Form Rpd-41277 - Local Liquor Excise Tax

ADVERTISEMENT

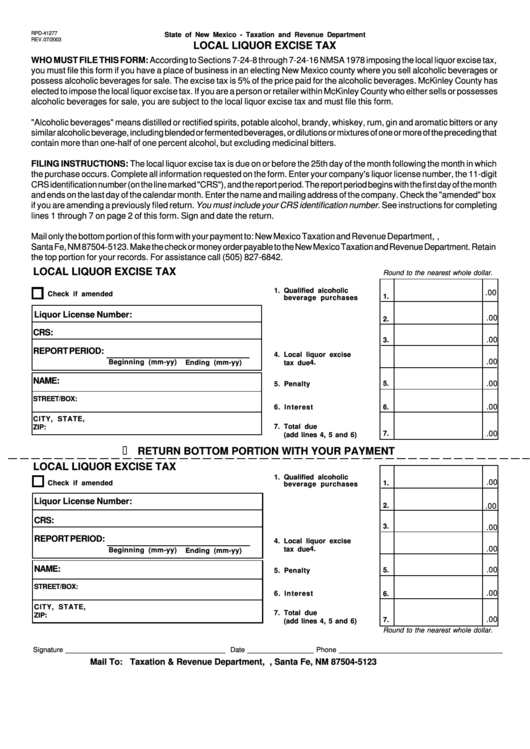

RPD-41277

State of New Mexico - Taxation and Revenue Department

REV. 07/2003

LOCAL LIQUOR EXCISE TAX

WHO MUST FILE THIS FORM: According to Sections 7-24-8 through 7-24-16 NMSA 1978 imposing the local liquor excise tax,

you must file this form if you have a place of business in an electing New Mexico county where you sell alcoholic beverages or

possess alcoholic beverages for sale. The excise tax is 5% of the price paid for the alcoholic beverages. McKinley County has

elected to impose the local liquor excise tax. If you are a person or retailer within McKinley County who either sells or possesses

alcoholic beverages for sale, you are subject to the local liquor excise tax and must file this form.

"Alcoholic beverages" means distilled or rectified spirits, potable alcohol, brandy, whiskey, rum, gin and aromatic bitters or any

similar alcoholic beverage, including blended or fermented beverages, or dilutions or mixtures of one or more of the preceding that

contain more than one-half of one percent alcohol, but excluding medicinal bitters.

FILING INSTRUCTIONS: The local liquor excise tax is due on or before the 25th day of the month following the month in which

the purchase occurs. Complete all information requested on the form. Enter your company's liquor license number, the 11-digit

CRS identification number (on the line marked "CRS"), and the report period. The report period begins with the first day of the month

and ends on the last day of the calendar month. Enter the name and mailing address of the company. Check the "amended" box

if you are amending a previously filed return. You must include your CRS identification number. See instructions for completing

lines 1 through 7 on page 2 of this form. Sign and date the return.

Mail only the bottom portion of this form with your payment to: New Mexico Taxation and Revenue Department, P.O. Box 25123,

Santa Fe, NM 87504-5123. Make the check or money order payable to the New Mexico Taxation and Revenue Department. Retain

the top portion for your records. For assistance call (505) 827-6842.

LOCAL LIQUOR EXCISE TAX

Round to the nearest whole dollar.

1. Qualified alcoholic

.00

Check if amended

1.

beverage purchases

Liquor License Number:

.00

2. Local liquor excise tax

2.

CRS:

3.

.00

3. Credits allowed

REPORT PERIOD:

4. Local liquor excise

.00

Beginning (mm-yy)

4.

Ending (mm-yy)

tax due

NAME:

5.

.00

5. Penalty

STREET/BOX:

6. Interest

.00

6.

CITY, STATE,

7. Total due

ZIP:

7.

.00

(add lines 4, 5 and 6)

RETURN BOTTOM PORTION WITH YOUR PAYMENT

LOCAL LIQUOR EXCISE TAX

1. Qualified alcoholic

.00

Check if amended

1.

beverage purchases

Liquor License Number:

2. Local liquor excise tax

2.

.00

CRS:

3.

3. Credits allowed

.00

REPORT PERIOD:

4. Local liquor excise

.00

4.

tax due

Beginning (mm-yy)

Ending (mm-yy)

NAME:

.00

5.

5. Penalty

STREET/BOX:

.00

6. Interest

6.

CITY, STATE,

7. Total due

ZIP:

.00

7.

(add lines 4, 5 and 6)

Round to the nearest whole dollar.

Signature _________________________________________ Date _________________ Phone __________________________________________

Mail To: Taxation & Revenue Department, P.O. Box 25123, Santa Fe, NM 87504-5123

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2