Instructions For Completion Of Form Ssa-7161-Ocr-Sm

ADVERTISEMENT

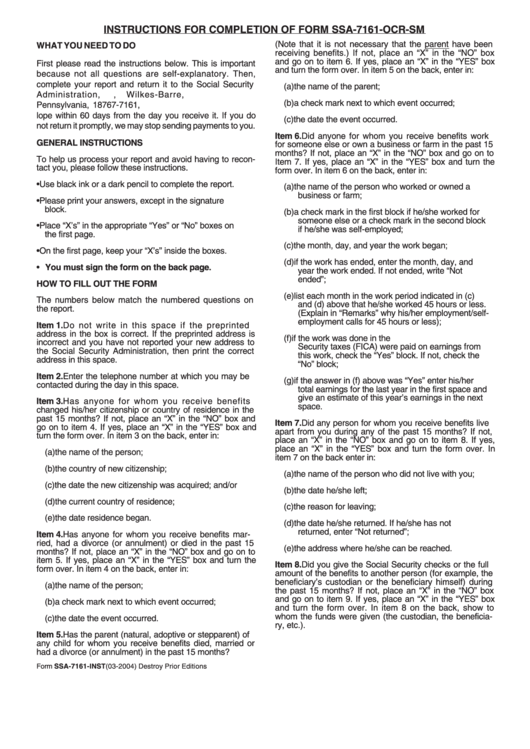

INSTRUCTIONS FOR COMPLETION OF FORM SSA-7161-OCR-SM

(Note that it is not necessary that the parent have been

WHAT YOU NEED TO DO

receiving benefits.) If not, place an “X” in the “NO” box

and go on to item 6. If yes, place an “X” in the “YES” box

First please read the instructions below. This is important

and turn the form over. In item 5 on the back, enter in:

because not all questions are self-explanatory. Then,

complete your report and return it to the Social Security

(a) the name of the parent;

Administration,

P.O.

Box

7161,

Wilkes-Barre,

(b) a check mark next to which event occurred;

Pennsylvania, 18767-7161, U.S.A. in the enclosed enve-

lope within 60 days from the day you receive it. If you do

(c) the date the event occurred.

not return it promptly, we may stop sending payments to you.

Item 6. Did anyone for whom you receive benefits work

GENERAL INSTRUCTIONS

for someone else or own a business or farm in the past 15

months? If not, place an “X” in the “NO” box and go on to

To help us process your report and avoid having to recon-

Item 7. If yes, place an “X” in the “YES” box and turn the

tact you, please follow these instructions.

form over. In item 6 on the back, enter in:

• Use black ink or a dark pencil to complete the report.

(a) the name of the person who worked or owned a

business or farm;

• Please print your answers, except in the signature

block.

(b) a check mark in the first block if he/she worked for

someone else or a check mark in the second block

• Place “X’s” in the appropriate “Yes” or “No” boxes on

if he/she was self-employed;

the first page.

(c) the month, day, and year the work began;

• On the first page, keep your “X’s” inside the boxes.

(d) if the work has ended, enter the month, day, and

• You must sign the form on the back page.

year the work ended. If not ended, write “Not

ended”;

HOW TO FILL OUT THE FORM

(e) list each month in the work period indicated in (c)

The numbers below match the numbered questions on

and (d) above that he/she worked 45 hours or less.

the report.

(Explain in “Remarks” why his/her employment/self-

employment calls for 45 hours or less);

Item 1. Do not write in this space if the preprinted

address in the box is correct. If the preprinted address is

(f) if the work was done in the U.S. or if U.S. Social

incorrect and you have not reported your new address to

Security taxes (FICA) were paid on earnings from

the Social Security Administration, then print the correct

this work, check the “Yes” block. If not, check the

address in this space.

“No” block;

Item 2. Enter the telephone number at which you may be

(g) if the answer in (f) above was “Yes” enter his/her

contacted during the day in this space.

total earnings for the last year in the first space and

give an estimate of this year’s earnings in the next

Item 3. Has anyone for whom you receive benefits

space.

changed his/her citizenship or country of residence in the

past 15 months? If not, place an “X” in the “NO” box and

Item 7. Did any person for whom you receive benefits live

go on to item 4. If yes, place an “X” in the “YES” box and

apart from you during any of the past 15 months? If not,

turn the form over. In item 3 on the back, enter in:

place an “X” in the “NO” box and go on to item 8. If yes,

place an “X” in the “YES” box and turn the form over. In

(a) the name of the person;

item 7 on the back enter in:

(b) the country of new citizenship;

(a) the name of the person who did not live with you;

(c) the date the new citizenship was acquired; and/or

(b) the date he/she left;

(d) the current country of residence;

(c) the reason for leaving;

(e) the date residence began.

(d) the date he/she returned. If he/she has not

returned, enter “Not returned”;

Item 4. Has anyone for whom you receive benefits mar-

ried, had a divorce (or annulment) or died in the past 15

(e) the address where he/she can be reached.

months? If not, place an “X” in the “NO” box and go on to

item 5. If yes, place an “X” in the “YES” box and turn the

Item 8. Did you give the Social Security checks or the full

form over. In item 4 on the back, enter in:

amount of the benefits to another person (for example, the

beneficiary’s custodian or the beneficiary himself) during

(a) the name of the person;

the past 15 months? If not, place an “X” in the “NO” box

and go on to item 9. If yes, place an “X” in the “YES” box

(b) a check mark next to which event occurred;

and turn the form over. In item 8 on the back, show to

whom the funds were given (the custodian, the beneficia-

(c) the date the event occurred.

ry, etc.).

Item 5. Has the parent (natural, adoptive or stepparent) of

any child for whom you receive benefits died, married or

had a divorce (or annulment) in the past 15 months?

Form SSA-7161-INST(03-2004) Destroy Prior Editions

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2