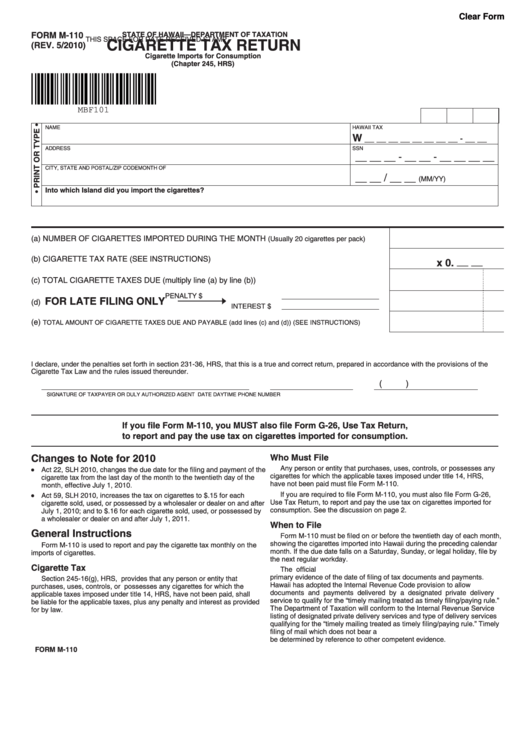

Clear Form

FORM M-110

STATE OF HAWAII—DEPARTMENT OF TAXATION

CIGARETTE TAX RETURN

THIS SPACE FOR DATE RECEIVED STAMP

(REV. 5/2010)

Cigarette Imports for Consumption

(Chapter 245, HRS)

MBF101

NAME

HAWAII TAX I.D. NO.

W

__ __ __ __ __ __ __ __ - __ __

ADDRESS

SSN

__ __ __ - __ __ - __ __ __ __

CITY, STATE AND POSTAL/ZIP CODE

MONTH OF

__ __ / __ __

(MM/YY)

Into which Island did you import the cigarettes?

(a) NUMBER OF CIGARETTES IMPORTED DURING THE MONTH

........

(Usually 20 cigarettes per pack)

(b) CIGARETTE TAX RATE (SEE INSTRUCTIONS) .................................................................................

x 0. __ __

(c) TOTAL CIGARETTE TAXES DUE (multiply line (a) by line (b)) ............................................................

PENALTY

$

FOR LATE FILING ONLY

(d)

INTEREST

$

(e) TOTAL AMOUNT OF CIGARETTE TAXES DUE AND PAYABLE (add lines (c) and (d)) (SEE INSTRUCTIONS) ................

I declare, under the penalties set forth in section 231-36, HRS, that this is a true and correct return, prepared in accordance with the provisions of the

Cigarette Tax Law and the rules issued thereunder.

(

)

SIGNATURE OF TAXPAYER OR DULY AUTHORIZED AGENT

DATE

DAYTIME PHONE NUMBER

If you file Form M-110, you MUST also file Form G-26, Use Tax Return,

to report and pay the use tax on cigarettes imported for consumption.

Changes to Note for 2010

Who Must File

•

Any person or entity that purchases, uses, controls, or possesses any

Act 22, SLH 2010, changes the due date for the filing and payment of the

cigarettes for which the applicable taxes imposed under title 14, HRS,

cigarette tax from the last day of the month to the twentieth day of the

have not been paid must file Form M-110.

month, effective July 1, 2010.

If you are required to file Form M-110, you must also file Form G-26,

•

Act 59, SLH 2010, increases the tax on cigarettes to $.15 for each

Use Tax Return, to report and pay the use tax on cigarettes imported for

cigarette sold, used, or possessed by a wholesaler or dealer on and after

consumption. See the discussion on page 2.

July 1, 2010; and to $.16 for each cigarette sold, used, or possessed by

a wholesaler or dealer on and after July 1, 2011.

When to File

General Instructions

Form M-110 must be filed on or before the twentieth day of each month,

showing the cigarettes imported into Hawaii during the preceding calendar

Form M-110 is used to report and pay the cigarette tax monthly on the

month. If the due date falls on a Saturday, Sunday, or legal holiday, file by

imports of cigarettes.

the next regular workday.

Cigarette Tax

The official U.S. Post Office cancellation mark will be considered

primary evidence of the date of filing of tax documents and payments.

Section 245-16(g), HRS, provides that any person or entity that

Hawaii has adopted the Internal Revenue Code provision to allow

purchases, uses, controls, or possesses any cigarettes for which the

documents and payments delivered by a designated private delivery

applicable taxes imposed under title 14, HRS, have not been paid, shall

service to qualify for the “timely mailing treated as timely filing/paying rule.”

be liable for the applicable taxes, plus any penalty and interest as provided

The Department of Taxation will conform to the Internal Revenue Service

for by law.

listing of designated private delivery services and type of delivery services

qualifying for the “timely mailing treated as timely filing/paying rule.” Timely

filing of mail which does not bear a U.S. Post Office cancellation mark will

be determined by reference to other competent evidence.

FORM M-110

1

1 2

2