Print

Reset

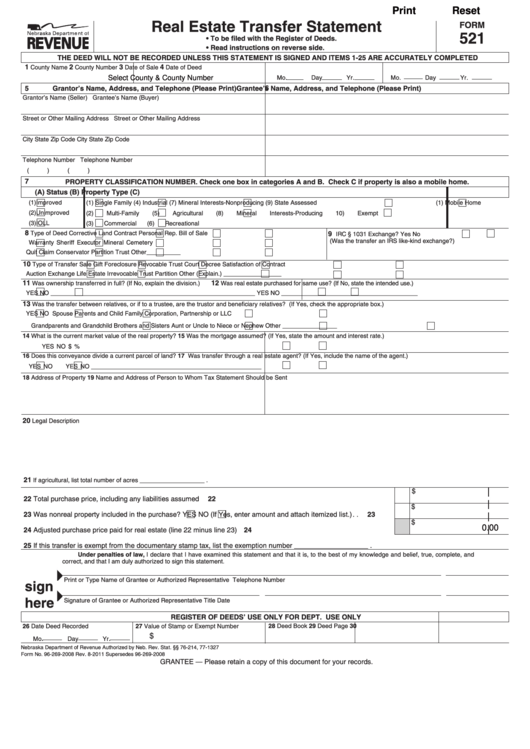

Real Estate Transfer Statement

FORM

521

• To be filed with the Register of Deeds.

• Read instructions on reverse side.

THE DEED WILL NOT BE RECORDED UNLESS THIS STATEMENT IS SIGNED AND ITEMS 1-25 ARE ACCURATELY COMPLETED

1

2

3

4

County Name

County Number

Date of Sale

Date of Deed

Mo.

Day

Yr.

Mo.

Day

Yr.

Select County & County Number

5

Grantor’s Name, Address, and Telephone (Please Print)

6

Grantee’s Name, Address, and Telephone (Please Print)

Grantor’s Name (Seller)

Grantee’s Name (Buyer)

Street or Other Mailing Address

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

Telephone Number

Telephone Number

(

)

(

)

7

PROPERTY CLASSIFICATION NUMBER. Check one box in categories A and B. Check C if property is also a mobile home.

(A) Status

(B) Property Type

(C)

(1)

Improved

(1)

Single Family

(4)

Industrial

(7)

Mineral Interests-Nonproducing

(9)

State Assessed

(1)

Mobile Home

(2)

Unimproved

(2)

Multi-Family

(5)

Agricultural

(8)

Mineral Interests-Producing

10)

Exempt

(3)

IOLL

(3)

Commercial

(6)

Recreational

8

Type of Deed

Corrective

Land Contract

Personal Rep.

Bill of Sale

9

IRC § 1031 Exchange?

Yes

No

(Was the transfer an IRS like-kind exchange?)

Warranty

Sheriff

Executor

Mineral

Cemetery

Quit Claim

Conservator

Partition

Trust

Other__________

10

Type of Transfer

Sale

Gift

Foreclosure

Revocable Trust

Court Decree

Satisfaction of Contract

Auction

Exchange

Life Estate

Irrevocable Trust

Partition

Other (Explain.) _________________

11

12

Was ownership transferred in full? (If No, explain the division.)

Was real estate purchased for same use? (If No, state the intended use.)

YES

NO ____________________________________________________________

YES

NO ________________________________________

13

Was the transfer between relatives, or if to a trustee, are the trustor and beneficiary relatives? (If Yes, check the appropriate box.)

YES

NO

Spouse

Parents and Child

Family Corporation, Partnership or LLC

Grandparents and Grandchild

Brothers and Sisters

Aunt or Uncle to Niece or Nephew

Other ________________

14 What is the current market value of the real property?

15 Was the mortgage assumed? (If Yes, state the amount and interest rate.)

YES

NO

$

%

16 Does this conveyance divide a current parcel of land?

17 Was transfer through a real estate agent? (If Yes, include the name of the agent.)

YES

NO

YES

NO __________________________________________________

18 Address of Property

19 Name and Address of Person to Whom Tax Statement Should be Sent

20

Legal Description

21

If agricultural, list total number of acres ___________________ .

$

22 Total purchase price, including any liabilities assumed

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

$

23 Was nonreal property included in the purchase?

YES

NO (If Yes, enter amount and attach itemized list.) . .

23

$

0.00

24 Adjusted purchase price paid for real estate (line 22 minus line 23) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25 If this transfer is exempt from the documentary stamp tax, list the exemption number ___________________ .

Under penalties of law, I declare that I have examined this statement and that it is, to the best of my knowledge and belief, true, complete, and

correct, and that I am duly authorized to sign this statement.

Print or Type Name of Grantee or Authorized Representative

Telephone Number

sign

here

Signature of Grantee or Authorized Representative

Title

Date

REGISTER OF DEEDS’ USE ONLY

FOR DEPT. USE ONLY

27 Value of Stamp or Exempt Number

28 Deed Book

29 Deed Page

30

26 Date Deed Recorded

$

Mo.

Day

Yr.

Nebraska Department of Revenue

Authorized by Neb. Rev. Stat. §§ 76-214, 77-1327

Form No. 96-269-2008 Rev. 8-2011 Supersedes 96-269-2008

GRANTEE — Please retain a copy of this document for your records.

1

1 2

2