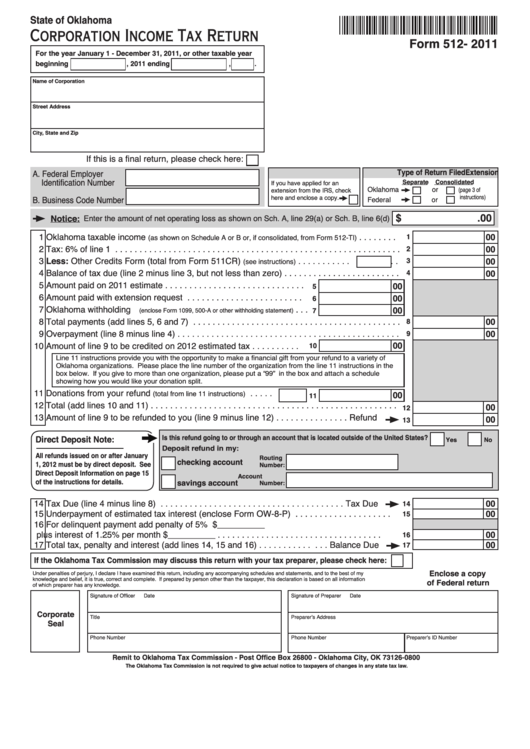

State of Oklahoma

Corporation Income Tax Return

Form 512- 2011

For the year January 1 - December 31, 2011, or other taxable year

beginning

, 2011 ending

,

.

Name of Corporation

Street Address

City, State and Zip

If this is a final return, please check here:

Extension

Type of Return Filed

A. Federal Employer

Identification Number

Separate

Consolidated

If you have applied for an

Oklahoma

or

(page 3 of

extension from the IRS, check

instructions)

here and enclose a copy.

B. Business Code Number

Federal

or

$

.00

Notice:

Enter the amount of net operating loss as shown on Sch. A, line 29(a) or Sch. B, line 6(d)

1 Oklahoma taxable income

. . . . . . . .

00

1

(as shown on Schedule A or B or, if consolidated, from Form 512-TI)

2 Tax: 6% of line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

2

3 Less: Other Credits Form (total from Form 511CR)

. . . . . . . . . . .

. .

00

3

(see instructions)

4 Balance of tax due (line 2 minus line 3, but not less than zero) . . . . . . . . . . . . . . . . . . . . . . . .

00

4

5 Amount paid on 2011 estimate . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

5

6 Amount paid with extension request . . . . . . . . . . . . . . . . . . . . . . . .

00

6

7 Oklahoma withholding

. . .

00

7

(enclose Form 1099, 500-A or other withholding statement)

8 Total payments (add lines 5, 6 and 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

8

9 Overpayment (line 8 minus line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

9

00

10 Amount of line 9 to be credited on 2012 estimated tax . . . . . . . . . .

10

Line 11 instructions provide you with the opportunity to make a financial gift from your refund to a variety of

Oklahoma organizations. Please place the line number of the organization from the line 11 instructions in the

box below. If you give to more than one organization, please put a “99” in the box and attach a schedule

showing how you would like your donation split.

11 Donations from your refund

. . . . .

(total from line 11 instructions)

00

11

12 Total (add lines 10 and 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

12

13 Amount of line 9 to be refunded to you (line 9 minus line 12) . . . . . . . . . . . . . . . Refund

00

13

Is this refund going to or through an account that is located outside of the United States?

Direct Deposit Note:

Yes

No

Deposit refund in my:

All refunds issued on or after January

Routing

checking account

1, 2012 must be by direct deposit. See

Number:

Direct Deposit Information on page 15

Account

of the instructions for details.

savings account

Number:

14 Tax Due (line 4 minus line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Tax Due

00

14

15 Underpayment of estimated tax interest (enclose Form OW-8-P) . . . . . . . . . . . . . . . . . . . .

00

15

16 For delinquent payment add penalty of 5% $__________

plus interest of 1.25% per month $__________ . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

16

17 Total tax, penalty and interest (add lines 14, 15 and 16) . . . . . . . . . . . . . . Balance Due

00

17

If the Oklahoma Tax Commission may discuss this return with your tax preparer, please check here:

Enclose a copy

Under penalties of perjury, I declare I have examined this return, including any accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct and complete. If prepared by person other than the taxpayer, this declaration is based on all information

of Federal return

of which preparer has any knowledge.

Signature of Officer

Date

Signature of Preparer

Date

Corporate

Title

Preparer’s Address

Seal

Phone Number

Phone Number

Preparer’s ID Number

Remit to Oklahoma Tax Commission - Post Office Box 26800 - Oklahoma City, OK 73126-0800

The Oklahoma Tax Commission is not required to give actual notice to taxpayers of changes in any state tax law.

1

1 2

2 3

3 4

4