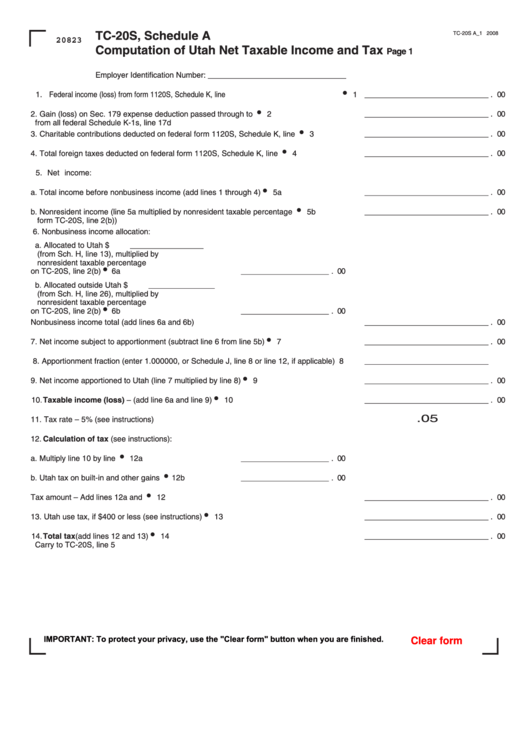

TC-20S, Schedule A

TC-20S A_1 2008

20823

Computation of Utah Net Taxable Income and Tax

Page 1

Employer Identification Number: ________ ___ ___ ___ __

1. Federal income (loss) from form 1120S, Schedule K, line 18...................................................

1 _ ___ ___ ___ __ _ _ _ _ _ . 00

2. Gain (loss) on Sec. 179 expense deduction passed through to shareholders............

2 _ ___ ___ ___ __ _ _ _ _ _ . 00

from all federal Schedule K-1s, line 17d

3. Charitable contributions deducted on federal form 1120S, Schedule K, line 12a .......

3 ___ ___ ___ ___ _ _ _ _ _ . 00

4. Total foreign taxes deducted on federal form 1120S, Schedule K, line 14l .................

4 ___ ___ ___ ___ _ _ _ _ _ . 00

5. Net income:

a.

Total income before nonbusiness income (add lines 1 through 4) .......................

5a ___ ___ ___ ___ _ _ _ _ _ . 00

b.

Nonresident income (line 5a multiplied by nonresident taxable percentage on ...

5b ___ ___ ___ ___ _ _ _ _ _ . 00

form TC-20S, line 2(b))

6. Nonbusiness income allocation:

a.

Allocated to Utah $__ ____ ____

(from Sch. H, line 13), multiplied by

nonresident taxable percentage

on TC-20S, line 2(b) .....................................

6a _____ ___ ___ _ . 00

b.

Allocated outside Utah $____ _ ____

(from Sch. H, line 26), multiplied by

nonresident taxable percentage

on TC-20S, line 2(b) .....................................

6b _____ ___ ___ _ . 00

Nonbusiness income total (add lines 6a and 6b) ........................................................

6 ___ ___ ___ ___ _ _ _ _ _ . 00

7. Net income subject to apportionment (subtract line 6 from line 5b)............................

7 ___ ___ ___ ___ _ _ _ _ _ . 00

8. Apportionment fraction (enter 1.000000, or Schedule J, line 8 or line 12, if applicable)

8 ___ ___ ___ ___ _ _ _ _ _

9. Net income apportioned to Utah (line 7 multiplied by line 8) ......................................

9 ___ ___ ___ ___ _ _ _ _ _ . 00

10. Taxable income (loss) – (add line 6a and line 9) ......................................................

10 ___ ___ ___ ___ _ _ _ _ _ . 00

.05

11. Tax rate – 5% (see instructions)..................................................................................

11

12. Calculation of tax (see instructions):

a.

Multiply line 10 by line 11 .............................

12a _____ ___ ___ _ . 00

b.

Utah tax on built-in and other gains ............

12b _____ ___ ___ _ . 00

Tax amount – Add lines 12a and 12b..........................................................................

12 _ ___ ___ ___ __ _ _ _ _ _ . 00

13. Utah use tax, if $400 or less (see instructions)...........................................................

13 ___ ___ ___ ___ _ _ _ _ _ . 00

14. Total tax (add lines 12 and 13)...................................................................................

14 __ ___ ___ ___ __ _ _ _ _ . 00

Carry to TC-20S, line 5

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2