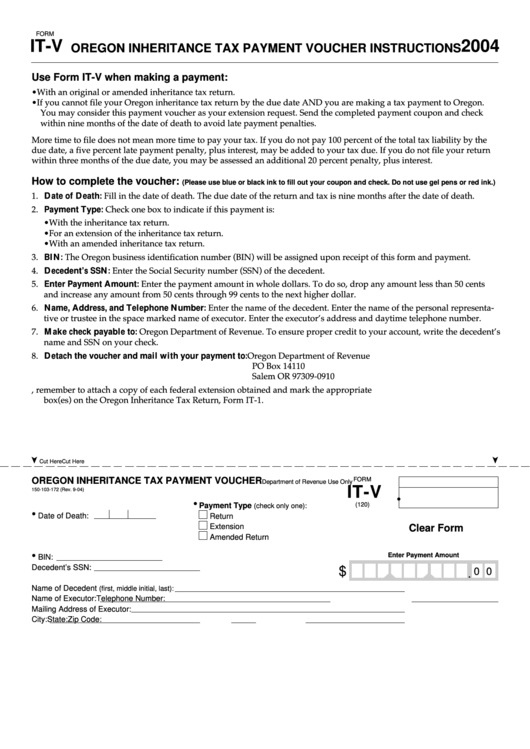

FORM

IT-V

2004

OREGON INHERITANCE TAX PAYMENT VOUCHER INSTRUCTIONS

Use Form IT-V when making a payment:

• With an original or amended inheritance tax return.

• If you cannot file your Oregon inheritance tax return by the due date AND you are making a tax payment to Oregon.

You may consider this payment voucher as your extension request. Send the completed payment coupon and check

within nine months of the date of death to avoid late payment penalties.

More time to file does not mean more time to pay your tax. If you do not pay 100 percent of the total tax liability by the

due date, a five percent late payment penalty, plus interest, may be added to your tax due. If you do not file your return

within three months of the due date, you may be assessed an additional 20 percent penalty, plus interest.

How to complete the voucher:

(Please use blue or black ink to fill out your coupon and check. Do not use gel pens or red ink.)

1. Date of Death: Fill in the date of death. The due date of the return and tax is nine months after the date of death.

2. Payment Type: Check one box to indicate if this payment is:

• With the inheritance tax return.

• For an extension of the inheritance tax return.

• With an amended inheritance tax return.

3. BIN: The Oregon business identification number (BIN) will be assigned upon receipt of this form and payment.

4. Decedent’s SSN: Enter the Social Security number (SSN) of the decedent.

5. Enter Payment Amount: Enter the payment amount in whole dollars. To do so, drop any amount less than 50 cents

and increase any amount from 50 cents through 99 cents to the next higher dollar.

6. Name, Address, and Telephone Number: Enter the name of the decedent. Enter the name of the personal representa-

tive or trustee in the space marked name of executor. Enter the executor’s address and daytime telephone number.

7. Make check payable to: Oregon Department of Revenue. To ensure proper credit to your account, write the decedent’s

name and SSN on your check.

8. Detach the voucher and mail with your payment to: Oregon Department of Revenue

PO Box 14110

Salem OR 97309-0910

9. When you file your return, remember to attach a copy of each federal extension obtained and mark the appropriate

box(es) on the Oregon Inheritance Tax Return, Form IT-1.

Cut Here

Cut Here

OREGON INHERITANCE TAX PAYMENT VOUCHER

FORM

Department of Revenue Use Only

IT-V

150-103-172 (Rev. 9-04)

•

•

(120)

Payment Type

(check only one):

•

Date of Death:

Return

Extension

Clear Form

Amended Return

•

Enter Payment Amount

BIN:

Decedent’s SSN:

$

0 0

.

Name of Decedent

(first, middle initial, last):

Name of Executor:

Telephone Number:

Mailing Address of Executor:

City:

State:

Zip Code:

1

1