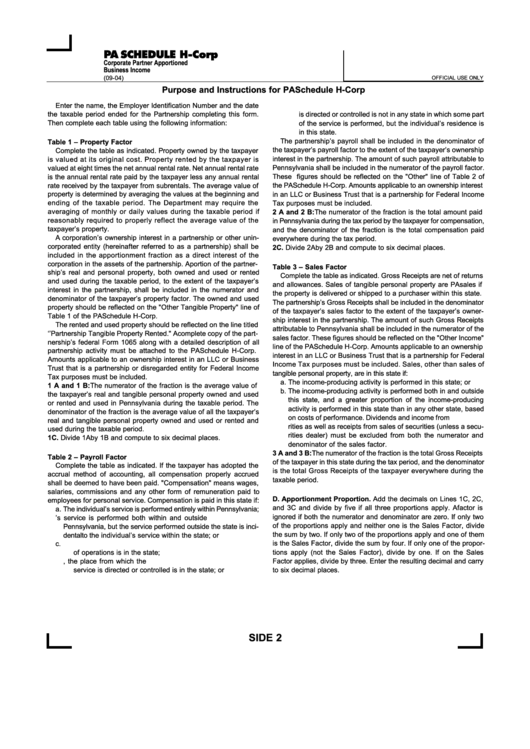

PA SCHEDULE H-Corp

Corporate Partner Apportioned

Business Income

(09-04)

OFFICIAL USE ONLY

Purpose and Instructions for PA Schedule H-Corp

Enter the name, the Employer Identification Number and the date

3. The base of operations or the place from which the service

the taxable period ended for the Partnership completing this form.

is directed or controlled is not in any state in which some part

Then complete each table using the following information:

of the service is performed, but the individual’s residence is

in this state.

The partnership’s payroll shall be included in the denominator of

Table 1 – Property Factor

the taxpayer’s payroll factor to the extent of the taxpayer’s ownership

Complete the table as indicated. Property owned by the taxpayer

interest in the partnership. The amount of such payroll attributable to

is valued at its original cost. Property rented by the taxpayer is

Pennsylvania shall be included in the numerator of the payroll factor.

valued at eight times the net annual rental rate. Net annual rental rate

is the annual rental rate paid by the taxpayer less any annual rental

These figures should be reflected on the "Other" line of Table 2 of

rate received by the taxpayer from subrentals. The average value of

the PA Schedule H-Corp. Amounts applicable to an ownership interest

property is determined by averaging the values at the beginning and

in an LLC or Business Trust that is a partnership for Federal Income

ending of the taxable period. The Department may require the

Tax purposes must be included.

averaging of monthly or daily values during the taxable period if

2 A and 2 B: The numerator of the fraction is the total amount paid

reasonably required to properly reflect the average value of the

in Pennsylvania during the tax period by the taxpayer for compensation,

taxpayer’s property.

and the denominator of the fraction is the total compensation paid

A corporation’s ownership interest in a partnership or other unin-

everywhere during the tax period.

corporated entity (hereinafter referred to as a partnership) shall be

2C. Divide 2A by 2B and compute to six decimal places.

included in the apportionment fraction as a direct interest of the

corporation in the assets of the partnership. A portion of the partner-

Table 3 – Sales Factor

ship’s real and personal property, both owned and used or rented

Complete the table as indicated. Gross Receipts are net of returns

and used during the taxable period, to the extent of the taxpayer’s

and allowances. Sales of tangible personal property are PA sales if

interest in the partnership, shall be included in the numerator and

the property is delivered or shipped to a purchaser within this state.

denominator of the taxpayer’s property factor. The owned and used

The partnership’s Gross Receipts shall be included in the denominator

property should be reflected on the "Other Tangible Property" line of

of the taxpayer’s sales factor to the extent of the taxpayer’s owner-

Table 1 of the PA Schedule H-Corp.

ship interest in the partnership. The amount of such Gross Receipts

The rented and used property should be reflected on the line titled

attributable to Pennsylvania shall be included in the numerator of the

‘’Partnership Tangible Property Rented." A complete copy of the part-

sales factor. These figures should be reflected on the "Other Income"

nership’s federal Form 1065 along with a detailed description of all

line of the PA Schedule H-Corp. Amounts applicable to an ownership

partnership activity must be attached to the PA Schedule H-Corp.

interest in an LLC or Business Trust that is a partnership for Federal

Amounts applicable to an ownership interest in an LLC or Business

Income Tax purposes must be included. Sales, other than sales of

Trust that is a partnership or disregarded entity for Federal Income

tangible personal property, are in this state if:

Tax purposes must be included.

a. The income-producing activity is performed in this state; or

1 A and 1 B: The numerator of the fraction is the average value of

b. The income-producing activity is performed both in and outside

the taxpayer’s real and tangible personal property owned and used

this state, and a greater proportion of the income-producing

or rented and used in Pennsylvania during the taxable period. The

activity is performed in this state than in any other state, based

denominator of the fraction is the average value of all the taxpayer’s

on costs of performance. Dividends and income from U.S. secu-

real and tangible personal property owned and used or rented and

rities as well as receipts from sales of securities (unless a secu-

used during the taxable period.

rities dealer) must be excluded from both the numerator and

1C. Divide 1A by 1B and compute to six decimal places.

denominator of the sales factor.

3 A and 3 B: The numerator of the fraction is the total Gross Receipts

Table 2 – Payroll Factor

of the taxpayer in this state during the tax period, and the denominator

Complete the table as indicated. If the taxpayer has adopted the

is the total Gross Receipts of the taxpayer everywhere during the

accrual method of accounting, all compensation properly accrued

taxable period.

shall be deemed to have been paid. "Compensation" means wages,

salaries, commissions and any other form of remuneration paid to

D. Apportionment Proportion. Add the decimals on Lines 1C, 2C,

employees for personal service. Compensation is paid in this state if:

and 3C and divide by five if all three proportions apply. A factor is

a. The individual’s service is performed entirely within Pennsylvania;

ignored if both the numerator and denominator are zero. If only two

b. The individual’s service is performed both within and outside

of the proportions apply and neither one is the Sales Factor, divide

Pennsylvania, but the service performed outside the state is inci-

the sum by two. If only two of the proportions apply and one of them

dental to the individual’s service within the state; or

is the Sales Factor, divide the sum by four. If only one of the propor-

c. 1. Some of the service is performed in the state and the base

tions apply (not the Sales Factor), divide by one. If on the Sales

of operations is in the state;

Factor applies, divide by three. Enter the resulting decimal and carry

2. If there is no base of operations, the place from which the

service is directed or controlled is in the state; or

to six decimal places.

SIDE 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1