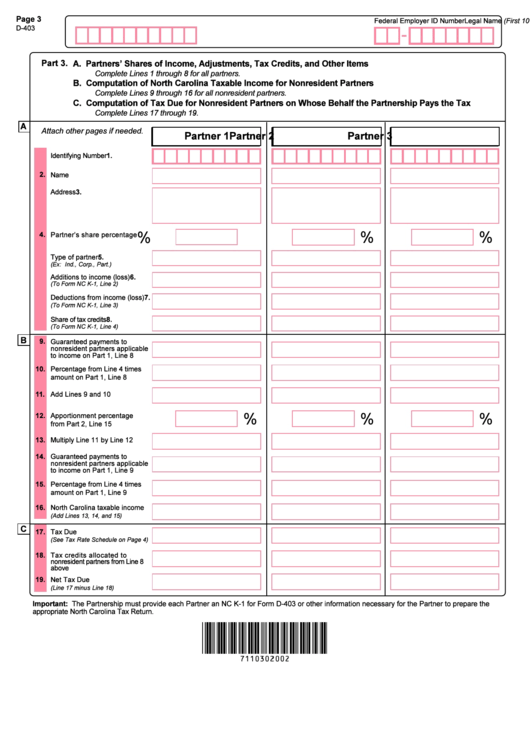

Form D-403 - North Carolina Tax Return

ADVERTISEMENT

Page 3

(First 10 Characters)

Part 3.

A. Partners’ Shares of Income, Adjustments, Tax Credits, and Other Items

Complete Lines 1 through 8 for all partners.

B. Computation of North Carolina Taxable Income for Nonresident Partners

Complete Lines 9 through 16 for all nonresident partners.

C. Computation of Tax Due for Nonresident Partners on Whose Behalf the Partnership Pays the Tax

Complete Lines 17 through 19.

A

Attach other pages if needed.

Partner 1

Partner 2

Partner 3

1.

2.

3.

%

%

%

4.

5.

(Ex: Ind., Corp., Part.)

6.

(To Form NC K-1, Line 2)

7.

(To Form NC K-1, Line 3)

8.

(To Form NC K-1, Line 4)

B

9.

10.

11.

%

%

%

12.

13.

14.

15.

16.

(Add Lines 13, 14, and 15)

C

17.

(See Tax Rate Schedule on Page 4)

18.

19.

(Line 17 minus Line 18)

Important: The Partnership must provide each Partner an NC K-1 for Form D-403 or other information necessary for the Partner to prepare the

appropriate North Carolina Tax Return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1