Form At3-51 - Annual Personal Property Return Of Sole Proprietorships And General Partnerships - 2003

ADVERTISEMENT

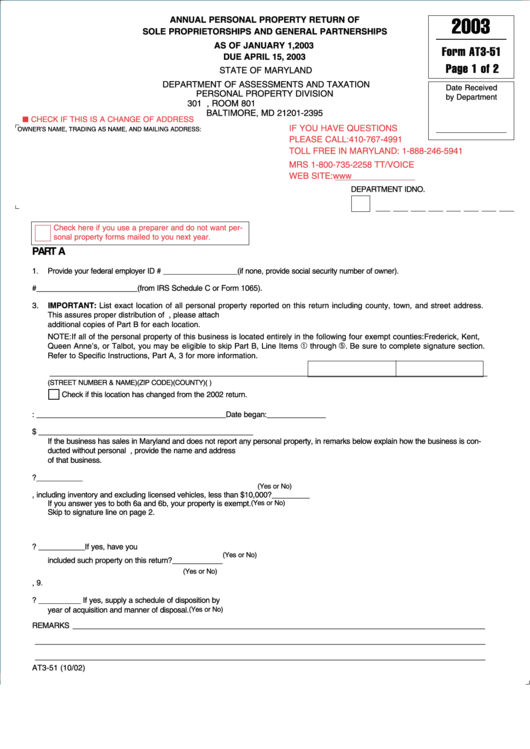

ANNUAL PERSONAL PROPERTY RETURN OF

2003

SOLE PROPRIETORSHIPS AND GENERAL PARTNERSHIPS

AS OF JANUARY 1, 2003

Form AT3-51

DUE APRIL 15, 2003

Page 1 of 2

STATE OF MARYLAND

DEPARTMENT OF ASSESSMENTS AND TAXATION

Date Received

PERSONAL PROPERTY DIVISION

by Department

301 W. PRESTON STREET, ROOM 801

BALTIMORE, MD 21201-2395

I I

CHECK IF THIS IS A CHANGE OF ADDRESS

IF YOU HAVE QUESTIONS

OWNER’S NAME, TRADING AS NAME, AND MAILING ADDRESS:

PLEASE CALL: 410-767-4991

TOLL FREE IN MARYLAND: 1-888-246-5941

MRS 1-800-735-2258 TT/VOICE

WEB SITE:

DEPARTMENT ID NO.

Check here if you use a preparer and do not want per-

sonal property forms mailed to you next year.

PART A

1.

Provide your federal employer ID #

__ __ __ __ __ __ __ __ __

(if none, provide social security number of owner).

2.

Provide your federal principal business code #

____ ____ ____ ____ ____ ____ (from IRS Schedule C or Form 1065).

3.

IMPORTANT: List exact location of all personal property reported on this return including county, town, and street address.

This assures proper distribution of assessments. If property is located in two or more locations in this jurisdiction, please attach

additional copies of Part B for each location.

NOTE: If all of the personal property of this business is located entirely in the following four exempt counties: Frederick, Kent,

➀

➄

Queen Anne’s, or Talbot, you may be eligible to skip Part B, Line Items

through

. Be sure to complete signature section.

Refer to Specific Instructions, Part A, 3 for more information.

________________________________________________________________________________________________________

(STREET NUMBER & NAME)

(ZIP CODE)

(COUNTY)

(INCORP . TOWN)

Check if this location has changed from the 2002 return.

4.

State your nature of business or profession: _____________________________________________Date began:______________

5.

Total gross sales or amount of business transacted during 2002. $ ___________________________________________________

If the business has sales in Maryland and does not report any personal property, in remarks below explain how the business is con-

ducted without personal property. If the business is using the personal property of another business, provide the name and address

of that business.

6a. Is this location the principal residence of the business owner? ___________

(Yes or No)

6b. Is the total original cost of all the property, including inventory and excluding licensed vehicles, less than $10,000? _________

If you answer yes to both 6a and 6b, your property is exempt.

(Yes or No)

Skip to signature line on page 2.

7.

State the opening and closing dates of your fiscal year. ____________________________________________________________

8.

Do you have any fully depreciated property or property expensed under IRS rules? ___________ If yes, have you

(Yes or No)

included such property on this return? ____________

(Yes or No)

9.

Property leased by your business. See Instructions for Part A, 9.

10. Has the business disposed of assets during 2002? __________ If yes, supply a schedule of disposition by

year of acquisition and manner of disposal.

(Yes or No)

REMARKS __________________________________________________________________________________________________

___________________________________________________________________________________________________________

___________________________________________________________________________________________________________

AT3-51 (10/02)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2