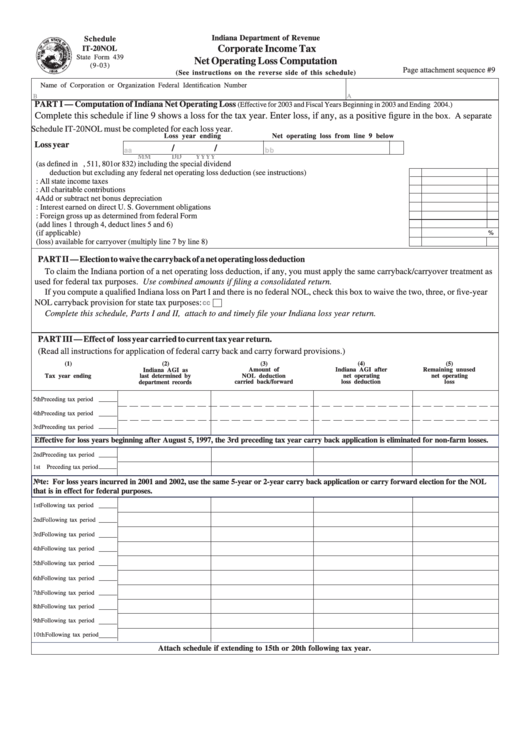

State Form 439 - Schedule It-20nol - Corporate Income Tax Net Operating Loss Computation

ADVERTISEMENT

Indiana Department of Revenue

Schedule

Corporate Income Tax

IT-20NOL

State Form 439

Net Operating Loss Computation

(9-03)

Page attachment sequence #9

(See instructions on the reverse side of this schedule)

Name of Corporation or Organization

Federal Identification Number

A

B

PART I — Computation of Indiana Net Operating Loss

(Effective for 2003 and Fiscal Years Beginning in 2003 and Ending 2004.)

Complete this schedule if line 9 shows a loss for the tax year. Enter loss, if any, as a positive figure in

the box. A separate

Schedule IT-20NOL must be completed for each loss year.

Net operating loss from line 9 below

Loss year ending

Loss year

/

/

aa

bb

MM

DD

YYYY

1. Enter federal taxable income (as defined in I.R.C. Sections 63, 511, 801or 832) including the special dividend

deduction but excluding any federal net operating loss deduction (see instructions) ................................................... 1

2. Add back: All state income taxes deducted .................................................................................................................. 2

3. Add back: All charitable contributions deducted .......................................................................................................... 3

4

Add or subtract net bonus depreciation allowance ....................................................................................................... 4

5. Deduct: Interest earned on direct U. S. Government obligations reported ................................................................... 5

6. Deduct: Foreign gross up as determined from federal Form 1118 ................................................................................ 6

7. Subtotal (add lines 1 through 4, deduct lines 5 and 6) .................................................................................................. 7

8. Indiana apportionment percentage from the apportionment schedule of the loss year return (if applicable) ............. 8

%

9. Indiana (loss) available for carryover (multiply line 7 by line 8) ................................................................................. 9

PART II — Election to waive the carryback of a net operating loss deduction

To claim the Indiana portion of a net operating loss deduction, if any, you must apply the same carryback/carryover treatment as

used for federal tax purposes. Use combined amounts if filing a consolidated return.

If you compute a qualified Indiana loss on Part I and there is no federal NOL, check this box to waive the two, three, or five-year

NOL carryback provision for state tax purposes:

cc

Complete this schedule, Parts I and II, attach to and timely file your Indiana loss year return.

PART III — Effect of loss year carried to current tax year return.

(Read all instructions for application of federal carry back and carry forward provisions.)

(1)

(2)

(3)

(4)

(5)

Amount of

Indiana AGI after

Remaining unused

Indiana AGI as

Tax year ending

NOL deduction

net operating

net operating

last determined by

carried back/forward

loss deduction

loss

department records

5th Preceding tax period

4th Preceding tax period

3rd Preceding tax period

Effective for loss years beginning after August 5, 1997, the 3rd preceding tax year carry back application is eliminated for non-farm losses.

2nd Preceding tax period

1st

Preceding tax period

Note: For loss years incurred in 2001 and 2002, use the same 5-year or 2-year carry back application or carry forward election for the NOL

that is in effect for federal purposes.

1st Following tax period

2nd Following tax period

3rd Following tax period

4th Following tax period

5th Following tax period

6th Following tax period

7th Following tax period

8th Following tax period

9th Following tax period

10th Following tax period

Attach schedule if extending to 15th or 20th following tax year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1