Instructions For Form Ct-1 - Employer'S Annual Railroad Retirement Tax Return - 2002

ADVERTISEMENT

02

2 0

Department of the Treasury

Internal Revenue Service

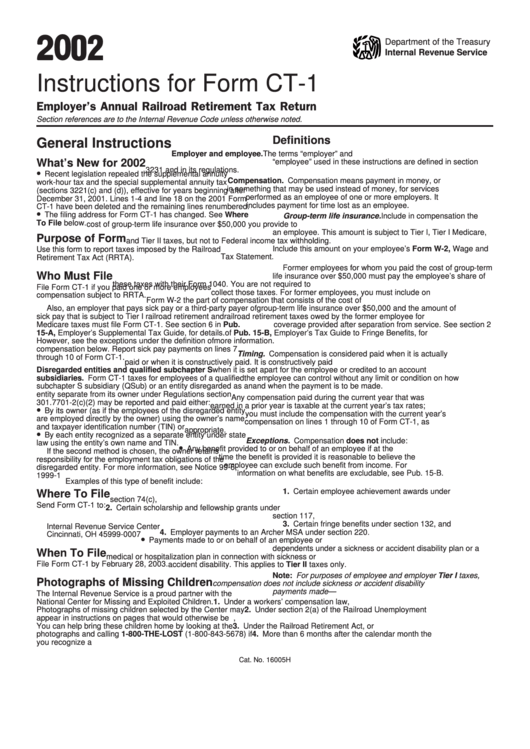

Instructions for Form CT-1

Employer’s Annual Railroad Retirement Tax Return

Section references are to the Internal Revenue Code unless otherwise noted.

Definitions

General Instructions

Employer and employee. The terms “employer” and

What’s New for 2002

“employee” used in these instructions are defined in section

3231 and in its regulations.

•

Recent legislation repealed the supplemental annuity

Compensation. Compensation means payment in money, or

work-hour tax and the special supplemental annuity tax

in something that may be used instead of money, for services

(sections 3221(c) and (d)), effective for years beginning after

performed as an employee of one or more employers. It

December 31, 2001. Lines 1-4 and line 18 on the 2001 Form

includes payment for time lost as an employee.

CT-1 have been deleted and the remaining lines renumbered.

•

The filing address for Form CT-1 has changed. See Where

Group-term life insurance. Include in compensation the

To File below.

cost of group-term life insurance over $50,000 you provide to

an employee. This amount is subject to Tier I, Tier I Medicare,

Purpose of Form

and Tier II taxes, but not to Federal income tax withholding.

Include this amount on your employee’s Form W-2, Wage and

Use this form to report taxes imposed by the Railroad

Tax Statement.

Retirement Tax Act (RRTA).

Former employees for whom you paid the cost of group-term

Who Must File

life insurance over $50,000 must pay the employee’s share of

these taxes with their Form 1040. You are not required to

File Form CT-1 if you paid one or more employees

collect those taxes. For former employees, you must include on

compensation subject to RRTA.

Form W-2 the part of compensation that consists of the cost of

Also, an employer that pays sick pay or a third-party payer of

group-term life insurance over $50,000 and the amount of

sick pay that is subject to Tier I railroad retirement and

railroad retirement taxes owed by the former employee for

Medicare taxes must file Form CT-1. See section 6 in Pub.

coverage provided after separation from service. See section 2

15-A, Employer’s Supplemental Tax Guide, for details.

of Pub. 15-B, Employer’s Tax Guide to Fringe Benefits, for

However, see the exceptions under the definition of

more information.

compensation below. Report sick pay payments on lines 7

Timing. Compensation is considered paid when it is actually

through 10 of Form CT-1.

paid or when it is constructively paid. It is constructively paid

Disregarded entities and qualified subchapter S

when it is set apart for the employee or credited to an account

subsidiaries. Form CT-1 taxes for employees of a qualified

the employee can control without any limit or condition on how

subchapter S subsidiary (QSub) or an entity disregarded as an

and when the payment is to be made.

entity separate from its owner under Regulations section

Any compensation paid during the current year that was

301.7701-2(c)(2) may be reported and paid either:

earned in a prior year is taxable at the current year’s tax rates;

•

By its owner (as if the employees of the disregarded entity

you must include the compensation with the current year’s

are employed directly by the owner) using the owner’s name

compensation on lines 1 through 10 of Form CT-1, as

and taxpayer identification number (TIN) or

appropriate.

•

By each entity recognized as a separate entity under state

Exceptions. Compensation does not include:

law using the entity’s own name and TIN.

•

Any benefit provided to or on behalf of an employee if at the

If the second method is chosen, the owner retains

time the benefit is provided it is reasonable to believe the

responsibility for the employment tax obligations of the

employee can exclude such benefit from income. For

disregarded entity. For more information, see Notice 99-6,

information on what benefits are excludable, see Pub. 15-B.

1999-1 C.B. 321.

Examples of this type of benefit include:

1. Certain employee achievement awards under

Where To File

section 74(c),

Send Form CT-1 to:

2. Certain scholarship and fellowship grants under

section 117,

3. Certain fringe benefits under section 132, and

Internal Revenue Service Center

4. Employer payments to an Archer MSA under section 220.

Cincinnati, OH 45999-0007

•

Payments made to or on behalf of an employee or

dependents under a sickness or accident disability plan or a

When To File

medical or hospitalization plan in connection with sickness or

File Form CT-1 by February 28, 2003.

accident disability. This applies to Tier II taxes only.

Note: For purposes of employee and employer Tier I taxes,

Photographs of Missing Children

compensation does not include sickness or accident disability

payments made —

The Internal Revenue Service is a proud partner with the

National Center for Missing and Exploited Children.

1. Under a workers’ compensation law,

Photographs of missing children selected by the Center may

2. Under section 2(a) of the Railroad Unemployment

appear in instructions on pages that would otherwise be blank.

Insurance Act for days of sickness due to on-the-job injury,

You can help bring these children home by looking at the

3. Under the Railroad Retirement Act, or

photographs and calling 1-800-THE-LOST (1-800-843-5678) if

4. More than 6 months after the calendar month the

you recognize a child.

employee last worked.

Cat. No. 16005H

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5