Form Nc-478d - Tax Credit Worker Training - 2000

ADVERTISEMENT

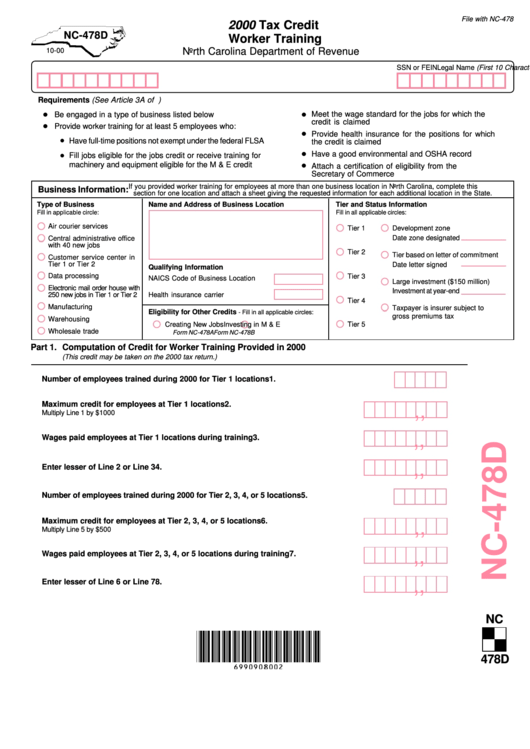

File with NC-478

2000 Tax Credit

NC-478D

Worker Training

North Carolina Department of Revenue

10-00

Legal Name (First 10 Characters)

SSN or FEIN

Requirements (See Article 3A of G.S. Chapter 105 and the Corporate Tax Bulletins for more information.)

Meet the wage standard for the jobs for which the

Be engaged in a type of business listed below

credit is claimed

Provide worker training for at least 5 employees who:

Provide health insurance for the positions for which

Have full-time positions not exempt under the federal FLSA

the credit is claimed

Have a good environmental and OSHA record

Fill jobs eligible for the jobs credit or receive training for

machinery and equipment eligible for the M & E credit

Attach a certification of eligibility from the N.C.

Secretary of Commerce

If you provided worker training for employees at more than one business location in North Carolina, complete this

Business Information:

section for one location and attach a sheet giving the requested information for each additional location in the State.

Type of Business

Name and Address of Business Location

Tier and Status Information

Fill in applicable circle:

Fill in all applicable circles:

Air courier services

Tier 1

Development zone

Date zone designated

Central administrative office

with 40 new jobs

Tier 2

Tier based on letter of commitment

Customer service center in

Tier 1 or Tier 2

Date letter signed

Qualifying Information

Data processing

Tier 3

NAICS Code of Business Location

Large investment ($150 million)

Electronic mail order house with

Investment at year-end

250 new jobs in Tier 1 or Tier 2

Health insurance carrier

Tier 4

Manufacturing

Taxpayer is insurer subject to

Eligibility for Other Credits

- Fill in all applicable circles:

gross premiums tax

Warehousing

Tier 5

Creating New Jobs

Investing in M & E

Wholesale trade

Form NC-478A

Form NC-478B

Part 1.

Computation of Credit for Worker Training Provided in 2000

(This credit may be taken on the 2000 tax return.)

,

1.

Number of employees trained during 2000 for Tier 1 locations

2.

Maximum credit for employees at Tier 1 locations

,

,

.

00

Multiply Line 1 by $1000

,

,

.

3.

Wages paid employees at Tier 1 locations during training

00

,

,

.

4.

Enter lesser of Line 2 or Line 3

00

,

5.

Number of employees trained during 2000 for Tier 2, 3, 4, or 5 locations

6.

Maximum credit for employees at Tier 2, 3, 4, or 5 locations

,

,

.

00

Multiply Line 5 by $500

,

,

.

7.

Wages paid employees at Tier 2, 3, 4, or 5 locations during training

00

,

,

.

8.

Enter lesser of Line 6 or Line 7

00

NC

478D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2