Form It-1040 Es - Ohio Estimated Income Tax Instructions And Worksheet - 2004

ADVERTISEMENT

Rev. 10/03

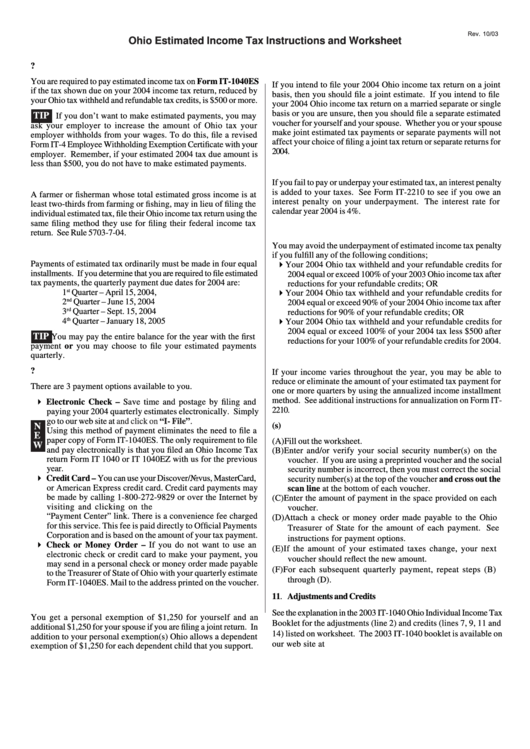

Ohio Estimated Income Tax Instructions and Worksheet

1. Do I Have To Make Estimated Tax Payments?

6. Joint and Separate Estimated Returns

You are required to pay estimated income tax on Form IT-1040ES

If you intend to file your 2004 Ohio income tax return on a joint

if the tax shown due on your 2004 income tax return, reduced by

basis, then you should file a joint estimate. If you intend to file

your Ohio tax withheld and refundable tax credits, is $500 or more.

your 2004 Ohio income tax return on a married separate or single

basis or you are unsure, then you should file a separate estimated

TIP

If you don’t want to make estimated payments, you may

voucher for yourself and your spouse. Whether you or your spouse

ask your employer to increase the amount of Ohio tax your

make joint estimated tax payments or separate payments will not

employer withholds from your wages. To do this, file a revised

affect your choice of filing a joint tax return or separate returns for

Form IT-4 Employee Withholding Exemption Certificate with your

2004.

employer. Remember, if your estimated 2004 tax due amount is

less than $500, you do not have to make estimated payments.

7. Interest Penalty

2. Farmer or Fisherman Filing Rules

If you fail to pay or underpay your estimated tax, an interest penalty

is added to your taxes. See Form IT-2210 to see if you owe an

A farmer or fisherman whose total estimated gross income is at

interest penalty on your underpayment. The interest rate for

least two-thirds from farming or fishing, may in lieu of filing the

calendar year 2004 is 4%.

individual estimated tax, file their Ohio income tax return using the

same filing method they use for filing their federal income tax

8. Avoiding the Underpayment of Estimated Income Tax Penalty.

return. See Rule 5703-7-04.

You may avoid the underpayment of estimated income tax penalty

3. Payment Due Dates

if you fulfill any of the following conditions;

Payments of estimated tax ordinarily must be made in four equal

Your 2004 Ohio tax withheld and your refundable credits for

installments. If you determine that you are required to file estimated

2004 equal or exceed 100% of your 2003 Ohio income tax after

tax payments, the quarterly payment due dates for 2004 are:

reductions for your refundable credits; OR

st

1

Quarter – April 15, 2004,

Your 2004 Ohio tax withheld and your refundable credits for

2

nd

Quarter – June 15, 2004

2004 equal or exceed 90% of your 2004 Ohio income tax after

3

rd

Quarter – Sept. 15, 2004

reductions for 90% of your refundable credits; OR

4

th

Quarter – January 18, 2005

Your 2004 Ohio tax withheld and your refundable credits for

2004 equal or exceed 100% of your 2004 tax less $500 after

TIP

You may pay the entire balance for the year with the first

reductions for your 100% of your refundable credits for 2004.

payment or you may choose to file your estimated payments

quarterly.

9. Annualized Income Installment Method

4. What Are My Payment Options?

If your income varies throughout the year, you may be able to

reduce or eliminate the amount of your estimated tax payment for

There are 3 payment options available to you.

one or more quarters by using the annualized income installment

method. See additional instructions for annualization on Form IT-

Electronic Check – Save time and postage by filing and

2210.

paying your 2004 quarterly estimates electronically. Simply

go to our web site at

and click on “I-

File”.

10. How to Complete the Declaration Voucher(s)

N

Using this method of payment eliminates the need to file a

E

paper copy of Form IT-1040ES. The only requirement to file

(A) Fill out the worksheet.

W

and pay electronically is that you filed an Ohio Income Tax

(B) Enter and/or verify your social security number(s) on the

return Form IT 1040 or IT 1040EZ with us for the previous

voucher. If you are using a preprinted voucher and the social

year.

security number is incorrect, then you must correct the social

Credit Card – You can use your Discover/Novus, MasterCard,

security number(s) at the top of the voucher and cross out the

or American Express credit card. Credit card payments may

scan line at the bottom of each voucher.

be made by calling 1-800-272-9829 or over the Internet by

(C) Enter the amount of payment in the space provided on each

visiting

and clicking on the

voucher.

“Payment Center” link. There is a convenience fee charged

(D) Attach a check or money order made payable to the Ohio

for this service. This fee is paid directly to Official Payments

Treasurer of State for the amount of each payment. See

Corporation and is based on the amount of your tax payment.

instructions for payment options.

Check or Money Order – If you do not want to use an

(E) If the amount of your estimated taxes change, your next

electronic check or credit card to make your payment, you

voucher should reflect the new amount.

may send in a personal check or money order made payable

(F) For each subsequent quarterly payment, repeat steps (B)

to the Treasurer of State of Ohio with your quarterly estimate

through (D).

Form IT-1040ES. Mail to the address printed on the voucher.

11. Adjustments and Credits

5. Personal and Dependency Exemptions

See the explanation in the 2003 IT-1040 Ohio Individual Income Tax

You get a personal exemption of $1,250 for yourself and an

Booklet for the adjustments (line 2) and credits (lines 7, 9, 11 and

additional $1,250 for your spouse if you are filing a joint return. In

14) listed on worksheet. The 2003 IT-1040 booklet is available on

addition to your personal exemption(s) Ohio allows a dependent

our web site at

.

exemption of $1,250 for each dependent child that you support.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2