Meals Tax Return - Town Of Purcellville

ADVERTISEMENT

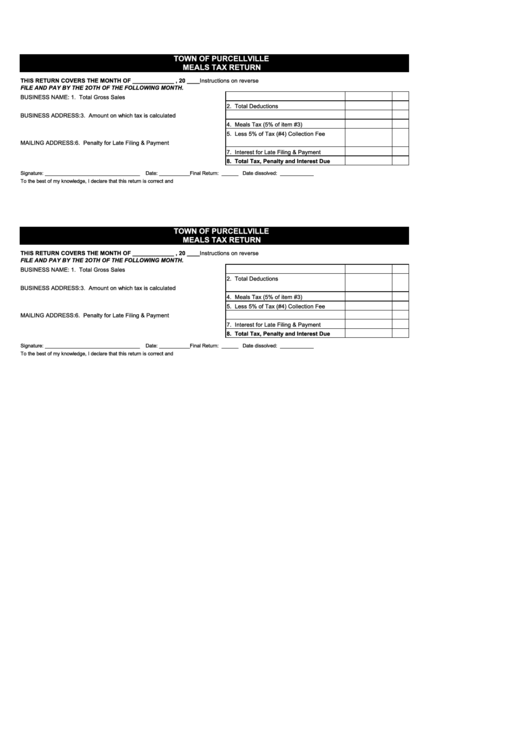

TOWN OF PURCELLVILLE

MEALS TAX RETURN

THIS RETURN COVERS THE MONTH OF _____________ , 20 ____

Instructions on reverse

FILE AND PAY BY THE 2OTH OF THE FOLLOWING MONTH.

BUSINESS NAME:

1. Total Gross Sales

2. Total Deductions

BUSINESS ADDRESS:

3. Amount on which tax is calculated

4. Meals Tax (5% of item #3)

5. Less 5% of Tax (#4) Collection Fee

MAILING ADDRESS:

6. Penalty for Late Filing & Payment

7. Interest for Late Filing & Payment

8. Total Tax, Penalty and Interest Due

Signature: __________________________________

Date: ___________

Final Return: ______ Date dissolved: ____________

To the best of my knowledge, I declare that this return is correct and complete.

Return white and canary copies with payment.

TOWN OF PURCELLVILLE

MEALS TAX RETURN

THIS RETURN COVERS THE MONTH OF _____________ , 20 ____

Instructions on reverse

FILE AND PAY BY THE 2OTH OF THE FOLLOWING MONTH.

BUSINESS NAME:

1. Total Gross Sales

2. Total Deductions

BUSINESS ADDRESS:

3. Amount on which tax is calculated

4. Meals Tax (5% of item #3)

5. Less 5% of Tax (#4) Collection Fee

MAILING ADDRESS:

6. Penalty for Late Filing & Payment

7. Interest for Late Filing & Payment

8. Total Tax, Penalty and Interest Due

Signature: __________________________________

Date: ___________

Final Return: ______ Date dissolved: ____________

To the best of my knowledge, I declare that this return is correct and complete.

Return white and canary copies with payment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1