Information And Instructions For Completing Application For Consumer'S Certificate Of Exemption (Form Dr-5) - Florida Department Of Revenue

ADVERTISEMENT

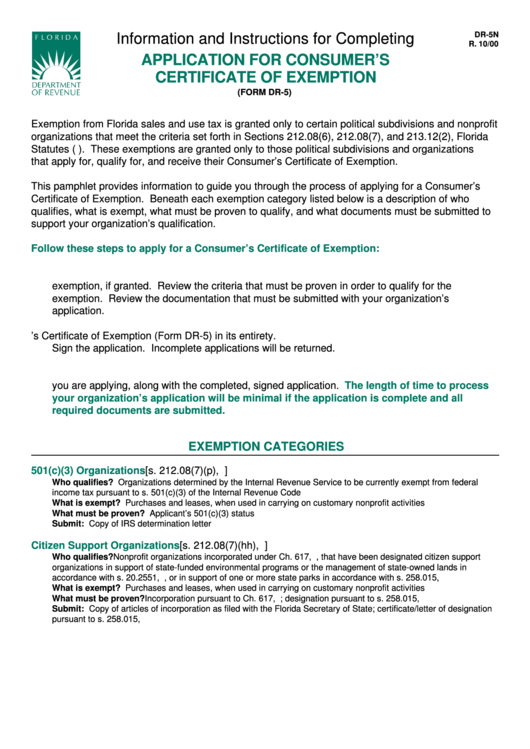

DR-5N

Information and Instructions for Completing

R. 10/00

APPLICATION FOR CONSUMER’S

CERTIFICATE OF EXEMPTION

(FORM DR-5)

Exemption from Florida sales and use tax is granted only to certain political subdivisions and nonprofit

organizations that meet the criteria set forth in Sections 212.08(6), 212.08(7), and 213.12(2), Florida

Statutes (F.S.). These exemptions are granted only to those political subdivisions and organizations

that apply for, qualify for, and receive their Consumer’s Certificate of Exemption.

This pamphlet provides information to guide you through the process of applying for a Consumer’s

Certificate of Exemption. Beneath each exemption category listed below is a description of who

qualifies, what is exempt, what must be proven to qualify, and what documents must be submitted to

support your organization’s qualification.

Follow these steps to apply for a Consumer’s Certificate of Exemption:

1.

Find the exemption category that best identifies your organization. Note the specific uses of the

exemption, if granted. Review the criteria that must be proven in order to qualify for the

exemption. Review the documentation that must be submitted with your organization’s

application.

2.

Complete the Application for Consumer’s Certificate of Exemption (Form DR-5) in its entirety.

Sign the application. Incomplete applications will be returned.

3.

Submit a copy of the documentation listed beneath the particular exemption category for which

you are applying, along with the completed, signed application.

The length of time to process

your organization’s application will be minimal if the application is complete and all

required documents are submitted.

EXEMPTION CATEGORIES

501(c)(3) Organizations

[s. 212.08(7)(p), F.S.]

Who qualifies? Organizations determined by the Internal Revenue Service to be currently exempt from federal

income tax pursuant to s. 501(c)(3) of the Internal Revenue Code

What is exempt? Purchases and leases, when used in carrying on customary nonprofit activities

What must be proven? Applicant’s 501(c)(3) status

Submit: Copy of IRS determination letter

Citizen Support Organizations

[s. 212.08(7)(hh), F.S.]

Who qualifies? Nonprofit organizations incorporated under Ch. 617, F.S., that have been designated citizen support

organizations in support of state-funded environmental programs or the management of state-owned lands in

accordance with s. 20.2551, F.S., or in support of one or more state parks in accordance with s. 258.015, F.S.

What is exempt? Purchases and leases, when used in carrying on customary nonprofit activities

What must be proven? Incorporation pursuant to Ch. 617, F.S.; designation pursuant to s. 258.015, F.S.

Submit: Copy of articles of incorporation as filed with the Florida Secretary of State; certificate/letter of designation

pursuant to s. 258.015, F.S.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4