Form 4567 - Michigan Business Tax Annual Return - 2012

ADVERTISEMENT

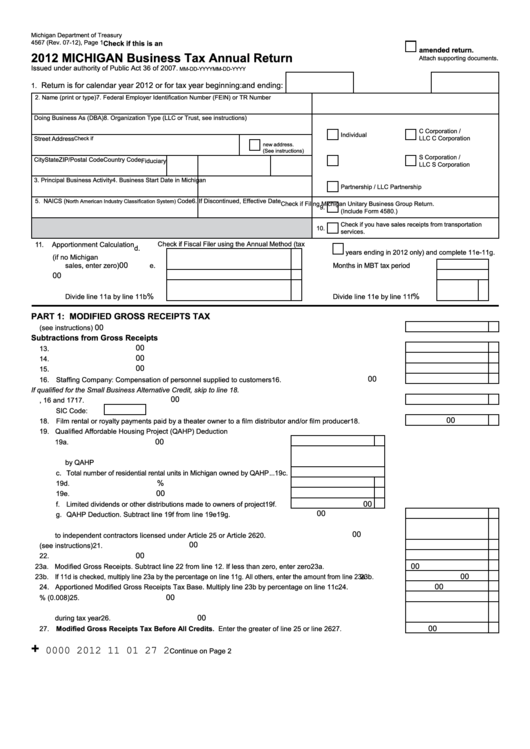

Michigan Department of Treasury

4567 (Rev. 07-12), Page 1

Check if this is an

amended return.

2012 MICHIGAN Business Tax Annual Return

.

Attach supporting documents

Issued under authority of Public Act 36 of 2007.

MM-DD-YYYY

MM-DD-YYYY

Return is for calendar year 2012 or for tax year beginning:

and ending:

1.

2. Name (print or type)

7. Federal Employer Identification Number (FEIN) or TR Number

Doing Business As (DBA)

8. Organization Type (LLC or Trust, see instructions)

C Corporation /

Individual

LLC C Corporation

Street Address

Check if

new address.

(See instructions)

S Corporation /

City

State

ZIP/Postal Code

Country Code

Fiduciary

LLC S Corporation

3. Principal Business Activity

4. Business Start Date in Michigan

Partnership / LLC Partnership

5. NAICS (

Code

6. If Discontinued, Effective Date

North American Industry Classification System)

Check if Filing Michigan Unitary Business Group Return.

9.

(Include Form 4580.)

Check if you have sales receipts from transportation

10.

services.

Check if Fiscal Filer using the Annual Method (tax

11.

Apportionment Calculation

d.

years ending in 2012 only) and complete 11e-11g.

a. Michigan Sales (if no Michigan

00

sales, enter zero) ........................

e. Months in MBT tax period .............

00

b. Total Sales ..................................

f. Total months ................................

c.

Apportionment Percentage.

g. Proration Percentage.

%

%

Divide line 11a by line 11b ..........

Divide line 11e by line 11f ............

PART 1: MODIFIED GROSS RECEIPTS TAX

00

12. Gross Receipts (see instructions)......................................................................................................................

12.

Subtractions from Gross Receipts

00

13. Inventory acquired during tax year ....................................................................................................................

13.

00

14. Depreciable assets acquired during tax year ....................................................................................................

14.

00

15. Materials and supplies not included in inventory or depreciable property .........................................................

15.

00

16. Staffing Company: Compensation of personnel supplied to customers ............................................................

16.

If qualified for the Small Business Alternative Credit, skip to line 18.

00

17. Deduction for contractors in SIC Codes 15, 16 and 17 .....................................................................................

17.

SIC Code:

00

18. Film rental or royalty payments paid by a theater owner to a film distributor and/or film producer ...................

18.

19. Qualified Affordable Housing Project (QAHP) Deduction

00

a. Gross receipts attributable to residential rentals in Michigan ........... 19a.

b. Number of residential rent restricted units in Michigan owned

by QAHP ........................................................................................... 19b.

c. Total number of residential rental units in Michigan owned by QAHP ... 19c.

%

d. Divide line 19b by line 19c and enter as a percentage .................... 19d.

00

e. Multiply line 19a by line 19d ............................................................. 19e.

00

f. Limited dividends or other distributions made to owners of project .... 19f.

00

g. QAHP Deduction. Subtract line 19f from line 19e ....................................................................................... 19g.

20. Payments made by taxpayers licensed under Article 25 or Article 26 of the Occupational Code

00

to independent contractors licensed under Article 25 or Article 26 ....................................................................

20.

00

21. Miscellaneous (see instructions) .......................................................................................................................

21.

00

22. Total Subtractions from Gross Receipts. Add lines 13 through 18 and 19g through 21 ....................................

22.

00

23a. Modified Gross Receipts. Subtract line 22 from line 12. If less than zero, enter zero ....................................... 23a.

00

23b. If 11d is checked, multiply line 23a by the percentage on line 11g. All others, enter the amount from line 23a ............ 23b.

00

24. Apportioned Modified Gross Receipts Tax Base. Multiply line 23b by percentage on line 11c .........................

24.

00

25. Multiply line 24 by 0.8% (0.008) .......................................................................................................................

25.

26. Enrichment Prohibition for dealers of personal watercraft or new motor vehicles. Enter amount collected

00

during tax year ...................................................................................................................................................

26.

00

27. Modified Gross Receipts Tax Before All Credits. Enter the greater of line 25 or line 26 .............................

27.

+

0000 2012 11 01 27 2

Continue on Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3