Form 1 - Employer'S Report To Determine Liability - 2003

ADVERTISEMENT

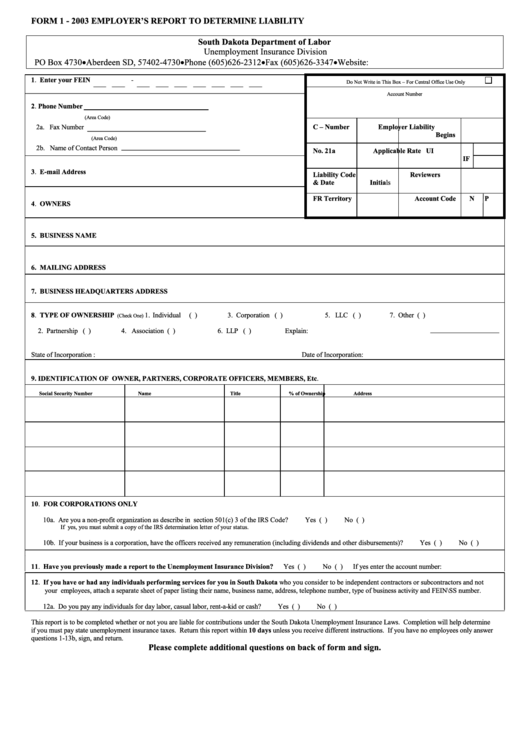

FORM 1 - 2003 EMPLOYER’S REPORT TO DETERMINE LIABILITY

South Dakota Department of Labor

Unemployment Insurance Division

PO Box 4730•Aberdeen SD, 57402-4730•Phone (605)626-2312•Fax (605)626-3347•Website:

1. Enter your FEIN

-

Do Not Write in This Box – For Central Office Use Only

Account Number

2. Phone Number

(Area Code)

2a. Fax Number

C – Number

Employer Liability

Begins

(Area Code)

2b. Name of Contact Person

No. 21a

Applicable Rate UI

IF

3. E-mail Address

Liability Code

Reviewers

& Date

Initials

FR Territory

Account Code

N

P

4. OWNERS

5. BUSINESS NAME

6. MAILING ADDRESS

7. BUSINESS HEADQUARTERS ADDRESS

8. TYPE OF OWNERSHIP

1. Individual

( )

3. Corporation ( )

5. LLC ( )

7. Other ( )

(Check One)

2. Partnership ( )

4. Association ( )

6. LLP ( )

Explain:

State of Incorporation :

Date of Incorporation:

9.

IDENTIFICATION OF OWNER, PARTNERS, CORPORATE OFFICERS, MEMBERS, Etc.

Social Security Number

Name

Title

% of Ownership

Address

10. FOR CORPORATIONS ONLY

10a. Are you a non-profit organization as describe in section 501(c) 3 of the IRS Code?

Yes ( )

No ( )

If yes, you must submit a copy of the IRS determination letter of your status.

10b. If your business is a corporation, have the officers received any remuneration (including dividends and other disbursements)?

Yes ( )

No ( )

11. Have you previously made a report to the Unemployment Insurance Division?

Yes ( )

No ( )

If yes enter the account number:

12. If you have or had any individuals performing services for you in South Dakota who you consider to be independent contractors or subcontractors and not

your employees, attach a separate sheet of paper listing their name, business name, address, telephone number, type of business activity and FEIN\SS number.

12a. Do you pay any individuals for day labor, casual labor, rent-a-kid or cash?

Yes ( )

No ( )

This report is to be completed whether or not you are liable for contributions under the South Dakota Unemployment Insurance Laws. Completion will help determine

if you must pay state unemployment insurance taxes. Return this report within 10 days unless you receive different instructions. If you have no employees only answer

questions 1-13b, sign, and return.

Please complete additional questions on back of form and sign.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2