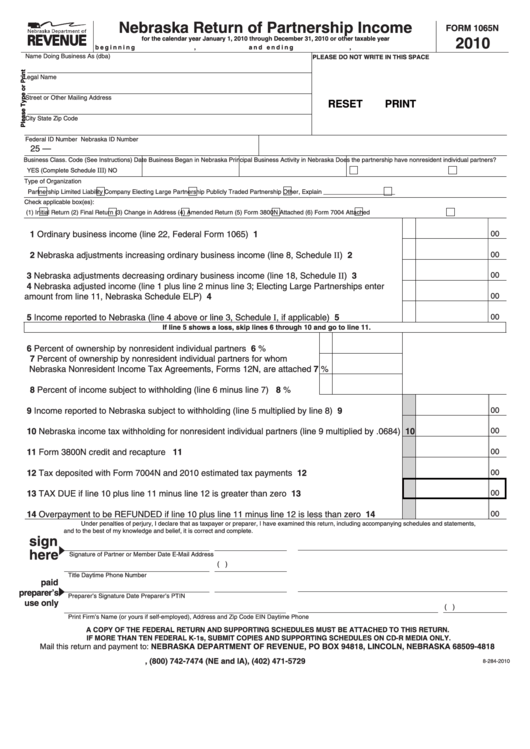

Nebraska Return of Partnership Income

FORM 1065N

2010

for the calendar year January 1, 2010 through December 31, 2010 or other taxable year

beginning

,

and ending

,

Name Doing Business As (dba)

PLEASE DO NOT WRITE IN THIS SPACE

Legal Name

Street or Other Mailing Address

RESET

PRINT

City

State

Zip Code

Federal ID Number

Nebraska ID Number

25 —

Business Class. Code (See Instructions)

Date Business Began in Nebraska Principal Business Activity in Nebraska Does the partnership have nonresident individual partners?

III

YES (Complete Schedule

)

NO

Type of Organization

Partnership

Limited Liability Company

Electing Large Partnership

Publicly Traded Partnership

Other, Explain _____________________

Check applicable box(es):

(1)

Initial Return

(2)

Final Return

(3)

Change in Address

(4)

Amended Return

(5)

Form 3800N Attached

(6)

Form 7004 Attached

1 Ordinary business income (line 22, Federal Form 1065) ..............................................................

1

00

2 Nebraska adjustments increasing ordinary business income (line 8, Schedule II) .......................

2

00

3 Nebraska adjustments decreasing ordinary business income (line 18, Schedule II) ....................

3

00

4 Nebraska adjusted income (line 1 plus line 2 minus line 3; Electing Large Partnerships enter

amount from line 11, Nebraska Schedule ELP) ............................................................................

4

00

5 Income reported to Nebraska (line 4 above or line 3, Schedule I, if applicable) ...........................

5

00

If line 5 shows a loss, skip lines 6 through 10 and go to line 11.

6 Percent of ownership by nonresident individual partners ............................ 6

%

7 Percent of ownership by nonresident individual partners for whom

Nebraska Nonresident Income Tax Agreements, Forms 12N, are attached 7

%

8 Percent of income subject to withholding (line 6 minus line 7) .................... 8

%

9 Income reported to Nebraska subject to withholding (line 5 multiplied by line 8) ..........................

9

00

10 Nebraska income tax withholding for nonresident individual partners (line 9 multiplied by .0684) 10

00

11 Form 3800N credit and recapture ................................................................................................. 11

00

12 Tax deposited with Form 7004N and 2010 estimated tax payments ............................................. 12

00

13 TAX DUE if line 10 plus line 11 minus line 12 is greater than zero ............................................... 13

00

14 Overpayment to be REFUNDED if line 10 plus line 11 minus line 12 is less than zero ................ 14

00

Under penalties of perjury, I declare that as taxpayer or preparer, I have examined this return, including accompanying schedules and statements,

and to the best of my knowledge and belief, it is correct and complete.

sign

here

Signature of Partner or Member

Date

E-Mail Address

(

)

Title

Daytime Phone Number

paid

preparer’s

Preparer’s Signature

Date

Preparer’s PTIN

use only

(

)

Print Firm’s Name (or yours if self-employed), Address and Zip Code

EIN

Daytime Phone

A COPY OF THE FEDERAL RETURN AND SUPPORTING SCHEDULES MUST BE ATTACHED TO THIS RETURN.

IF MORE THAN TEN FEDERAL K-1s, SUBMIT COPIES AND SUPPORTING SCHEDULES ON CD-R MEDIA ONLY.

Mail this return and payment to: NEBRASKA DEPARTMENT OF REVENUE, PO BOX 94818, LINCOLN, NEBRASKA 68509-4818

, (800) 742-7474 (NE and IA), (402) 471-5729

8-284-2010

1

1 2

2 3

3 4

4