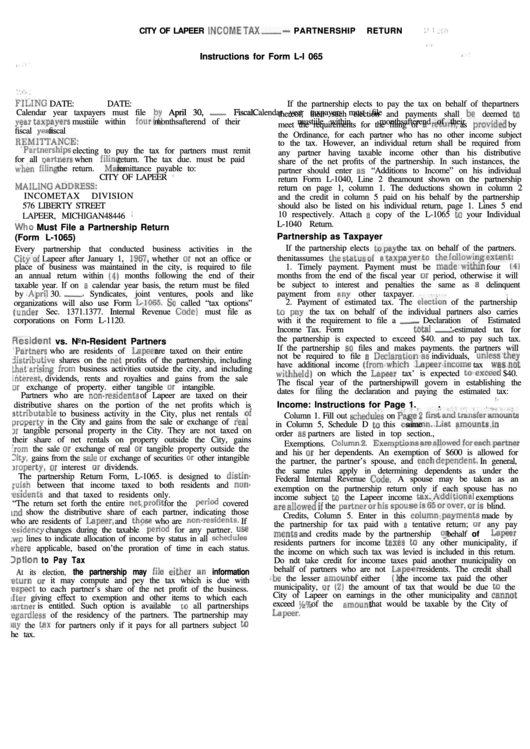

Instructions For Form L-L 065 - City Of Lapeer Income Tax Partnership Return

ADVERTISEMENT

” : -:..

.,

.’

/. .”

Iii’,.

FILING

FILING

y(lartaxpayers

y(lartaxpayers

REMiTTANCE:

.Partnerships electing to puy the tax for partners must remit

tihkn filing the return. M&e remittance payable to:

MAILINO

AtiDRESS:

Who Must File a Partnership Return

Ciiji’of Lapeer after January 1, 1967. whether or not an office or

(under Sec. 1371.1377. Internal Revenue Code)

Gident vs. Non-Resident Partners

.Paitners who are residents of Lapeer are taxed on their entire

%stributive

th&arising from business activities outside the city, and including

ibiter&, dividends, rents and royalties and gains from the sale

nr exchange of property. either tangible or intangible.

nttributable to business activity in the City, plus net rentals of

praperty in the City and gains from the sale or exchange of real

x tangible personal property in the City. They are not taxed on

jrom the sale or exchange of real or tangible property outside the

Zity, gains from the sale or exchange of securities or other intangible

xoperty, or interest or dividends.

:uish between that income taxed to both residents and non-

,eSidents

md show the distributive share of each partner, indicating those

widency changes during the taxable period

use

,WJJ lines to indicate allocation of income by status in all schedules

where applicable, based on’the proration of time in each status.

3ption to Pay Tax

eturn or it may compute and pey the tax which is due with

espect to each partner’s share of the net profit of the business.

liter giving effect to exemption and other items to which each

zxtner is entitled. Such option is available tn all partnerships

egardless of the residency of the partners. The partnership may

bay the t+x for partners only if it pays for all partners subject to

thefollowingextent:

‘,

to pay the tax on behalf of the individual partners also carries

_ ‘-estimated tax for

withheld1

! ’

amounts.in same

areallowedif the partnerorhis spouseis65orover.

oris blind.

merits and credits made by the partnership 0” behalf

Lapeer

.be the lesser amount of either (1) the income tax paid the other

Lapeer.

CITY OF LAPEER INCOMETAX-- PARTNERSHIP

RETURN

Instructions for Form L-l 065

DATE:

DATE:

If the partnership elects to pay the tax on behalf of thepartners

Calendar year taxpayers must file py April 30, - Fiscal

Calendar year taxpayers must file py April 30, - Fiscal

. .

thereof, then such election and payments shall be deemed to

mustiile within four(4) monthsafterend of their

mustiile within four(4) monthsafterend of their

meet the requirements for the filing of a &turn, as provided by

fiscal war.

fiscal war.

the Ordinance, for each partner who has no other income subject

to the tax. However, an individual return shall be required from

any partner having taxable income other than his distributive

for all oartners when filine return. The tax due. must be paid

share of the net profits of the partnership. In such instances, the

partner should enter as “Additions to Income” on his individual

CITY OF LAPEER ’

return Form L-1040, Line 2 theamount shown on the partnership

return on page 1, column 1. The deductions shown in column 2

INCOMETAX

DIVISION

and the credit in column 5 paid on his behalf by the partnership

576 LIBERTY STREET

should also be listed on his individual return, page 1. Lines 5 end

10 respectively. Attach a copy of the L-1065 to your Individual

LAPEER, MICHIGAN48446 :

L-1040 Return.

Partnership as Taxpayer

(Form L-1065)

If the partnership elects &pay the tax on behalf of the partners.

Every partnership that conducted business activities in the

thenitassumes thestatusof ataxpayerto

place of business was maintained in the city, is required to file

1. Timely payment. Payment must be madewithin

four 141

an annual return within 14) months following the end of their

months from the end of the fiscal year or period, otherwise it will

be subject to interest and penalties the same as a delinquent

taxable year. If on n calendar year basis, the return must be filed

by -April 30. -. Syndicates, joint ventures, pools and like

payment from any

other taxpayer.

2. Payment of estimated tax. The election of the partnership

organizations will also use Form L.1065. So called “tax options”

must file as

corporations on Form L-1120.

with it the requirement to file a - Declaration

of

Estimated

Income Tax. Form L-1040.ES. if the total

the partnership is expected to exceed $40. and to pay such tax.

If the partnership so files and makes payments. the partners will

not be required to file a Declaration~as individuals, unless,they

shares on the nkt profits of the partnership, including

have additional income (from,which .Lapeer,income tax was.not

on which the Lapeer tax’ is expected twexceed $40.

The fiscal year of the partnershipwill govern in establishing the

dates for filing the declaration and paying the estimated tax:

Partners who are norxesidents

of Lapeer are taxed on their

Income: Instructions for Page 1

.

.

distributive shares on the portion of the net profits which is

Column 1. Fill out schedul&

on Pa&‘2 fi&a&t’~&r’&nu&

in Column 5, Schedule D to this column..List

order as partners are listed in top section.,

their share of net rentals on property outside the City, gains

Exemptions. Column2. Exemptionsareallowedforeachpartner

and his or her dependents. An exemption of $600 is allowed for

the partner, the partner’s spouse, and eachdependent. In general,

the same rules apply in determining dependents as under the

The partnership Return Form, L-1065. is designed to distin.

Federal Internal Revenue Code.

A spouse may be taken as an

exemption on the partnership return only if each spouse has no

and that taxed to residents only.

income subject to the Lapeer income tax.,Additional

exemptions

“The return set forth the entire n&profit for the period

covered

Credits, Column 5. Enter in this column,payments

made by

who are residents of Lnpeer. and those who are ncmresidents. If

the partnership for tax paid with B tentative return; or any pay

for any partner.

of

residents partners for income tax& to any other municipality, if

the income on which such tax was levied is included in this return.

Do ndt take credit for income taxes paid another municipality on

behalf of partners who are not Lepeer residents. The credit shall

At its election, the partnership may file either sn information

municipality, or (2) the amount of tax that would be due to the

City of Lapeer on earnings in the other municipality and cannat

exceed $% of the amount that would be taxable by the City of

he tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2