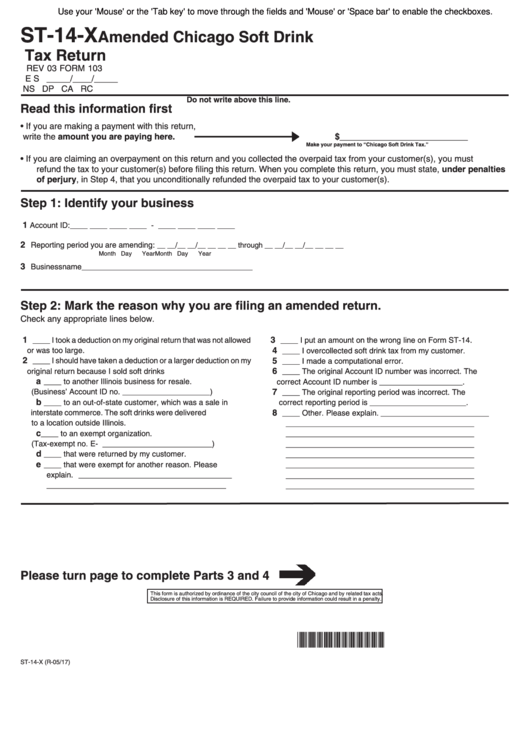

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

ST-14-X

Amended Chicago Soft Drink

Tax Return

REV 03

FORM 103

E S _____/____/_____

NS DP CA RC

Do not write above this line.

Read this information first

•

If you are making a payment with this return,

write the amount you are paying here.

$___________________________

Make your payment to “Chicago Soft Drink Tax.”

•

If you are claiming an overpayment on this return and you collected the overpaid tax from your customer(s), you must

refund the tax to your customer(s) before filing this return. When you complete this return, you must state, under penalties

of perjury, in Step 4, that you unconditionally refunded the overpaid tax to your customer(s).

Step 1: Identify your business

1

Account ID: ____ ____ ____ ____ - ____ ____ ____ ____

2

Reporting period you are amending:

__ __/__ __/__ __ __ __ through __ __/__ __/__ __ __ __

Month Day

Year

Month Day

Year

3

Business name _______________________________________

Step 2: Mark the reason why you are filing an amended return.

Check any appropriate lines below.

1

3

____ I took a deduction on my original return that was not allowed

____ I put an amount on the wrong line on Form ST-14.

4

____ I overcollected soft drink tax from my customer.

or was too large.

2

5

____ I should have taken a deduction or a larger deduction on my

____ I made a computational error.

6

original return because I sold soft drinks

____ The original Account ID number was incorrect. The

a

____ to another Illinois business for resale.

correct Account ID number is ___________________.

7

(Business’ Account ID no. ____________________)

____ The original reporting period was incorrect. The

b

____ to an out-of-state customer, which was a sale in

correct reporting period is ______________________.

8

interstate commerce. The soft drinks were delivered

____ Other. Please explain. ________________________

to a location outside Illinois.

___________________________________________

c

____ to an exempt organization.

___________________________________________

(Tax-exempt no. E- _________________________)

___________________________________________

d

____ that were returned by my customer.

___________________________________________

e

____ that were exempt for another reason. Please

___________________________________________

explain. ___________________________________

___________________________________________

_________________________________________

___________________________________________

Please turn page to complete Parts 3 and 4

This form is authorized by ordinance of the city council of the city of Chicago and by related tax acts.

Disclosure of this information is REQUIRED. Failure to provide information could result in a penalty.

*710331110*

ST-14-X (R-05/17)

1

1 2

2